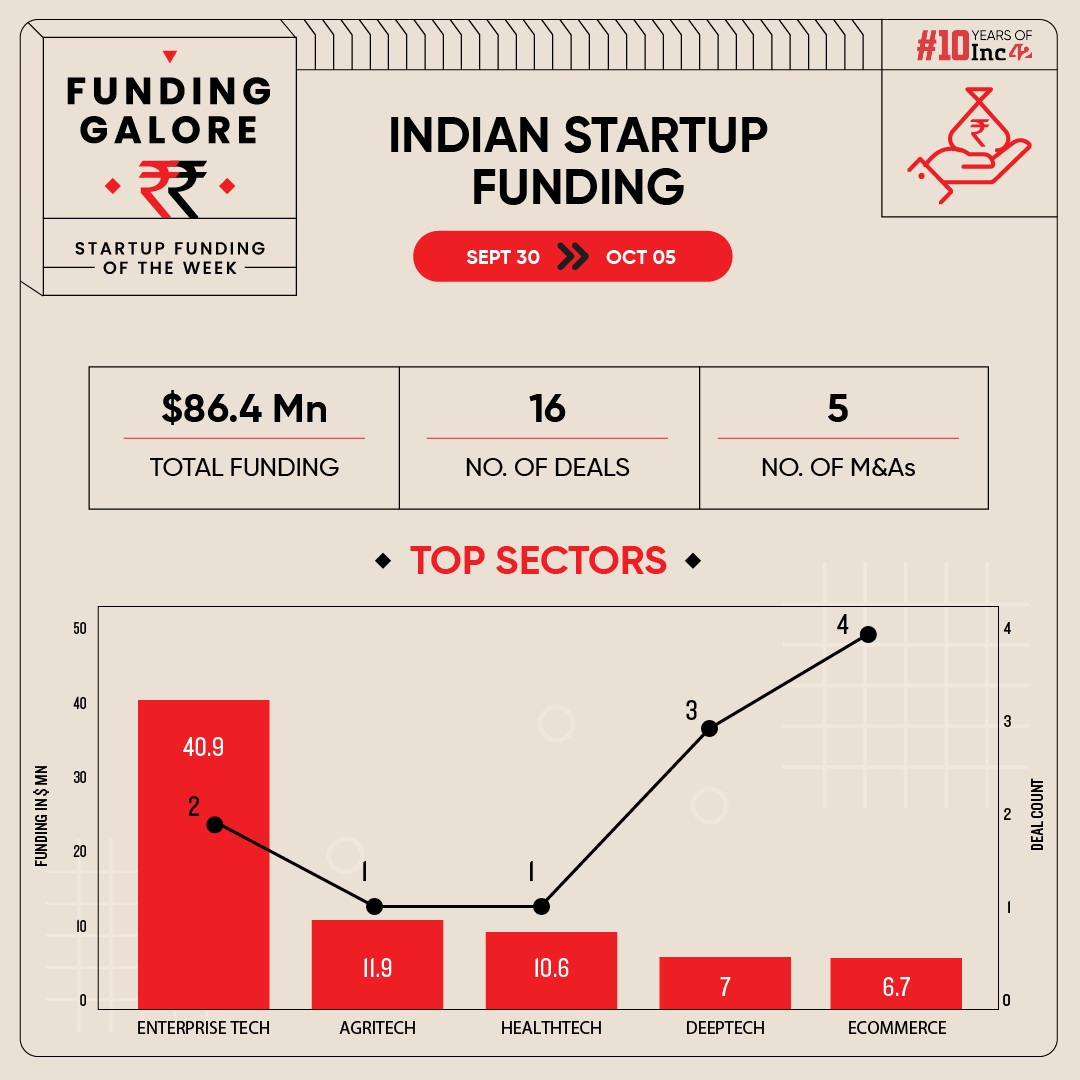

Indian startups cumulatively raised $86.4 Mn across 16 deals, a 80% decline from the $432.2 Mn raised across 24 deals last week

The week saw coworking space startup DevX file its DRHP with the SEBI

Seed funding dipped this week, with startups at this level only managing to raise $1.9 Mn as against $44.5 Mn raised last week

Investment activity across the Indian startup ecosystem saw a dip this week after bucking upward trends. In the week between September 30 and October 5, startups managed to raise $86.4 Mn via 16 deals, more than 80% drop from $432.2 Mn raised across 24 deals in the preceding week.

It is pertinent to note that the week was sans mega funding and further marks the beginning of festivity in India.

Funding Galore: Indian Startup Funding Of The Week [ Sep 30 – Oct 5 ]

Date

Name

Sector

Subsector

Business Model

Funding Round Size

Funding Round Type

Investors

Lead Investor

3 Oct 2024

Mstack

Enterprisetech

Enterprise Services

B2B

$40 Mn

Series A

Lightspeed, Alphawave, HSBC Innovation Banking

Lightspeed, Alphawave

1 Oct 2024

Waycool

Agritech

Market Linkage

B2B-B2C

$11.9 Mn

Debt

Grand Anicut

Grand Anicut

30 Sep 2024

BASIC Home Loan

Fintech

Lendingtech

B2C

$10.6 Mn

Series B

BII, CE-Ventures, Gruhas, LetsVenture, 100 Unicorns, Venture Catalysts, Ashish Kacholia

BII

3 Oct 2024

Str8bat

Deeptech

IoT & Hardware

B2C

$3.5 Mn

Series A

Exfinity Venture Partners, RTL, Eternal Capital, VCats Group, Techstars, SucSEED Indovation Fund

