Per data compiled by Inc42, edtech startups raised $278 Mn in the first nine months of 2024, up a mere 3% from the $269 Mn raised in the corresponding period a year ago

PhysicsWallah alone netted $210 Mn of the total edtech funding raised in the three quarters of 2024. Sans PW, the Indian edtech funding in the first nine months of the year endured a decline of nearly 75% YoY

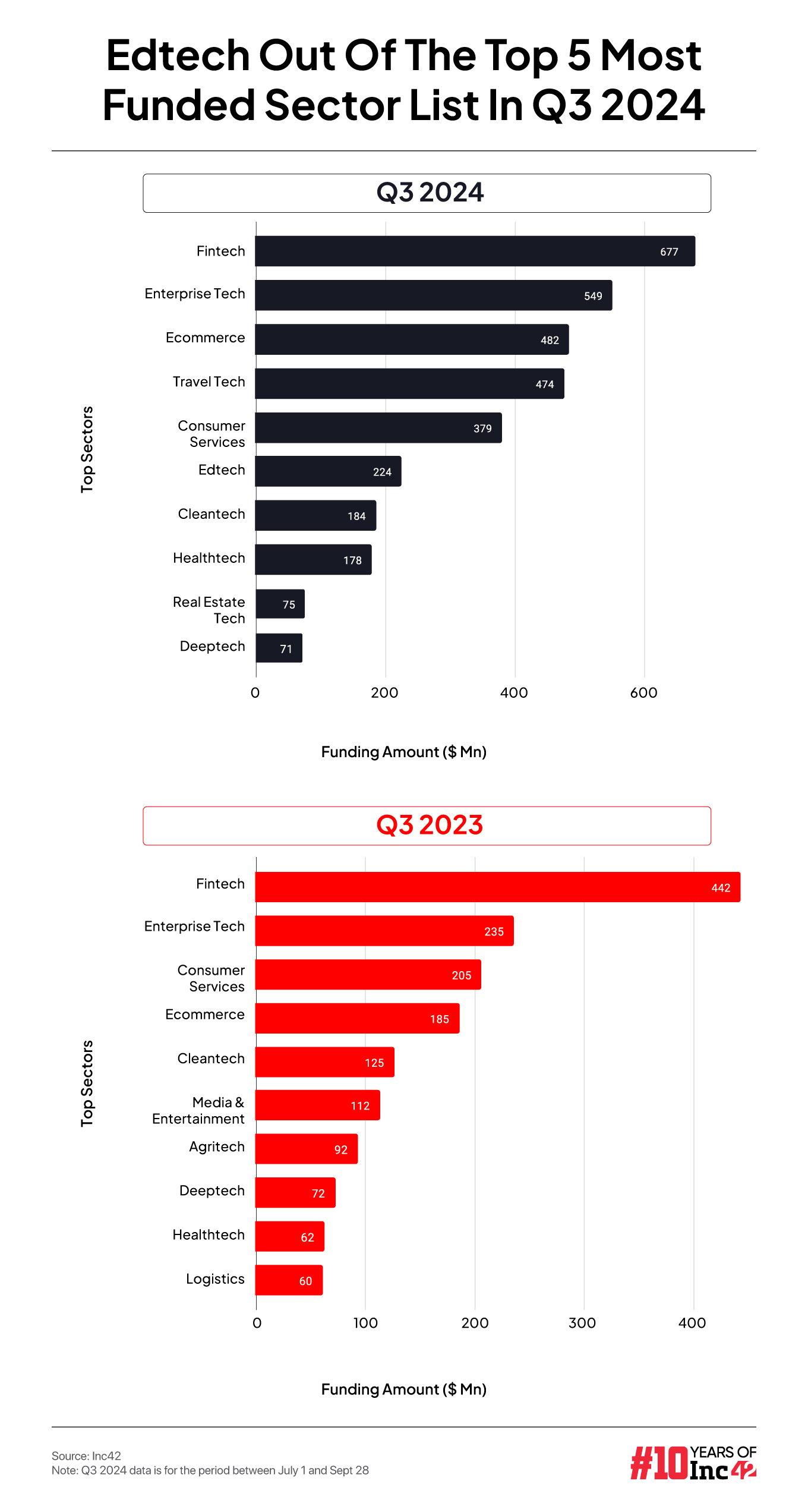

The Indian edtech sector couldn’t make it to the list of the top 10 most funded startup sectors during the recently-concluded quarter

The funding gold rush of 2021-2022 gave a major boost to several sectors but the Indian edtech space turned out to be the prime beneficiary when the pandemic brought the world to its knees.

