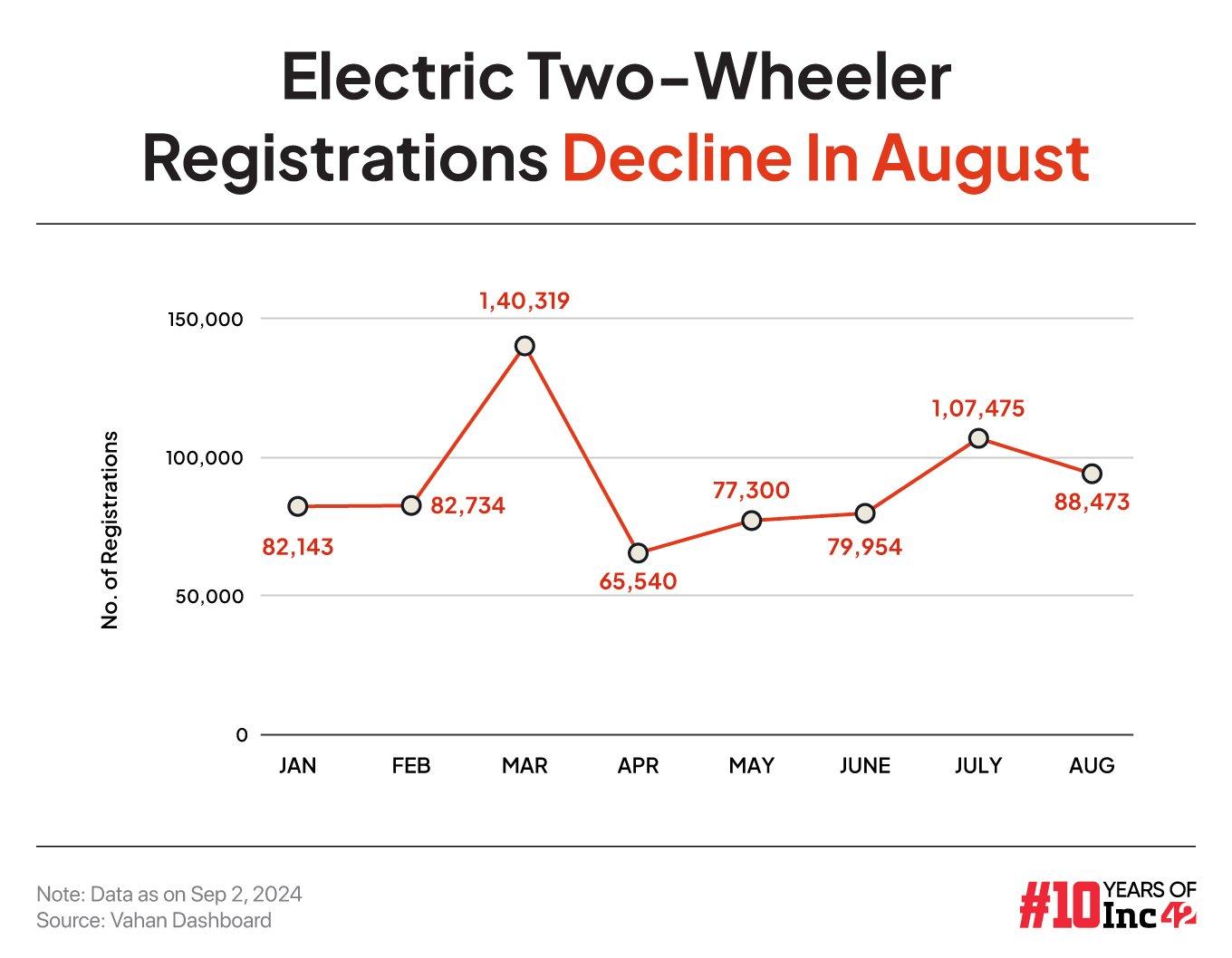

Total EV two-wheeler registrations fell to 88,473 units last month from over 1.07 Lakh units in July

Recently listed Ola Electric’s total escooter registrations slumped 34% MoM to 27,517 units in August

