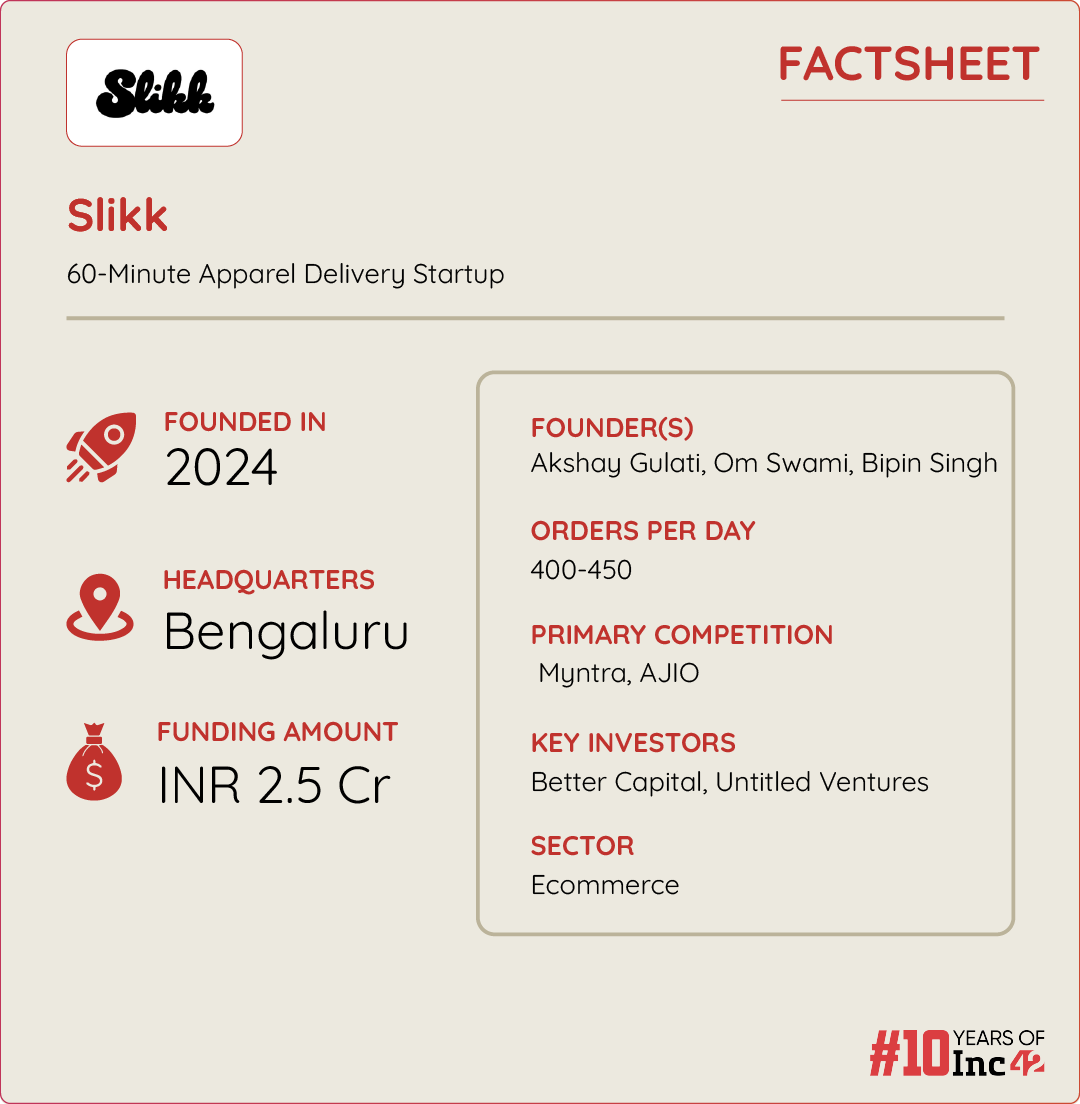

Launched in August 2024 by Akshay Gulati, Om Swami and Bipin Singh, quick commerce startup Slikk delivers Gen-Z focused fashion items within 60 minutes in select locations of Bengaluru

Since launch, Slikk’s app on the Google Play Store has seen over 10K downloads and is currently completing about 100 deliveries per day

The startup has raised INR 2.5 Cr in a pre-seed round led by Better Capital, with participation from Untitled Ventures

What do shoppers want most if all the world is a virtual shopping cart? There is no need to ask around. It is all about instant gratification, buying what one wants online and getting it delivered in minutes. The business of quick commerce (q-commerce) thrives on this tenet, taking consumer convenience and impulsive buying to new heights.

Despite initial scepticism, q-commerce in India is rapidly growing. The market is projected to reach $9.9 Bn by 2029 from the current $3.3 Bn at a CAGR exceeding 4.5%.

