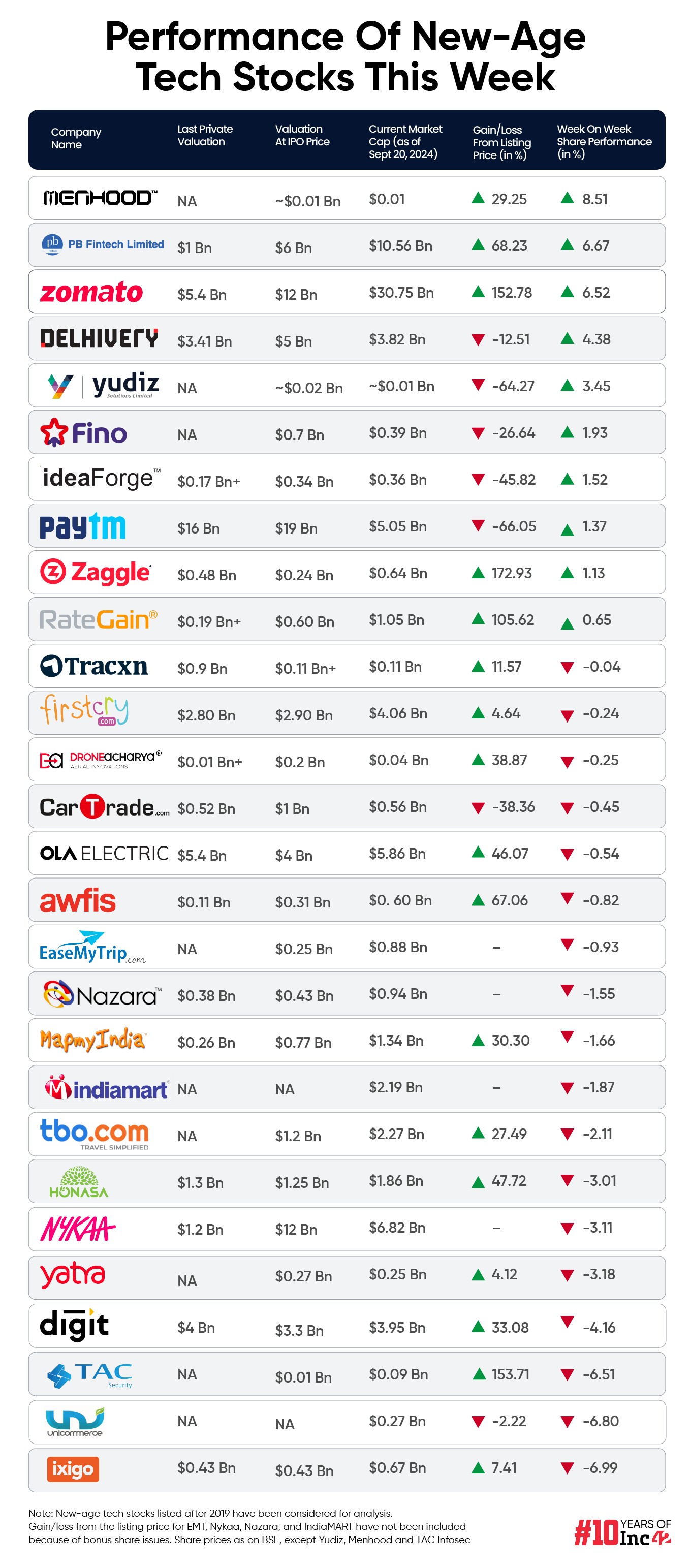

Eighteen of the 28 startups under Inc42's coverage declined in a range of just below 1% to under 7% this week, with ixigo emerging as the biggest loser

Shares of 10 new-age tech stocks gained in a range of just under 1% to over 8% this week, with NSE Emerge listed D2C brand Menhood emerging as the biggest gainer

Meanwhile, benchmark indices Nifty 50 and Sensex touched all-time highs twice this week

The Indian equity market continued its upward march this week, with the benchmark indices touching all-time highs. Despite this bull run, investor sentiment towards new-age tech stocks took a hit during the week. Eighteen of the 28 startups under Inc42’s coverage declined in a range of just below 1% to under 7% this week.

Recently listed travel tech startup ixigo took the biggest hit this week, with its shares plunging 6.99% to INR 144.75. Unicommerce, FirstCry, Awfis, Go Digit were among the other stocks which ended in the red this week. Shares of gaming major Nazara also dipped 1.55% to end the week at INR 1,034.10 despite its acquisition spree and plans to raise INR 900 Cr funding.

