Since its inception, Angel School has empowered over 400 investors, providing them with the skills to navigate the complexities of startup investing

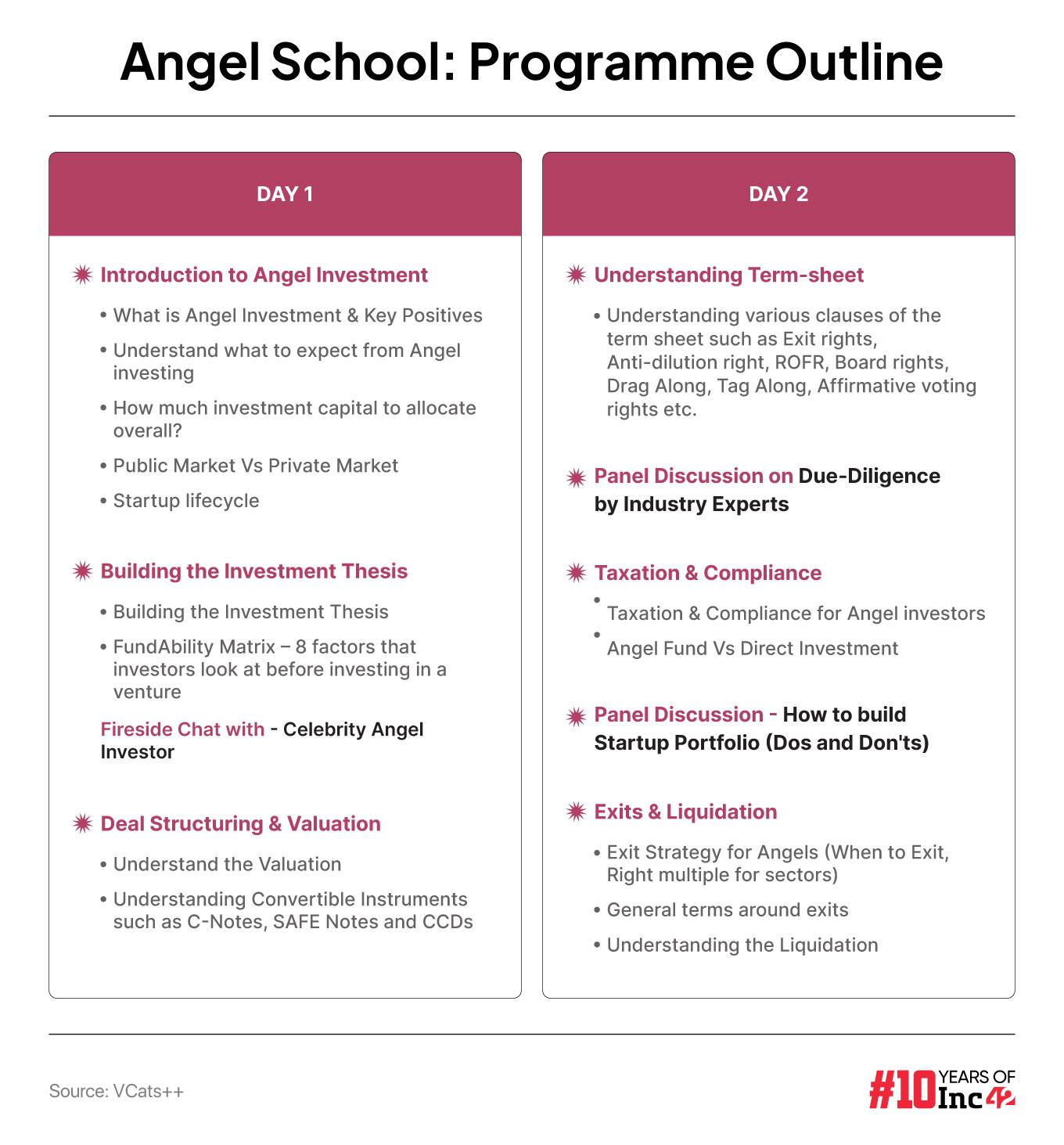

The programme will cover angel investing fundamentals, investment thesis building, deal structuring, valuations, key term sheet clauses, taxation, compliance, portfolio strategies and exit planning

The sixth edition of the programme will be held on August 24-25

Multi-stage venture capital firm Venture Catalysts++ is all set to hold the sixth edition of its programme ‘Angel School’ on August 24-25. The initiative is designed to educate and empower aspiring angel investors by equipping them with the necessary tools and knowledge to make well-informed investment decisions.

According to Inc42’s India Startup Investor Landscape Report, India currently has over 125 angel networks and syndicates. This figure is expected to cross the 200 mark by 2030. Investing in startups, particularly in their early stages, presents a unique opportunity to unlock value that traditional investment avenues like capital markets may not offer. Alternative investments, such as in startups, often mitigate risk and provide pathways for portfolio diversification.

However, many new investors lack the experience needed to effectively evaluate startups, which can result in poor investment decisions and potential losses. The two-day online programme aims to assist HNIs (high-net-worth individuals) in navigating these challenges by learning insider strategies and best practices from leading institutional investors.

The Impact Of Angel School

Founded in 2016 by Dr Apoorva Ranjan Sharma, Anil Jain, Anuj Golechha and Gaurav Jain, Venture Catalysts++ has syndicated $720 Mn across more than 360 portfolio startups. As startup investments gain momentum, the VC firm seeks not only to deliver financial returns to angel investors but also to elevate India’s startup ecosystem.

Since its inception, Angel School has empowered over 400 investors, providing them with the skills to navigate the complexities of startup investing.

Angel School has featured marquee investors as mentors, including Rajan Anandan, managing director of Peak XV Partners & Surge; and Dr Sharma of VCats++ and Ramakant Sharma, cofounder of Livspace.

The latest edition of Angel School will cover all essential topics which aspiring investors need to know – an introduction to angel investing, comparing public vs private markets, and the startup lifecycle. Experts will also teach ways to build an investment thesis and understanding deal structuring, valuations, and convertible instruments like C-Notes and SAFE Notes.

Additionally, the programme will cover key term sheet clauses, taxation, compliance, and strategies for building a startup portfolio. The programme would conclude with a session on exit strategies and liquidation.

Why To Take Up Angel Investing?

With the country’s startup ecosystem growing by leaps and bounds, angel investing presents an opportunity for wealth creation and supporting young entrepreneurs.

According to Inc42 data, seed investments grew 23% YoY in H1 2024, reaching $589 Mn across 229 deals. This highlights the rapid growth in early-stage investments and the critical role angel investors play in supporting new ideas and innovations, which have the potential to transform industries.

In a significant move for startups and investors, the Union Budget 2024-25, presented by finance minister Nirmala Sitharaman, abolished the angel tax. This was the tax levied on capital raised by unlisted companies when the share value exceeded the fair market value.

Over time, this tax became a challenge for stakeholders, as tax authorities began issuing notices to startups and scrutinising their valuation methods. The move to abolish angel tax is expected to give a further boost to angel investing in the country by improving its appeal among HNIs.

Amid all these, programmes like Angel School offer a platform for aspiring investors to build a community of like-minded peers and contribute to fueling India’s startup growth story.

Ad-lite browsing experience

Ad-lite browsing experience