Hence, businesses in this space are experimenting with newer categories and faster deliveries to amp up their growth. What started with groceries has now forayed into myriad segments like home and living, beauty and personal care, consumer electronics, kitchen essentials, sports and lifestyle, toys and games and more.

The race to the top is also heating up. Startups like Zepto, Blinkit (formerly Grofers and now a Zomato subsidiary) and Swiggy Instamart currently lead the market, but deep-pocketed ecommerce giants are catching up fast. Flipkart Minutes and BigBasket’s BB Now are making rapid strides, while Amazon India is eyeing a foray into this burgeoning market early next year.

Bengaluru-based Slikk, a one-month-old startup on the quick commerce block, is not daunted, though, in spite of the cut-throat competition. Instead, it has picked up fashion ecommerce, set to surpass $112 Bn by the decade’s end, and aligned its delivery window with quick commerce to ensure instant gratification. This practice is currently not in vogue in fashion ecommerce, a category with high return rates.

Launched in August 2024 by Akshay Gulati, Om Swami and Bipin Singh, Slikk is now delivering fashion items within 60 minutes in select locations of Bengaluru and serving about 100 users per day. It also offers a try-and-buy option and a seven-day return policy to bring down high returns and earn consumer trust.

It also raised INR 2.5 Cr in a pre-seed round led by Better Capital, with participation from Untitled Ventures. Although the funding was disclosed shortly after the startup’s launch in late August, cofounder and CEO Akshay Gulati said the capital infusion happened about three months ago.

Slikk is not the only startup betting big on new categories in quick commerce. A few weeks ago, Inc42 featured another newcomer, Swish, trying to usher in the 10-minute model in the food delivery space. It operates a cloud kitchen called Pod in Bengaluru’s HSR Layout and delivers to areas within a 1.5 km radius.

Why Slikk Opted For The Road Less Taken

Before setting up Slikk, the founders worked for retail tech startup Perpule, which offered a platform-independent PoS (point of sale) machine and cloud-based services to help small offline businesses manage their inventories, billing and overall customer experience for enhanced operations.

When Amazon India acquired Perpule, the trio was absorbed and held managerial roles in product and software development. During the stint, they also understood that UI/UX (user interface and user experience) personalisation was a critical prerequisite for online fashion shoppers, resulting in a fast and hassle-free experience.

Their idea to launch a curated marketplace and time-sensitive delivery model stemmed from an observation that shoppers usually abandoned their search if they had to browse too long to find what they wanted. In contrast, onboarding selective brands based on the latest fashion trends might keep shoppers intrigued and lead to better conversion rates, Slikk’s cofounder and CEO Akshay Gulati told Inc42.

Initially, the founders wanted to launch a hyper-personalised ecommerce platform for young people, especially Gen Z and young millennials. “We define Slikk as a curated fashion marketplace that delivers in 60 minutes. But when we picked this idea, the focus wasn’t on quick commerce. It was more about personalising and curating fashion that was better suited for young shoppers,” said Gulati.

Fashion curation as a concept seemed promising, but doubts lingered over its viability and competitive advantage. Further brainstorming led to another unique value proposition – a delivery window of 60 minutes or less.

Slikk implemented the q-commerce model and started selling exclusive collections from ‘top-notch but undiscovered’ D2C fashion labels such as RIGO, Zaccai, Soul Store, Untung and more. It has also integrated artificial intelligence (AI) technology into its UI/UX design to ensure the startup’s offerings match its target customers’ preferences and shopping behaviours (more on that later).

However, major players are not lagging. Per media reports, fashion ecommerce giant Myntra (owned by the Flipkart group) piloted a four-hour delivery service, signalling a shift towards faster delivery. Similarly, Nykaa, a beauty and personal care giant that has forayed into online fashion, will introduce express delivery service in metro cities and reduce delivery timelines.

Again, Blinkit and Swiggy Instamart were reportedly in talks with Arvind Fashions, Fabindia, Woodland and PUMA about featuring their products on the q-commerce platforms. Although nothing much has materialised on those fronts, the U.S. Polo Association and Decathlon India have partnered with q-commerce platform Zepto to offer premium fashion products and sporting goods.

A Deep Dive Into Slikk’s Playbook To Ace Fashion Q-Commerce

Ask industry experts why quick commerce has yet to take off in the e-fashion segment, and they would blame it on key challenges such as unpredictable demand and the lack of an agile restocking system. High return rates and delayed reverse logistics also hinder the quick reselling of ‘returned’ products and affect the bottom line.

Despite these hurdles, Slikk’s numbers are growing. Since the launch of its website and the app on August 25, it has seen more than 10K downloads, even though its service is now limited to a few Bengaluru pin codes such as MG Road, Church Street, Bellandur and HSR Layout.