Meanwhile, 10 new-age tech stocks gained in a range of just under 1% to over 8% this week. The biggest gainer this week was NSE Emerge listed D2C brand Menhood, with its shares gaining 8.51% to end the week at INR 137. PB Fintech, Zomato, Paytm, and RateGain were among the other gainers this week.

Amid this, Nifty 50 and Sensex touched their all-time highs on Thursday (September 19) and Friday (September 20). This was the third consecutive week when the indices tested new all-time high marks. Sensex ended the week 1.9% higher at 84,544.31, while Nifty 50 jumped 1.7% to end at 25,790.95.

The major driver of this bull run was the interest rate cut by the US Federal Reserve in the middle of the week. The US Fed cut the interest rate by 50 basis points for the first time in nearly four years.

Vishal Goenka, co-founder of IndiaBonds.com, noted that the Fed’s decision comes amid significant differences in central bank policies worldwide. For example, Brazil’s central bank raised rates this week, and the Bank of Japan is also considering a similar move.

“India has remained well insulated from the rest of the world rate movements for now and the tremendous rally in risk assets plus projected economic growth keep an inflationary underlying force in the economy,” he said.

Asit C. Mehta Investment Interrmediates’ AVP of derivatives research Hrishikesh Yedve said that the ongoing bullish momentum is likely to continue and take Nifty 50 towards 25,900-26,000 levels.

“On the upside, 26,000 will act as an immediate hurdle for Nifty. On the downside, 25,500 will serve as an immediate support for Nifty, followed by 15-DEMA support, which is placed near 25,300 levels. As long as Nifty stays above 25,600, a “Buy on Dips” strategy is advisable for traders,” he said.

Amid the bull run on the bourses, the IPO boom also continues in the Indian equity market. Foodtech major Swiggy is expected to publicly file DRHP soon for its mega IPO. It is said to be looking to raise $1.4 Bn through the IPO. Its IPO is likely to comprise a fresh issue of equity shares worth INR 3,750 Cr ($450 Mn) and an offer-for-sale (OFS) component worth INR 6,664 Cr (around $799 Mn).

Commenting on the IPO trends, Pantomath Capital Advisors said, “With 59 IPOs raising INR 63,862 Cr in 2024 and an average first-day gain of 30%, far above the global average of 22%, the demand for Indian IPOs is clear. Both local and international investors are driving this momentum, and all signs point to continued growth and opportunities ahead.”

With that said, let’s take a deeper look at the performance of the new-age tech stocks this week.

