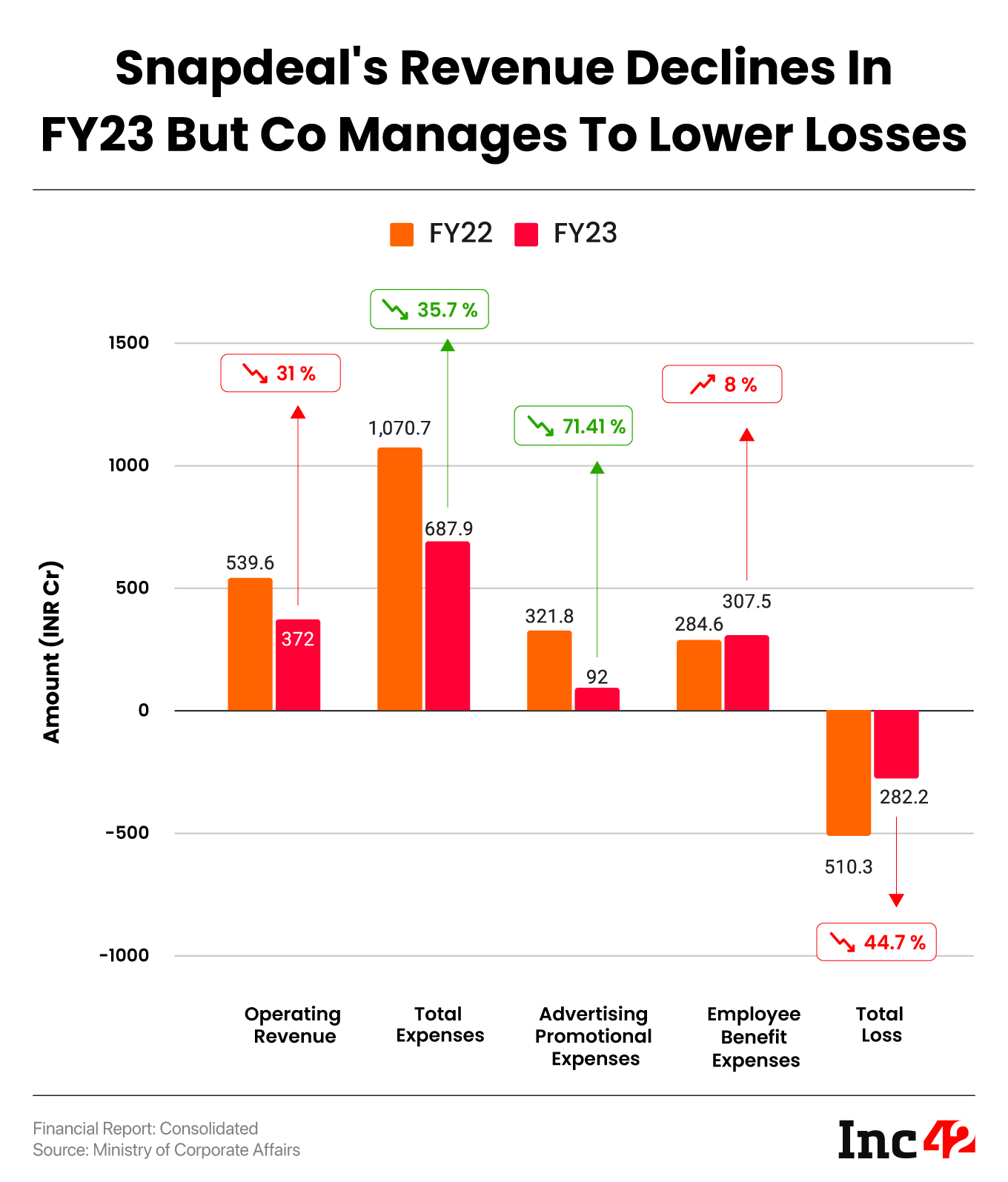

The Kunal Bahl-led ecommerce platform’s consolidated net loss narrowed 44.7% to INR 282.2 Cr in FY23 from INR 510.3 Cr in FY22