Exfinity Venture Partners

3 Oct 2024

Furnishka

Ecommerce

D2C

B2C

$3.3 Mn

pre-Series A

IndiaQuotient, Sparrow Capital, Sujeet Kumar, Ramakant Sharma

IndiaQuotient

30 Sep 2024

LISSUN

Healthtech

Fitness & Wellness

B2C

$2.5 Mn

pre-Series A

RPSG Capital Ventures, Multiply Ventures, Atrium Angels, IvyCap Ventures, Sucseed Ventures, Rainmatter

RPSG Capital Ventures

30 Sep 2024

FermionIC Design

Deeptech

IoT & Hardware

B2B

$2.5 Mn

–

–

–

4 Oct 2024

True Balance

Lendingtech

Consumer Lending

B2C

$2.3 Mn

Debt

VentureSoul Partners

VentureSoul Partners

3 Oct 2024

ZEVO

Cleantech

Electric Vehicle

B2B-B2C

$2 Mn

pre-Series A

Pegasus India Fund, BizDateUp, JIIF

–

1 Oct 2024

ClayCo

Ecommerce

D2C

B2C

$2 Mn

Series A

Unilever Ventures

Unilever Ventures

3 Oct 2024

AI Health Highway

Healthtech

MedTech

B2B

$1.5 Mn

pre-Series A

Turbostart, Rainmatter, Chennai Angels, BITS BioCyTiH Foundation

–

30 Sep 2024

Conscious Chemist

Ecommerce

D2C

B2C

$1.4 Mn

–

Atomic Capital

Atomic Capital

3 Oct 2024

Oncare

Healthtech

Telemedicine

B2C

$1 Mn

Seed

Huddle Ventures, TRTL Ventures, Cloud Capital, DeVC

Huddle Ventures

1 Oct 2024

IG Drones

Deeptech

Dronetech

B2B

$1 Mn

–

India Accelerator

India Accelerator

30 Sep 2024

Zintlr

Enterprisetech

Horizontal SaaS

B2B

$0.9 Mn

Seed

Om Jain, JIIF, Motilal Oswal, Vimal Shah, Sparsh Jain, Vinod Dugar, Ramesh Jain, Prabhakar

Om Jain

3 Oct 2024

Secret Alchemist

Ecommerce

D2C

B2C

–

–

Samantha Prabhu

Samantha Prabhu

Source: Inc42

*Part of a larger round

Note: Only disclosed funding rounds have been included

Key Startup Funding Highlights Of The Week

- On the back of the week’s top funding round, which saw Mstack raising $40 Mn, entrerprisetech retained its top spot as the most funded sector.

- Ecommerce witnessed the most number of deals materialise this week. Startups in the sector raised $6.7 Mn via 4 deals.

- Seed funding dipped this week, with startups at this level only managing to raise $1.9 Mn as against $44.5 Mn raised last week.

Startup Fund Launches Of This Week

- Angel investment network ThinKuvate marked the first close of its maiden India fund, ThinKuvate India Fund – I, at INR 25 Cr. The firm is targeting a total corpus of INR 100 Cr for the fund.

- Early-stage focused venture capital firm Trillion Dollar Ventures (TDV) floated its second fund with a target corpus of NR 50 Cr ($5.9 Mn). The fund will back 10-12 pre-seed and seed stage startups annually with an average ticket size of INR 1-2 Cr.

Updates On Indian Startup IPOs

- Enroute to its initial public offering (IPO), foodtech major Swiggy received approval from its shareholders to increase the size of the fresh issue in its IPO to INR 5,000 Cr from INR 3,750 Cr earlier.

- Ahmedabad-based coworking space provider DevX filed its draft red herring prospectus (DRHP) with market regulator Securities and Exchanges Board of India (SEBI) this week. Its proposed IPO will consist solely of a fresh issue of 2.47 Cr equity shares.

- CarDekho is in advanced talks with bankers for a $500 Mn IPO, which it plans to file by March 2025.

Mergers and Acquisitions This Week

- Edtech startup Adda247 has bought placement preparation platform PrepInsta to foray private and public sector jobs test prep space.

- Listed cybersecurity startup TAC Infosec acquired US-based cybersecurity firm CyberSandia to strengthen its presence in the US and expand its global footprint. It also acquired WOS to strengthen its position in the UAE market.

- Fruits and vegetables platform Pluckk acquired D2C nutrition brand Upnourish for $1.4 Mn.

- FirstCry’s rollup startup arm Brainbees’ completely acquired D2C brand The Butternut Co by investing an additional INR 8 Cr for a 100% stake in the startup.

Other Developments Of The Week

- Angel investment firm BizDateup’s cofounders Jeet Chandan and Meet Jain picked up an undisclosed stake in Swiggy.

- Peak XV Partners pared the size of its $2.85 Bn fund by 16% or $465 Mn more than a year after it split from Silicon Valley-based Sequoia Capital.

- Ratan Tata partially exited broking platform Upstox with 10X returns after the startup concluded a buyback of 5% of Tata’s stake in it.

- Fabless semiconductor startup FermionIC Design is looking to raise $6 Mn in a funding round led by Lucky Investment Managers’ Ashish Kacholia and his associates. The startup has already raked in $2.5 Mn as part of the investment round.

- Belgium-based VC firm Verlinvest is looking to double its annual investment in India in three years. Its managing director and head of Asia Arjun Anand has invested over $110.3 Mn annually in India over the last few years and aims to double this in the next two-three years.

Ad-lite browsing experience

Ad-lite browsing experience