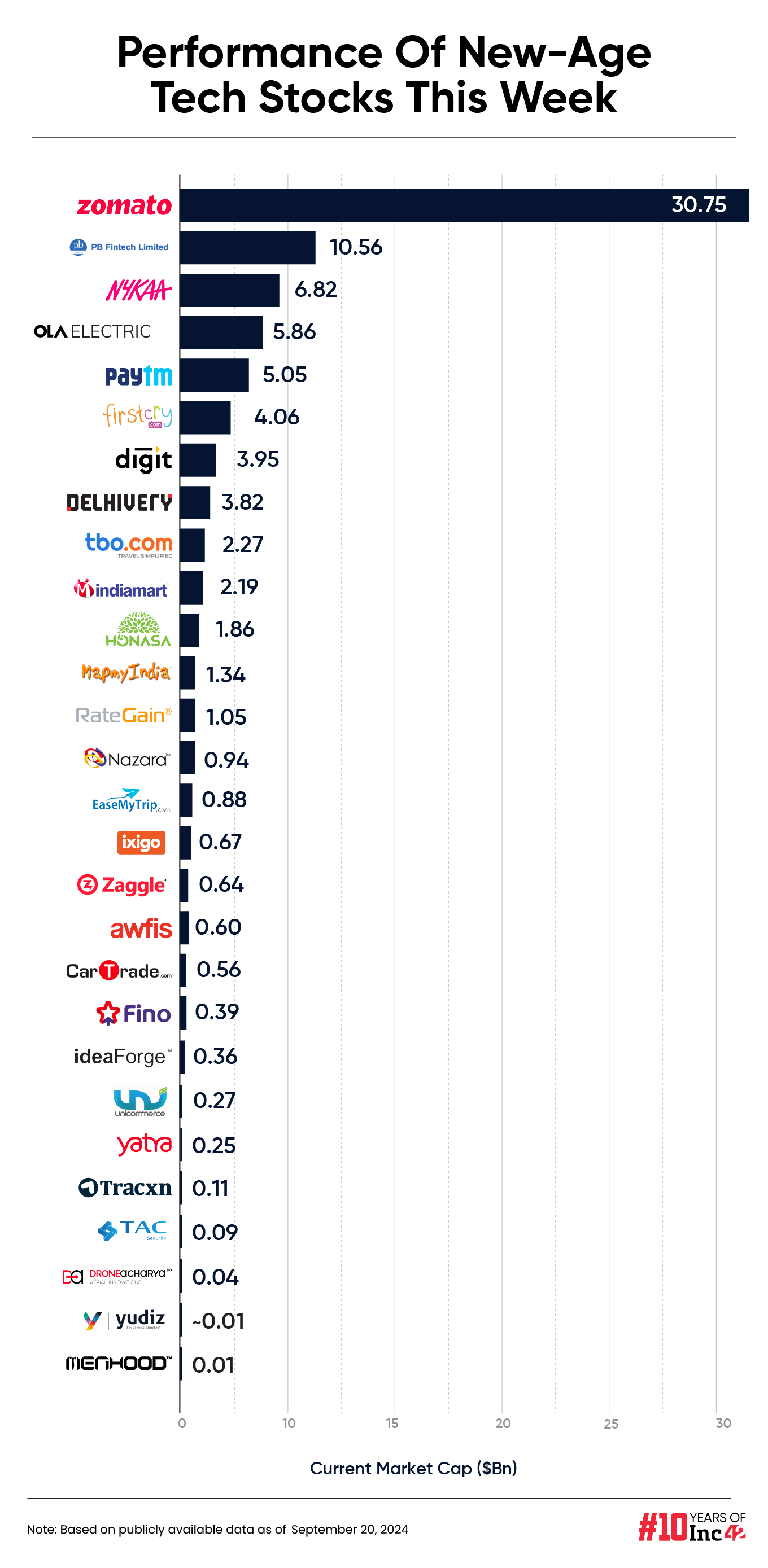

Despite stock prices dipping, the total market capitalisation of 28 new-age tech stocks under Inc42’s coverage stood at around $85.49 Bn at the end of this week as against $82.93 Bn at the end of last week.