The forced closure of schools and colleges paved the way for digital learning, and techies started to form a beeline to cater to the growing demand for online education. Not to mention, the growing demand for skill development among the workforce working in tech and tech-adjacent industries also fuelled the edtech growth story in India.

This propelled the Indian edtech space to become the third most-funded sector in 2021, securing $4.7 Bn in investments — only trailing behind ecommerce ($10.7 Bn) and fintech ($8 Bn). In fact, edtech raised $2.4 Bn in 2022 alone. Such was the scale that these two years accounted for 64% of the total $11 Bn the sector raised between 2014 and 2024.

But then, the reality struck when the world opened to business as usual, presenting challenges that the industry sleuths hadn’t anticipated. As physical classrooms reopened, the demand for online learning plateaued, exposing the cracks in edtech’s business models and their long-term sustainability. The results were immediate and stark. The edtech startup funding dropped 88% year-on-year to $283 Mn in 2023.

With this massive drop in funding many skeletons started to tumble out of the closets. For one, a lot of startups started to struggle with their incomplete playbooks amid expiring runways due to investors tightening their purse strings. This led to layoffs, shutdowns and whatnot.

The troubles compounded for the sector when BYJU’S, the country’s biggest edtech, started to stagger from being the poster child of India’s edtech boom to getting embroiled in back-to-back controversies. And we know how the fates of the once-edtech decacorn have unravelled since then, especially in 2024.

Well, to be true, the Indian edtech space is not doing too well, even as the first nine months of the ongoing year have done a little better on the funding front compared to the year-ago period.

As per Inc42’s quarterly funding report (Q3, 2024), startups in the space raised $278 Mn in the first nine months of 2024, up a mere 3% from the $269 Mn raised in the corresponding period in 2023.

However, on a year-on-year basis, edtech funding in the third quarter of 2024 was up 357% to $224 Mn from a mere $49 Mn in Q3 2023.

However, what needs to be acknowledged is that PhysicsWallah alone netted $210 Mn of the total edtech funding raised in the three quarters of 2024.

Sans PhysicsWallah, the Indian edtech funding in the first nine months of the year seems to be dangling at around $68 Mn, enduring a decline of nearly 75% YoY. Similarly, the edtech funding during Q3 of 2024 stood at just $14 Mn, without counting PhysicsWallah.

Notably, as per Inc42’s latest Indian Tech Startup Funding Report Q3 2024, PhysicsWallah was the second biggest mega deal after Zepto’s $340 Mn in this year’s September quarter.

Despite this, the Indian edtech sector couldn’t make it to the list of the top 10 most funded startup sectors during the recently-concluded quarter.

Is The Indian Edtech Sector Headed For Revival?

Despite the dilapidated state of affairs, experts hope that the sector may see a funding revival, especially when we have startups like PhysicsWallah (PW) to support the Indian edtech growth story. Notably, the edtech unicorn raised $210 Mn (approximately INR 1,756.7 Cr) in its Series B funding led by Hornbill Capital at a post-money valuation of $2.8 Bn.

“The edtech industry has learned valuable lessons from its rapid rise and fall after the pandemic. While the initial boom showed potential, many companies struggled to scale effectively, highlighting the need for a hybrid approach. PhysicsWallah is a standout example, managing to break through the clutter. The future of education is not just in online models, but in combining digital and offline experiences,” Anup Jain, founding partner of India Early Stage Fund said.

He also noted that the K-12 segment has become crowded, with numerous edtech players competing for the same space. This is because K-12 is the highest-funded subsector in edtech. As per Inc42’s annual “The State Of Indian Startup Ecosystem Report“, the K-12 segment received $5.8 Bn between 2014 and 2024, accounting for 54.5% of total edtech funding.

Meanwhile, Jain sees new opportunities for the segment with the roll out of the National Education Policy (NEP).

Access Free ReportFurther, there is a growing shift towards design thinking and skill-based learning, which offers startups a chance to thrive by focussing on employability and career development. Per industry experts, the future of education will focus on preparing students for real-world challenges, particularly in the age of AI and automation.

