The agritech startup offers integrated services, including smart warehousing, small-ticket loans, collateral management and custodian services, market linkage and farming advisory

StarAgri claims to be profitable and has raised INR 350 Cr+ to scale operations and diversify its product portfolio

The startup wants to expand its global footprint and focus on the Middle East and African regions

Farming has been one of the oldest and most labour-intensive sectors since ancient hunter-gatherers embraced it as a convenient way of growing and gathering food. Cut to the action today, agritech has emerged as a sunrise sector and modern-day tech has transformed how crops are sown, harvested, stored and sold.

Agritech in India has witnessed phenomenal growth in recent years, with nearly 2.8K agritech startups recognised by the government’s flagship initiative, Startup India, and hundreds more operating in the country. An analysis by Inc42 further reveals that the sector has attracted $2.4 Bn from prominent global and Indian investors since 2014.

All this has led to impactful innovations. From data collection and analysis for precision farming to machine-based quality management, waste-free supply chains and online marketplaces, the technology makeover of agriculture is gradually becoming a way of life among Indian farmers.

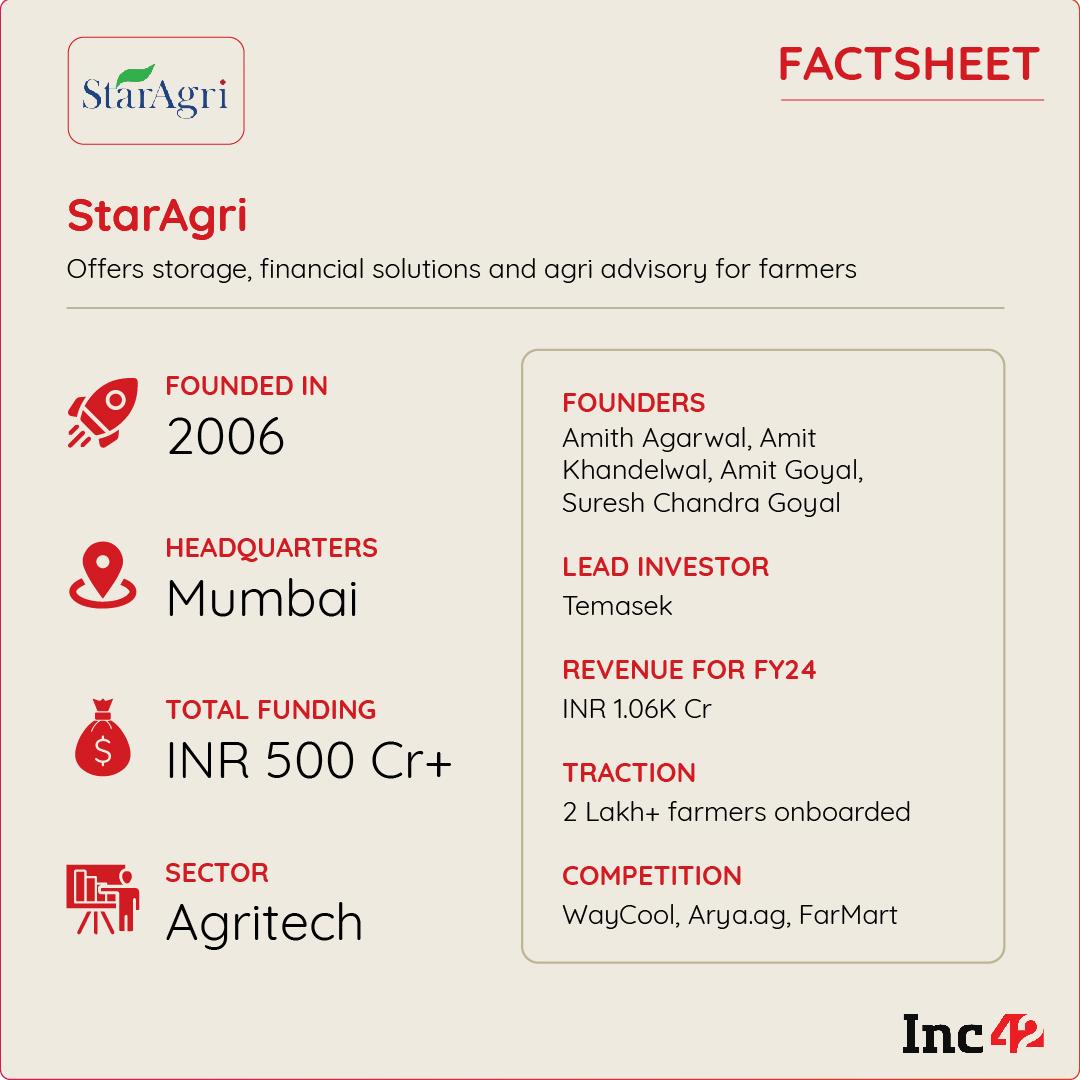

Although India is home to 125 Mn smallholding farmers and nearly half the population depends on agriculture for their livelihoods, only a few entrepreneurs ventured into this complex and challenging domain in the 2000s, when the startup culture was less prevalent. Mumbai-based StarAgri was a pioneer in this field, as its four founders shared a passion for farming and started working on various aspects of the agri ecosystem as early as 2006.

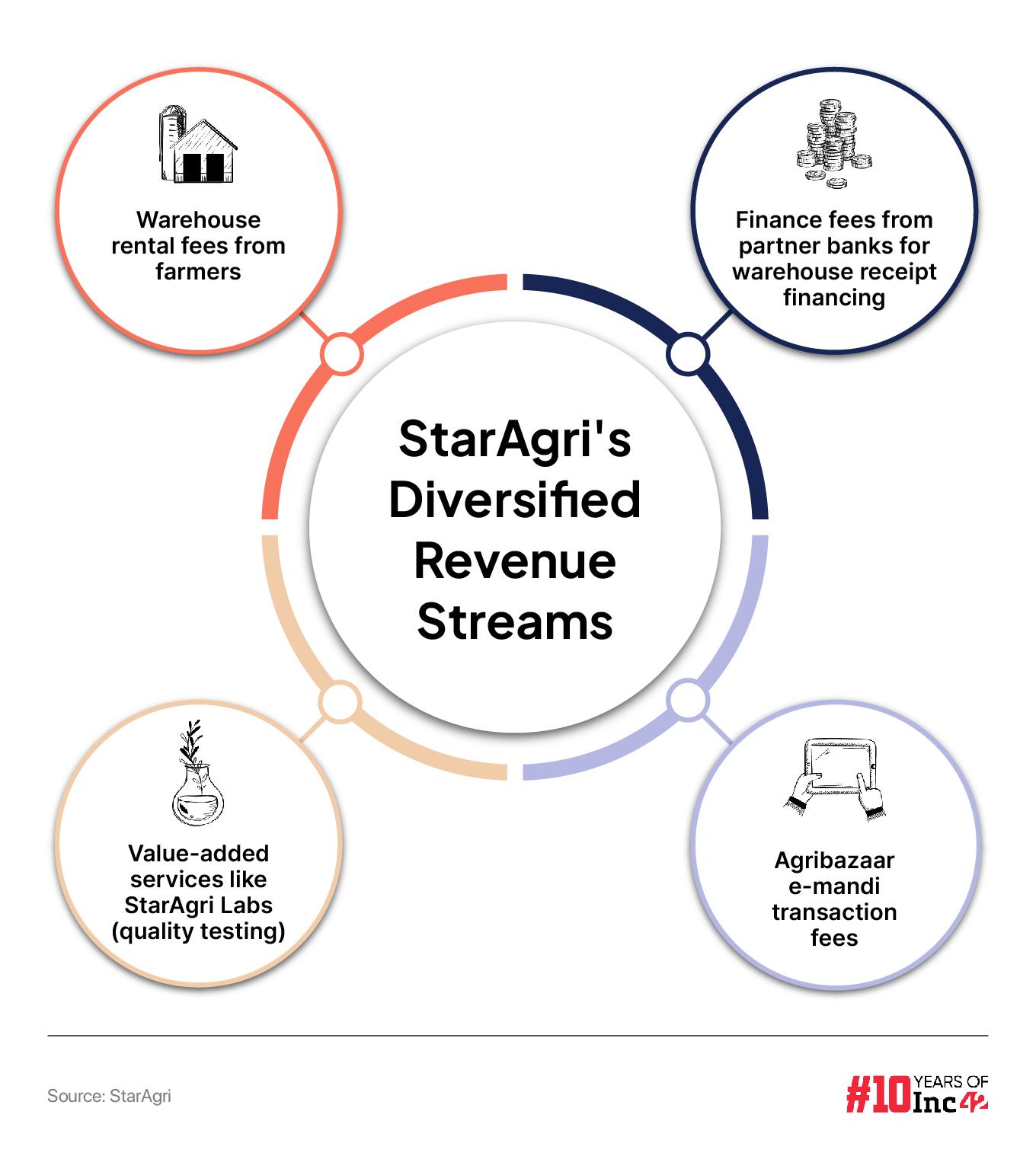

Eighteen years later, the platform’s niche is providing a comprehensive suite of services, including warehousing, market linkage (via Agribazaar), procurement and exports, collateral management, small-ticket agri loans (via Agriwise Finserv, its NBFC arm), agricultural advisory and more.