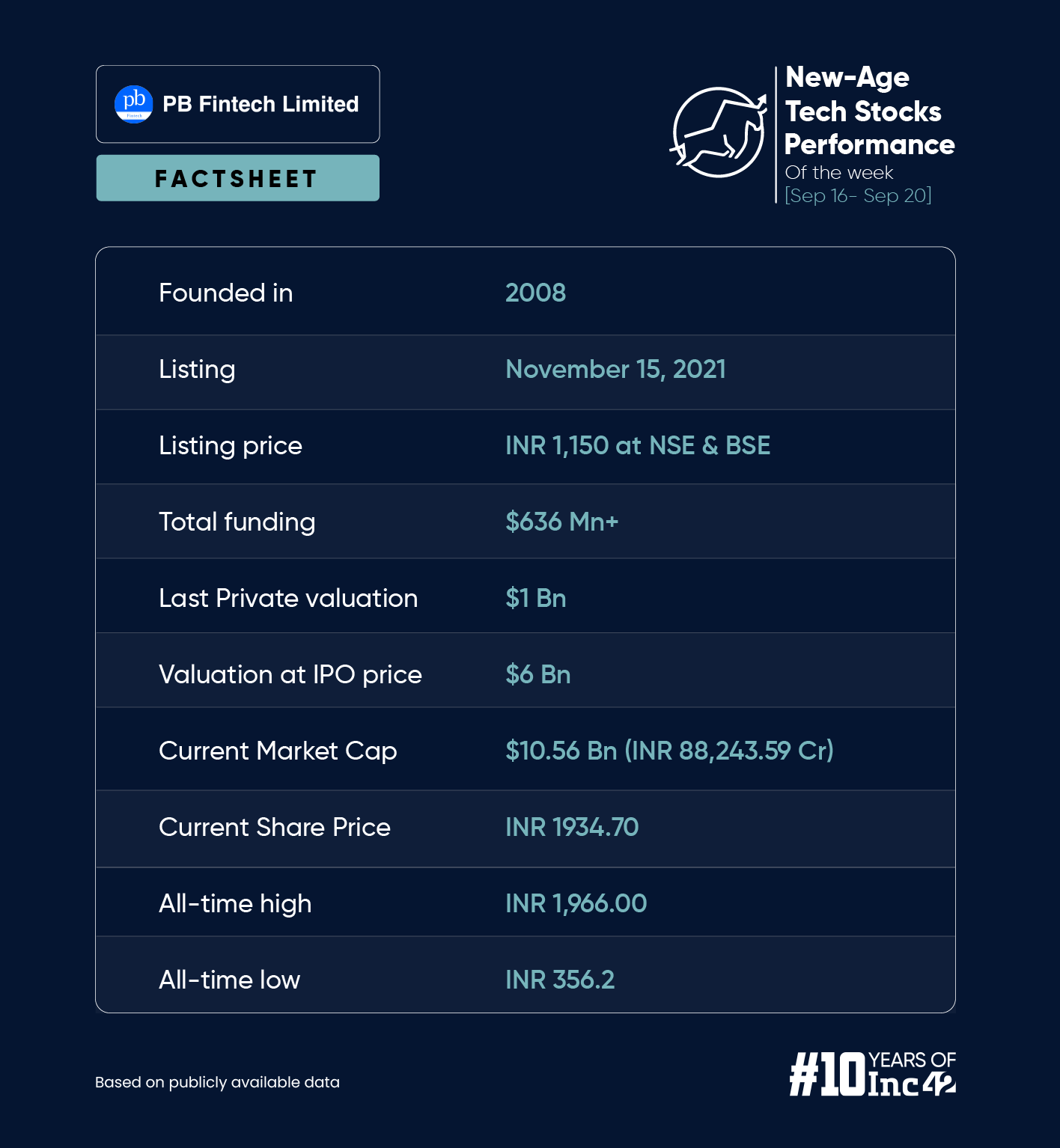

PB Fintech Zooms To New Highs

Shares of the parent of Policybazaar touched a fresh all-time high of INR 1,966 on September 20. The stock ended the week at INR 1,934.70, up 6.67% from last week. With the rally, PB Fintech’s market cap zoomed past the $10 Bn mark, touching $10.56 Bn by the end of the week.

The rally came two weeks after the startup released its annual report, in which its founders Yashish Dahiya and Alok Bansal said that it will focus on improving its claim process. PB Fintech is also aiming to increase the share of secured loans in its total disbursal to 50% by FY26 from 12% now.

“Average is a terrible metric, especially in the risk category. We already work with partners to look at digitally acquired risk, and how we can look at smaller & smaller customer segments to provide the right product. Similarly, the claims experience is as much about the Insurer side processes as it is about the actual experience in the garage or hospital,” the founders said.

For the uninitiated, PB Fintech operates digital insurance marketplace Policybazaar, lending platform Paisabazaar, online platform for financial products.

In the first quarter of the financial year 2024-25 (Q1 FY25), PB Fintech reported a consolidated net profit of INR 59.98 Cr as against a loss of INR 11.9 Cr in the year-ago quarter. It was its third consecutive profitable quarter. Operating revenue surged 51.8% to INR 1,010.5 Cr in Q1 FY25 from INR 665.6 Cr in the year-ago quarter.