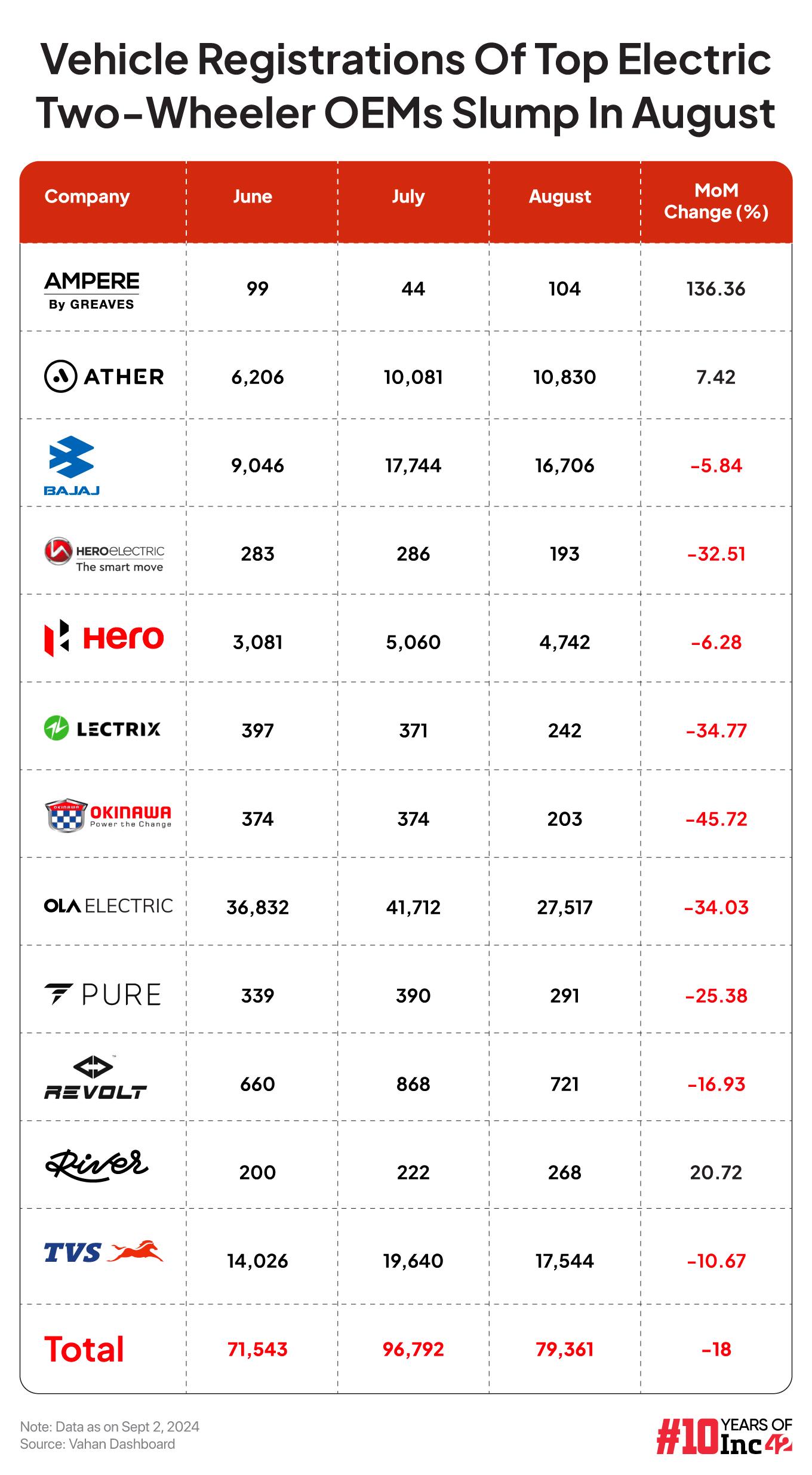

While TVS Motor’s registrations fell about 11% to 17,544 units from 19,640 units in July, Bajaj Auto’s escooter registrations were down merely about 6% MoM to 16,706 units

After a sharp rise in July, two-wheeler electric vehicle (EV) registrations witnessed a decline of about 18% in August. The registrations of Ola Electric, the leading EV two-wheeler player in terms of market share, fell below 30,000 units last month.

