The company entered the space in February this year and is on track to exceed INR 100 Cr in ARR by October

Leveraging its existing customer base, the ecommerce foray is part of Jar’s efforts to diversify revenue streams and reduce losses

Founded in 2021, Jar operates a mobile-based app, which allows users to invest as little as INR 1

With an eye on diversifying its product mix, Tiger Global-backed wealthtech startup Jar is said to have entered into the ecommerce space with its D2C jewellery brand Nek.

The cofounder and CEO of the gold-focussed micro-savings platform, Nishchay AG, told Livemint that the company entered the space in February this year and is on track to exceed INR 100 Cr in annual recurring revenue (ARR) by October.

As per the report, Nischay said that the move is part of Jar’s efforts to diversify revenue streams and reduce losses. “Gold is widely understood and stable. Since our users save in gold, launching Nek as a jewellery brand was a natural progression,” he added.

As per the report, Nek focusses on gold jewellery and leverages Jar’s existing customer base that has invested in digital gold. However, Nischay added that revenue from the core digital gold vertical will remain the primary growth driver, contributing over 50% to the overall topline.

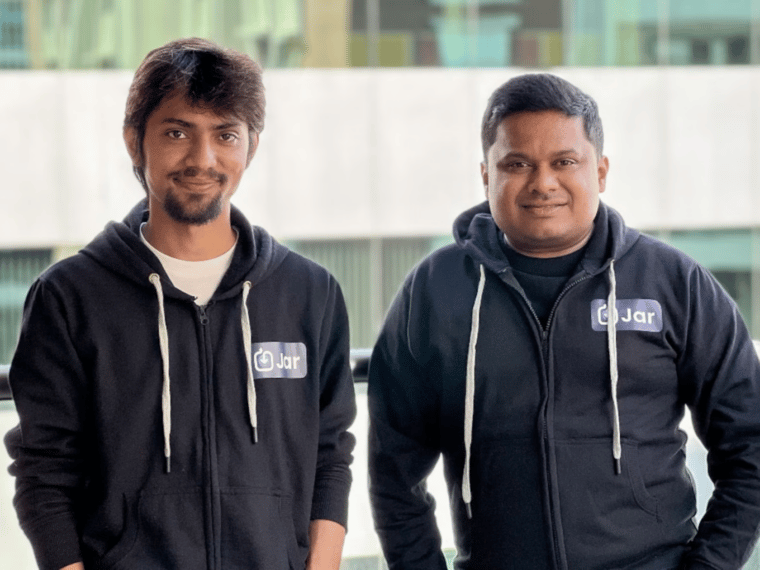

Founded in January 2021 by Nischay and Misbah Ashraf, Jar operates a mobile-based app, which allows users to invest as little as INR 1. It claims to have more than 1.5 Cr users on the platform.

This comes close on the heels of Jar bagging $22.6 Mn in its Series B funding round at a post-money valuation of $300 Mn from Tiger Global, and Eximius Ventures, among others. It recently partnered PhonePe to roll out a new ‘Daily Savings’ feature to spur the purchase of digital gold.

Notably, the ecommerce foray comes months after Jar was said to be mulling a foray into the peer-to-peer (P2P) lending space with its new offering ‘Jar Plus’.

On the financial front, Jar saw its net loss widen almost 77% year-on-year (YoY) to INR 122.8 Cr in FY23 despite a sharp jump in revenues. Meanwhile, operating revenue jumped 1,000% to INR 8.7 Cr during the period under review from INR 73.8 Lakh in FY22.

Ad-lite browsing experience

Ad-lite browsing experience