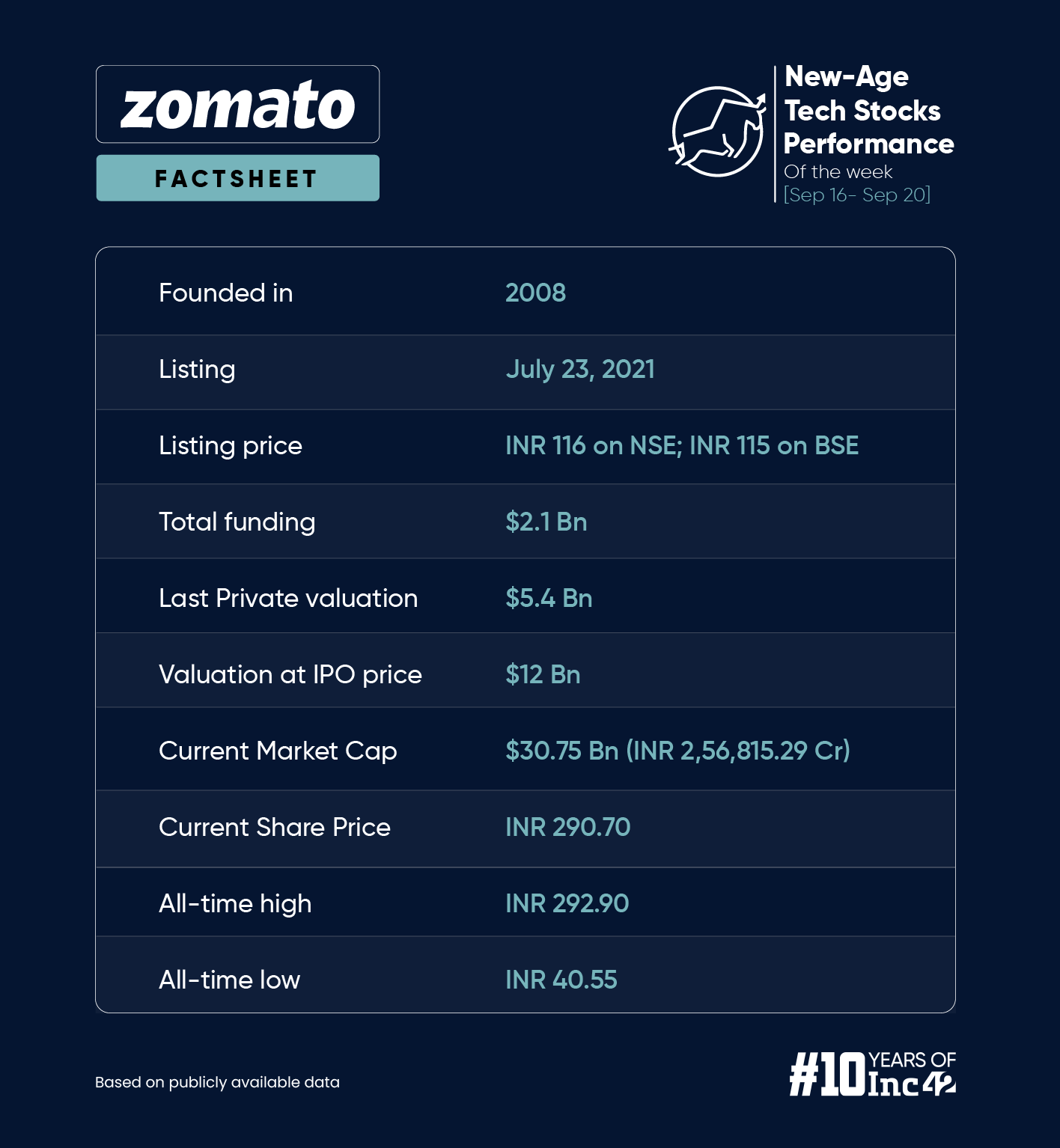

Zomato’s Market Capitalisation Goes Past $30 Bn Mark

Zomato also saw its share price touch a fresh all-time high this week. The startup’s shares touched INR 292.90 on September 20 before ending the week at INR 290.70. The stock zoomed 6.52% week-on-week.

With the bull run, the market cap of Zomato crossed the $30 Bn mark and stood at $30.75 Bn at the end of the week.

The company’s shares have been rallying for almost a year on the back of its strong financial performance. Zomato’s profit after tax in FY24 stood at INR 351 Cr as against a net loss of INR 971 Cr in the previous fiscal. Besides, its EBITDA also grew to INR 42 Cr as against an EBITDA loss of INR 783 Cr it made in the year.

Zomato’s consolidated net profit zoomed multifold to INR 253 Cr in Q1 of FY25. Its revenue from operations jumped 74% to INR 4,206 Cr in Q1 FY25 from INR 2,416 Cr in the corresponding quarter last year.

Moving forward, the company is working on scaling up its going out vertical with the launch of its new app ‘District’. For this, it announced the acquisition of the entertainment and ticketing business of Paytm for INR 2,048 Cr in August.

Following this, JP Morgan’s revised price target (PT) of Zomato’s stock’s price target (PT) to INR 340, indicating a 40% upside on September 5.

The brokerage attributed its bullish outlook to Zomato’s expansion of Blinkit, which has been successfully scaled across all major metro cities after demonstrating its viability in the NCR region.

The brokerage anticipates Blinkit’s scale will significantly boost monetisation through channel margins and advertising revenue. Moreover, improved store-level economics are expected to enhance the company’s EBITDA outlook further, it said.