Total EV two-wheeler registrations fell to 88,473 units last month from over 1.07 Lakh units registered in July, as per Vahan data as of September 2. However, the registrations rose 41% compared to 62,782 units in August 2023.

Recently listed Ola Electric’s total escooter registrations slumped 34% month-on-month (MoM) to 27,517 units in August. Its vehicle registrations stood at 41,712 units in July and 36,832 units in June.

It is worth noting that following its public market debut, the Bhavish Aggarwal-led EV startup unveiled its electric motorcycles in August. Its three electric motorcycles – Roadster X, Roadster, and Roadster Pro – are priced between INR 74,999 and INR 2,49,999.

Meanwhile, Jefferies pointed out in a research report recently that while Ola Electric’s market share rose to 35% in FY24 in the EV two-wheeler category from 21% in FY23 and further to 49% in the first quarter of FY25, the EV manufacturer has started seeing a decline now.

Ola Electric’s market share slipped to 39% in July and to 33% in August, while legacy players like TVS Motor and Bajaj Auto have been regaining their market shares, the brokerage noted in the report released mid-August.

In fact, amid an overall decline in the EV two-wheeler sales in August, TVS’s registrations fell about 11% to 17,544 units from 19,640 units in July.

On the other hand, Bajaj Auto’s escooter registrations were down merely about 6% MoM to 16,706 units in August.

Currently, Ola Electric, TVS, and Bajaj are the top three two-wheeler EV players in India. When compared on a year-on-year (YoY) basis, Ola Electric’s vehicle registrations grew almost 47% in August, while TVS saw a 13% rise. Meanwhile, Bajaj Auto saw a massive 154% YoY increase in registrations.

As per the Vahan numbers, Ola Electric’s market share in the EV two-wheeler segment stood at 31% in August as against 39% in July. TVS held about a 20% market share last month as compared to 18% in July. Bajaj Auto increased its market share to 19% from a little over 8% in July.

Ather Energy was at the fourth spot with about 12% market share in August as against 9% in July.

Ather’s escooter registrations increased 7.4% MoM to 10,830 last month. Recently, the EV startup also joined the unicorn club with an INR 600 Cr ($71 Mn) fundraise.

Okinawa, Hero Electric, Pure EV, Revolt, and a few others, who have been under pressure since the FAME II fiasco last year, continued to witness decline in sales in August.

Meanwhile, one of the newest escooter players in the Indian automotive market, River, has started seeing an increase in sales. Its EV registrations grew over 20% to 268 units in August from 222 units in July.

In June, the startup saw about 200 vehicle registrations. In January this year, River only had 43 units of EV registrations. Speaking to Inc42 during its $40 Mn fundraise earlier this year, River’s cofounder and CEO Aravind Mani said that the startup was not looking at leading players but was focusing on building its fundamentals.

Meanwhile, electric motorcycle manufacturer Ultraviolette’s vehicle registrations stood at 46 units in August, a slight decline on a MoM basis.

It is pertinent to note that the number of EV registrations in July this year was the highest after 1.4 Lakh units recorded in March, the month when the FAME-II subsidy scheme came to an end.

The Federation of Automobile Dealers Associations (FADA) attributed the growth in this category of EV sales in July this year to discounts and the nearing deadline for the end of the Electric Mobility Promotion Scheme (EMPS) 2024 scheme deadline.

The Ministry of Heavy Industries earlier introduced the INR 500 Cr EMPS 2024 earlier this year. It is a stopgap scheme aimed at helping the EV industry with demand subsidies following the end of the FAME-II scheme and before the launch of the FAME-III scheme.

While EMPS was expected to end in July, it recently got another extension till September end.

Overall, total EV registrations in the country, across categories, declined to 1.63 Lakh units last month from 1.87 Lakh units in July.

Ad-lite browsing experience

Ad-lite browsing experience