The CEO further claims a steady rise in orders and consumer base, projecting an order run rate of 4-5K per month within the first full month of operations (September 2024). He aims to achieve an average of 8K orders in October. Until mid-September, its daily orders varied between 300 and 400 and were delivered by a combination of in-house drivers and riders from logistics partners like Porter and Shiprocket.

But these developments are not a natural extension of q-commerce growth. Instead, Slikk has carefully analysed the scenario and adopted three winning strategies.

It woos fashion-forward young professionals. They are the aspirational buyers willing to spend on fashion. So, it pays to be as close as possible for visibility and service excellence. Consider this. Slikk has set up a dark store in southern Bengaluru, close to its active pin codes. But Gulati did not choose the location merely to meet delivery deadlines. The aim is to be present in areas with a high density of young shoppers.

“The median age of our customers is 26 as we want to attract fashion-conscious young people looking for high-quality products and premium brands. Hence, we focus on major areas in Bengaluru where the population is more or less under 30,” he said.

To emphasise its Gen Z focus, the startup offers curated styles and collections featuring what the youth finds hip and trendy. As fashion is a fast-paced industry, Slikk intends to refresh its stock keeping units (SKUs) regularly and aims to onboard 75 brands by September from the current 50.

It uses AI for hyper-personalisation. Slikk’s key differentiator lies in tailoring one’s shopping experience. The startup uses artificial intelligence to curate the items displayed based on their previous purchases, search queries, interactions, demographic data and other key criteria. As a result, when users open the app/website, they are shown a select range of brands and products that match their preferences and buying behaviours.

Gulati says this AI-driven approach has been designed to encourage impulse buying and reduce browsing time.

“When you land on our page, we aim to personalise the buying process and use AI to understand consumer behaviour better. It has led to much higher conversion rates than other ecommerce platforms, as we offer curated products that our target audience is more likely to purchase,” he added.

It aims to control inventory for fast & reliable deliveries. Finally, supply chain gaps can affect business banking on q-commerce, according to Gulati.

“Many ecommerce companies now offer same-day delivery, but it hasn’t really improved customer experience. That’s because they rely on a drop-shipping model, where part of the inventory is stored in their warehouses and the rest comes directly from the brands. This can create delivery delays and make it difficult to respond to shifting consumer preferences. We believe fashion shoppers will soon demand faster deliveries and a business model like ours will grow manifold in the coming years,” he said.

To steer clear of this pitfall, Slikk wants to take complete control of its inventory as it expands its offerings. It wants to set up four warehouses in Bengaluru in the next six months and scale its operations across seven major Tier I cities in the next two years.

Is Slikk Here For The Long Run?

Slikk has ambitious growth plans for a month-old startup, but Gulati is bullish on expansion for a reason. The CEO says that the new venture’s three-pronged strategy – warehousing near the customer base, in-house logistics and using new-age technology for better UX – has helped reduce operational costs and resulted in better unit economics.

In essence, Slikk’s founders think that the sustainability of its business model will hinge on optimising unit economics to support future scaling. “If we continue to trim down other expenses and build our entire supply chain in-house, the business will be sustainable in the long run,” said Gulati. True to this principle, the startup has minimised its marketing expenditure and solely relies on word-of-mouth and social media channels to drive engagement.

Nevertheless, it will require significant capital investments to set up the necessary infrastructure (warehousing, logistics and a technology network to run the business pan-India). However, the CEO declined to divulge the costs and said he had no plans to raise institutional funding at this point.

Slikk has seen investor interest but is holding out on the opportunity to raise a larger round. Gulati said that further capital infusion would only make sense if the startup’s playbook works out, helping it gain a strong foothold in Bengaluru.

Another way to impact one’s bottom line is to increase customers’ average order value (AOV). Currently, this amount hovers around INR 1,800, helping net INR 550-600 per order. Slikk is now looking to increase its AOV, adding more revenue to each sale. Gulati also foresees a rise in average order volume as the venture scales.

Industry insiders are not so optimistic. AOV is undoubtedly a critical success metric representing customer experience. In brief, the more engaged customers are, the more likely they are to spend. So, it is not surprising that major q-commerce players like Blinkit and Swiggy Instamart have added high-value premium products like electronics and fashion to their portfolios to grow their average basket size. But will it work equally well for a newcomer like Slikk?

A case in point is Zepto. Despite a $5 Bn valuation and $1.6 Bn funding in its kitty, the q-commerce platform is experimenting with ‘affordable’ solutions to capture a bigger market share. Rather than jumping off the deep end, Slikk needs to study all market trends and competitor moves to stay in the race for the longer term and create ‘value’ for customers.

[Edited by: Sanghamitra Mandal]

Ad-lite browsing experience

Ad-lite browsing experience