Snapdeal’s operating revenue declined 31% to INR 372 Cr during the year from INR 539.6 Cr in FY22

Led by a steep 71% decline in advertising expenses, Snapdeal’s total expenses fell 35.7% YoY to INR 687.9 Cr in FY23

Ecommerce major Snapdeal’s parent entity AceVector saw its consolidated operating revenue decline 31% to INR 372 Cr in the financial year 2022-23 (FY23) from INR 539.6 Cr reported in the prior fiscal year.

However, the Kunal Bahl-led ecommerce platform managed to lower its loss despite the decrease in sales revenue. Snapdeal’s net loss narrowed 44.7% to INR 282.2 Cr in FY23 from INR 510.3 Cr in the prior year.

Founded by Bahl and Rohit Bansal in 2010, Snapdeal

The startup’s income from sale of services fell 30.2% year-on-year (YoY) to INR 57.7 Cr during the year under review. Other operating revenue or income from ancillary activities declined 31.2% YoY to INR 314.2 Cr in FY23.

It is pertinent to note that the startup’s net loss also includes an one-time income of INR 20 Cr from the sale of investments in Freecharge.

Snapdeal’s subsidiaries include Unicommerce, which offers a software-as-a-service (SaaS)-based order management and fulfilment platform to ecommerce and retail businesses, and Stellaro Brands.

In 2021, Snapdeal filed its draft red herring prospectus (DRHP) with the Securities and Exchange Board of India (SEBI) for its IPO and planned to raise over INR 1,250 Cr from the public offering. However, amid the funding winter and turmoil in the domestic and global markets, the ecommerce platform dropped its IPO plans in 2022.

However, as per a latest report, it is planning an IPO of its subsidiary Unicommerce eSolutions Pvt Ltd in 2024 on the back of improvement in market conditions.

Amid its declining sales, Snapdeal also made a debut on the government-backed Open Network for Digital Commerce (ONDC) in FY23.

Where Did Snapdeal Spend?

The SoftBank and Alibaba-backed company, which competes directly with Walmart-backed Flipkart and Amazon, lowered its total expenses by 35.7% to INR 687.9 Cr in FY23 from INR 1,070.7 Cr in the previous year.

Advertising Expenses: A major decline in Snapdeal’s total expenses was a result of it lowering its advertising and promotional expenses. The expense under the head declined over 71% to INR 92 Cr in the reported year from INR 321.8 Cr in FY22.

Employee Cost: However, Snapdeal’s employee benefit expenses kept growing. The cost increased 8% to INR 307.5 Cr in the reported year from INR 284.6 Cr in FY22.

In that, the startup spent INR 178 Cr towards salaries and wages in FY23 as against INR 173.9 Cr in the bucket last year. Employee share-based payment (equity settled) rose 22.5% YoY to INR 119 Cr in the reported fiscal.

Purchases Of Stock-In-Trade: Snapdeal lowered its spending in the bucket to INR 5.6 Cr in FY23 from INR 1.3 Cr the year before.

Miscellaneous Expenses: While the ecommerce platform did not elaborate on its miscellaneous expenses, the spending in this bucket decreased almost 37% YoY to INR 226.3 Cr in FY23.

Snapdeal said in its FY23 financial statements that the company had cash and bank balances of INR 62.8 Cr as of March 31, 2023 against INR 216.1 Cr a year ago.

“The board of directors of the company approved a revised business plan and strategy for the year ended March 31, 2023, which amongst other steps included further optimisation of the future costs. Basis the revised direction, the company expects to significantly right size and reduce the monthly cash burn,” it added.

Snapdeal has raised over $1.5 Bn so far across multiple funding rounds.

Ad-lite browsing experience

Ad-lite browsing experience