The startup also raised INR 350 Cr+ from major investors led by Singapore-based Temasek.

StarAgri claims it has onboarded and serviced more than 4 Lakh farmers and runs a network of 1,300+ warehouses spanning across 18 states. It has a warehousing capacity of 4.2 Million MT (metric tons) and manages assets worth INR 16,900 Cr AUM, as per the startup .

Founder-CEO Amith Agarwal mentioned that the startup turned profitable from the first year of its launch and clocked INR 1,006 Cr in revenue in FY24. Inc42 accessed StarAgri’s profit and loss statement for the year ending 31 March 2024 (FY24) to confirm its profitability.

It aims to onboard 100 Lakh farmers within the next three years.

StarAgri’s Smart Warehousing Provides Crop Provenance, Paving The Path For Agri-Financing

In techno agriculture (smart or precision farming), the focus is primarily on satellite/drone-guided monitoring, data-driven decisions, equipment automation and adaptive sensors/actuators that can turn traditional tools into smart machines. In short, it is a complete digital and technological makeover.

However, subsistence farming in countries like India has always been an uncertain enterprise, given two major challenges: Lack of financing and the absence of modern warehousing in rural India, which leads to massive spoilage and post-harvest losses. According to industry research, the losses incurred between harvesting and consumption ranged between 3-13% in 2022, and the economy suffered a setback worth INR 1.5 Lakh Cr.

StarAgri was determined to deal with such losses even in those early days and entered the agribusiness market with groundbreaking warehousing solutions. Its operations started in Rajasthan, and it provided state-of-the-art temperature-controlled storage, real-time stock updates and handling and weighing services.

This emphasis on traceability throughout the supply chain ensures that commodities remain verifiable collateral, enabling farmers to secure loans from NBFCs. Rigorous inspections by qualified personnel and automated monitoring to track stock movements and conditions underpin this innovative approach.

The agri startup also launched extensive outreach and awareness programmes. Conducted by its on-ground support team, these sessions educate farmers about modern storage methods and the benefits of using StarAgri services to help protect their produce and maximise their profits.

“Building the infrastructure was our biggest hurdle. We needed to create affordable and relevant physical and digital infrastructure for Indian farmers. This meant constructing scientific storage facilities alongside developing digital platforms for transactions,” said Agarwal.

StarAgri’s initial success in warehousing prompted further expansion and a deep dive into other critical issues like agri loans and market linkages. Eventually, Agarwal relocated to Mumbai in August 2009 to set up headquarters in the country’s economic capital and scale up operations in Maharashtra.

During this period, the founders became aware of the RBI’s efforts to improve financial inclusion while encouraging banks to lend to farmers. However, the SMF segment (small and marginal farmers) failed to access asset-backed formal loans due to a lack of collateral, loan default caused by frequent crop failures and an unstructured market unable to guarantee fair trade price to ensure operational viability.

To make agri loans more accessible, StarAgri initially partnered with ICICI Bank to enable warehouse receipt financing, which considers stored commodities as collateral. After a certified warehouse like StarAgri inspects produce quality and quantity, a warehouse receipt is issued, which allows farmers to secure loans from banks or other financial institutions. Soon after, the startup expanded its collaborations to include Axis Bank and Punjab National Bank. Today it has tie-ups with over 30 banks and financial institutions including PSU leaders like SBI and private sector banks like HDFC Bank.

