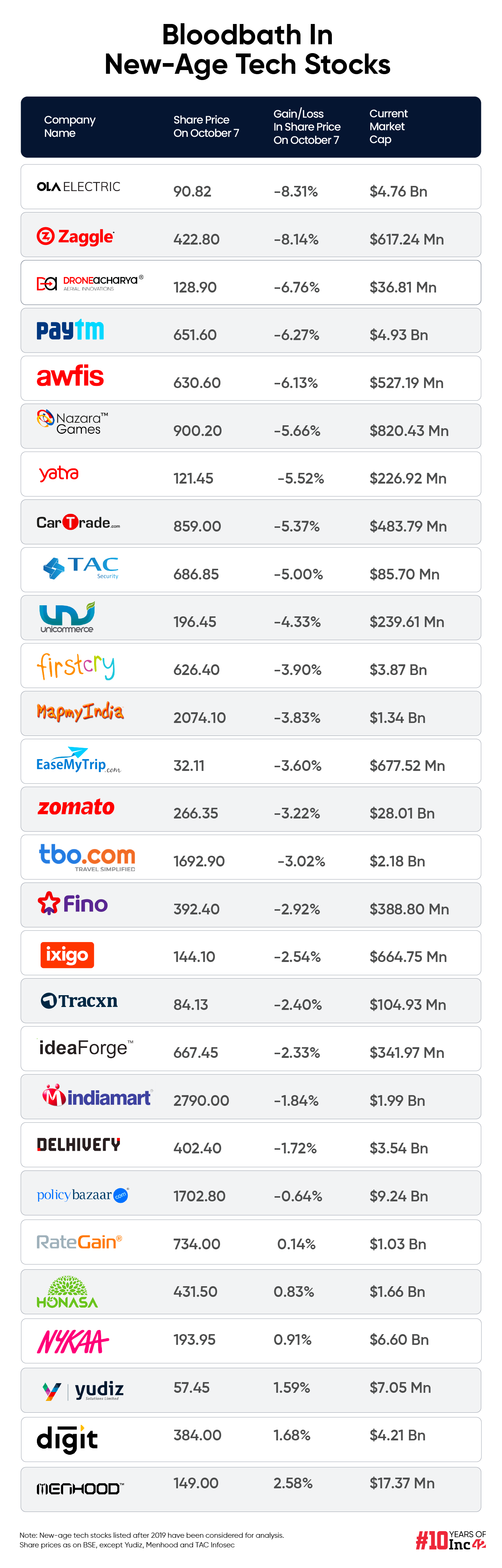

Twenty two out of the 28 stocks under Inc42's coverage fell in a range of 0.64% to over 8% in today’s session, with Ola Electric emerging as the biggest loser

Shares of fintech SaaS startup Zaggle crashed 8.14% to INR 422.80, while Paytm and Awfis declined over 6% each

Overall, the cumulative total market capitalisation of the 28 new-age tech stocks declined $2.3 Bn to stand at $78.52 Bn at the end of today’s session

There was a bloodbath in new-age tech stocks on Monday (October 7) as the decline in the broader market continued in today’s session.

Twenty two out of the 28 stocks under Inc42’s coverage fell in a range of 0.64% to over 8% in today’s session. Ola Electric emerged as the biggest loser, with its shares plummeting 8.3% to end the day at INR 90.82.

It was followed by fintech SaaS startup Zaggle, which fell 8.14% to INR 422.80. The startup announced the appointment of Kotak Mahindra Bank’s consumer banking head Virat Sunil Diwanji as an additional director to its board.

While Paytm declined 6.27%, Awfis fell 6.13% today. Nazara, Cartrade and FirstCry were among the other major losers today.

Meanwhile, NSE SME listed D2C startup Menhood continued its bull run from last week to emerge as the biggest gainer today. Shares of its parent Macobs Technologies ended today’s trading session at INR 149, up 2.58% from previous close. Go Digit, Nykaa, Honasa, RateGain and Yudiz were the other new-age tech stocks which ended in the green today.

Overall, the cumulative total market capitalisation of the 28 new-age tech stocks declined $2.3 Bn to stand at $78.52 Bn at the end of today’s session as against $80.85 Bn on October 4 (Friday).

In the broader market, benchmark indices Sensex fell 0.78% to 81,050 and Nifty50 declined 0.87% to 24,795.75. BSE SmallCap index crashed 3.27% to 54,117.72 and BSE Midcap went down 1.85% to 47,019.08.

Commenting on today’s market performance, Hrishikesh Yedve, AVP of technical and derivatives research at Asit C. Mehta Investment Intermediates, said, “Nifty started the day flat to positive but remained under pressure after an initial bounce, ultimately closing on a negative note at 24,796. Technically, on the daily chart, the index (Nifty 50) formed a red candle, signalling weakness. However, the index managed to defend the 24,750 level, providing some relief for the bulls.”

“As long as the index holds within the 24,700–24,750 range, a short-term pullback could be possible. However, if Nifty sustains below 24,700, deeper declines could follow,” he added.

It is pertinent to note that markets were on a downward spiral last week as well. While Sensex slumped 4.5% to 81,688.45 in the previous week, Nifty50 went down 4.4% to 25,014.60.

Rising geopolitical tensions in the Middle East have kept the investors on tenterhooks. Besides, the stimulus measures announced by China have led to global investors shifting their focus to the Chinese market from the Indian market.

Ad-lite browsing experience

Ad-lite browsing experience