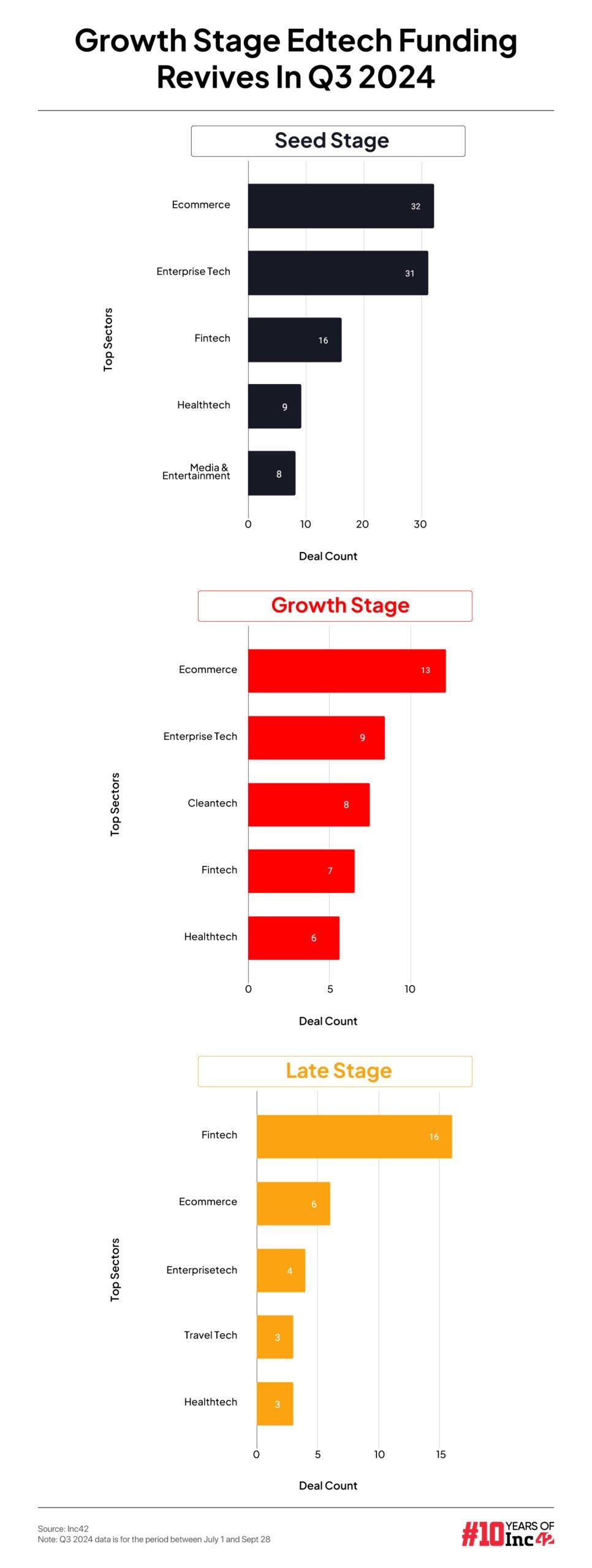

“Funding revival will likely start from seed and pre-seed rounds. Beyond one or two exceptions, there hasn’t been much significant interest in late-stage investments. For edtech companies, the challenge is that business models and unit economics can shift overnight. That’s why we anticipate more seed and Series A activity in the near future, as products driven by AI and machine learning show strong traction,” Rohit Krishna, partner at WEH Ventures, said.

The Future Of Edtech In India

Anticipating revival in seed and pre-seed edtech rounds, WEH Ventures’ Krishna sees new technologies, like generative AI, as key drivers for the next big edtech boom.

He also envisions such technologies driving significant improvements in product quality, all while reducing costs. Notably, the industry is witnessing a wave of new companies capitalising on emerging technologies, particularly in the early stages.

Unlike the edtech gold rush of 2021-2022, startups founded more recently have started to look more lucrative to investors. This is because these startups, helped by emerging technologies, are endeavouring to create more interactive and engaging content.

Additionally, generative AI is being employed to automate administrative tasks within edtech platforms, streamlining operations so educators can focus more on teaching.

Access Free ReportFurthermore, as conversational AI and chatbots gain traction in education, many companies will be seen using them to provide personalised and immersive learning experiences. Additionally, AI-assisted grading has improved the speed of assessments, allowing users to receive graded assignments promptly and benefit from instant feedback.

Hence, investors predict a revival in early-stage funding for edtech over the next year, although they will remain cautious before committing to large investments.

[Edited By Shishir Parasher]

Ad-lite browsing experience

Ad-lite browsing experience