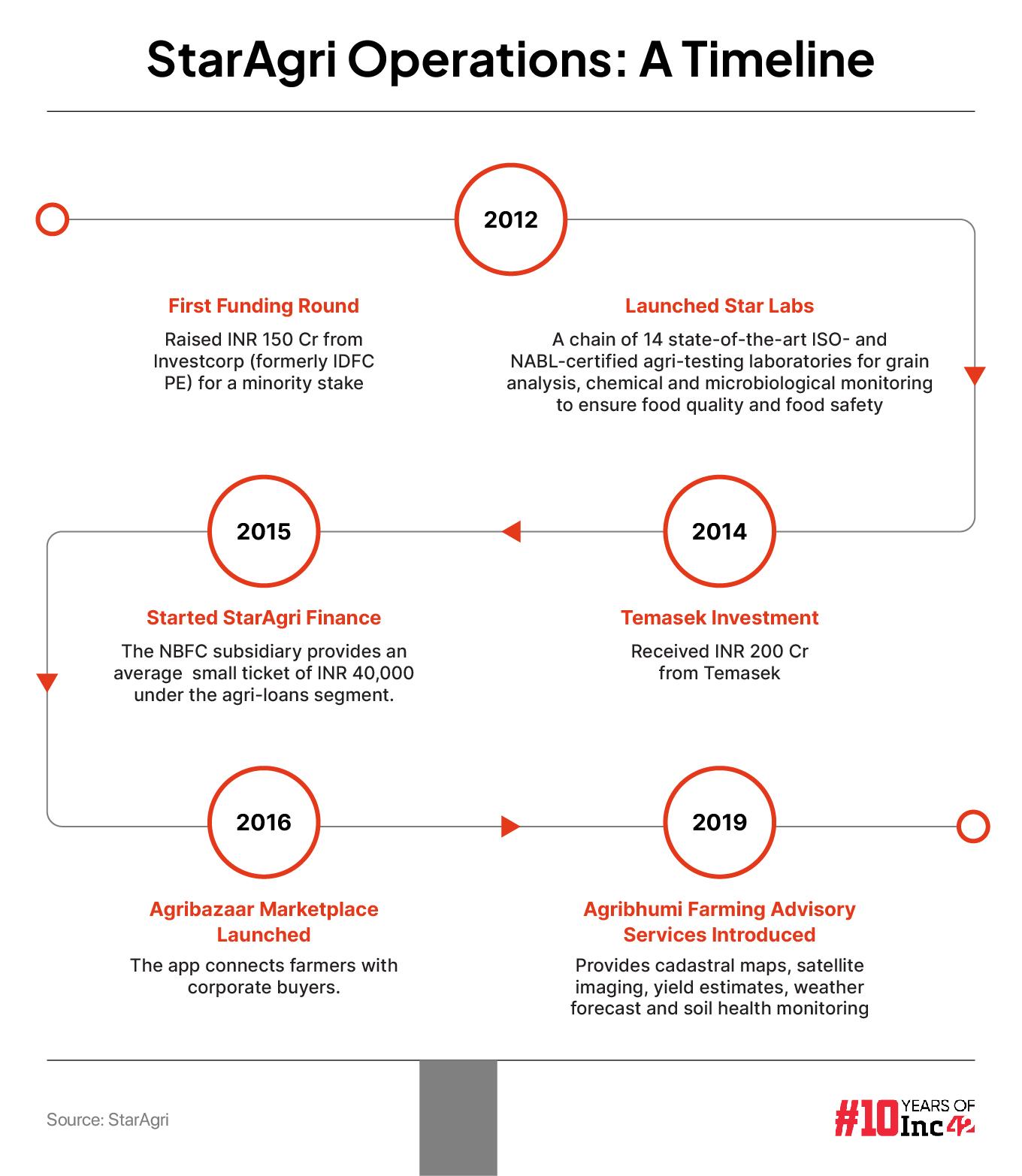

By 2011, StarAgri received accreditation of ISO 17025 for the first lab by NABL, ISO 22000 for Food Safety management system for Warehouse, and ISO 9001 for International Standard for Quality Management system. In another two years, it expanded to 183 locations across seven states, including Rajasthan, Maharashtra, Uttar Pradesh, Madhya Pradesh and Punjab among others.

Early Funding For Expansion: How StarAgri Strived To Build An Equitable Future

“StarAgri was profitable from the outset, but we needed capital to scale operations across states and diversify our product portfolio,” said Agarwal.

Institutional funding was a challenging proposition, though, as venture capital in India was in its nascency in the 2010s. So, the trio took a bold step and invested their own money when they developed warehousing solutions from scratch.

StarAgri secured $30 Mn (then INR 150 Cr) from Investcorp in 2012, followed by $35 Mn (then INR 200 Cr) from Temasek two years later. This was a substantial amount, considering agritech was a niche and somewhat unattractive segment at the time, and sci-fi-like tech wizardry needed for precision farming was a far cry.

“Banks were not ideally suited to finance certain customers as the latter lacked documentation or failed to comply with terms and conditions,” explained Agarwal. “Also, farmers mostly required small-ticket loans, sometimes as low as INR 5-7K. Traditional banks are not suitable for raising such small amounts.”

Recognising the gap, StarAgri launched its NBFC subsidiary, StarAgri Finance, in 2015 to provide tailored financial solutions for the ‘unbanked’ and the ‘underbanked’ farmers. It supports a hybrid environment, enabling online loan processing, while people not familiar with such systems can seek help from the on-ground support team.

Detailing the impact of this initiative on stakeholders in the agricultural and allied sectors, Agarwal said, “We serve agribusinesses, agricultural trade and rural enterprises through our NBFC. We also offer financial support to milking, cattle rearing, and other perishable rural businesses.”

A Mandi At Farmers’ Fingertips For Selling More, Earning Better

No agritech firm is complete without an output market linkage that seamlessly connects farmers with retail, wholesale and institutional buyers via an easy-to-use digital interface.

True to this new-age tech mandate, StarAgri launched Agribazaar in 2016. The digital marketplace is designed to ‘de-mandify’ the agri-business, bypassing traditional supply chains and intermediaries whose hefty margins erode the famers’ (producers’) profits.

To begin with, any farmer can list their produce directly on the Agribazaar app, which aggregates the demand for each crop and displays the best price. To streamline transactions further, the startup has developed the Agripay wallet, a proprietary checkout solution within Agribazaar, to ensure that farmers receive payments directly from the app, enabling secure and prompt financial transactions.

StarAgri has also partnered with prominent corporate buyers such as Britannia Industries, Cargill, ITC and Reliance Bazaar and helps with responsible procurement, sales and exports.

“Also, our online model reduces intermediation costs from the typical 3.25% to a paltry 0.5%. This directly leads to higher profits for farmers,” said Agarwal. The basic intermediation fee covers the cost of running the portal and providing other services.

Interestingly, homegrown market linkage players emerged in droves after the internet boom of 2015-16. Agarwal said the widespread availability of affordable smartphones and internet access in rural India significantly improved connectivity. “We capitalised on these advancements by developing mobile-friendly platforms for greater convenience. That’s the go-to hardware for India,” he said.

In 2019, StarAgri launched Agribhumi, a farming advisory app offering a host of services such as satellite imaging, cadastral map generation, yield estimates, weather forecast and soil health monitoring.

StarAgri Has Ambitious Plans, But Which Segment Will Maximise Growth?

With its diversified operations across service segments, StarAgri is confident about its future growth and wants to expand its global footprint in the Middle East and African markets in the next two to three years. This strategic move follows its initial foray into these regions in 2023.

“As one of the few profitable companies in the agritech space, an IPO is a natural next step for us,” said Agarwal. “We also aim to partner with more farmers in India and abroad.”

The agritech sector in India has seen steady growth in recent years and presents a potential of $25 Bn by 2025, according to an Inc42 report. It covers key sub-sectors like market linkage, agri-finance and precision farming. But market linkage is pivotal in improving smallholder farmers’ access to bigger, more lucrative markets and driving their profitability.

To illustrate, let us take a look at the data. Market linkage is poised to capture about $12 Bn, almost half of the total agritech market, revealing its importance and attraction among investors.

For StarAgri to thrive, it will need to bolster its efforts in this critical and highly competitive segment, as its homegrown peers like WayCool, Arya.ag, FarMart are already leading the way in the market linkage space. These startups are also into agri-financing and crop advisory but primarily dominate the market linkage segment.

While improved market linkage helps maintain a healthy power balance within the supply chain and reduces post-harvest losses due to better market coordination, StarAgri has stayed ahead of competition in the agri-warehousing space, yet another critical area that requires immediate attention. According to India Infrastructure Research, the country’s agricultural warehousing capacity must increase from 145 Mn tonnes in June 2023 to 223 Mn tonnes by 2026-27 to ensure smooth operations.

Given the way the world is trying to cope with a gargantuan global demand (around 10 Bn to feed sustainably by 2050) and the severe challenges of climate change, agritech may soon become one of the most critical sectors, attracting robust support from private investors and the public sector. And early signs are already emerging right here in India, opening numerous opportunities for StarAgri and its ilk.

The Indian government’s announcement in July 2024 to set up an INR 750 Cr Category-II Alternative Investment Fund (AIF) for agriculture and allied industries clearly indicates the sector’s growth potential and the promise Indian agritech startups hold.

Ad-lite browsing experience

Ad-lite browsing experience