Meanwhile, Zomato’s GST troubles continued to grow deeper in the week. In the week, West Bengal GST authorities slapped a fresh tax demand and penalty order of over INR 17.70 Cr in the week.

ixigo Emerges As The Biggest Loser This Week

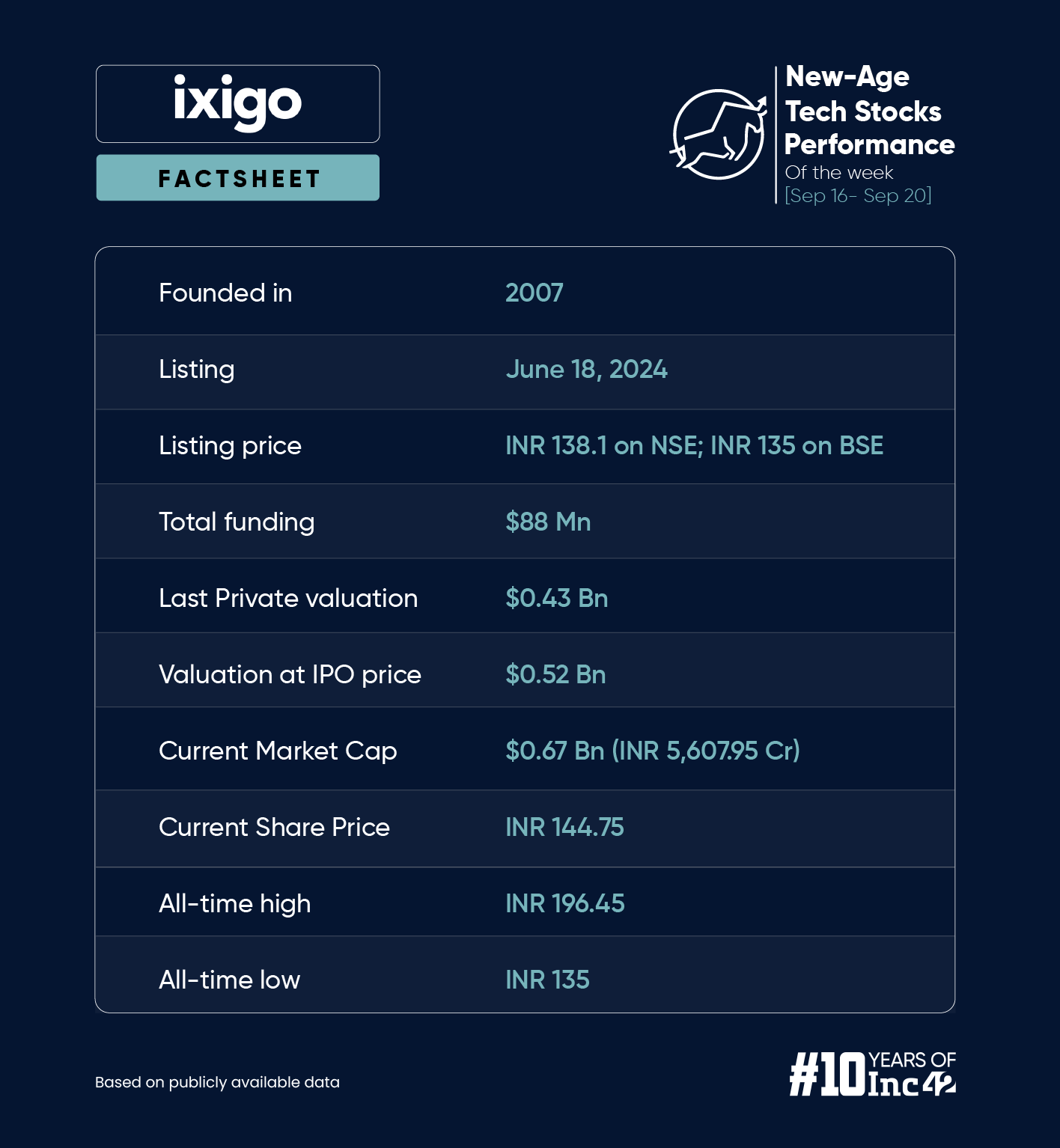

Shares of ixigo continued to go down during the week, dropping 6.99% to INR 144.70. With this, its market cap also declined to $671.7 Mn (INR 5,607.95 Cr).

Founded in 2007 by Aloke Bajpai and Rajnish Kumar, ixigo generates revenue by selling a variety of travel services, including flights, trains, bus tickets, hotel bookings, and holiday packages.

Recently, ixigo’s bus ticketing platform AbhiBus partnered with German travel tech company FlixBus as the latter expands its presence in India.

In Q1 FY25, ixigo posted a 78% increase in its PAT to INR 14.85 Cr compared to INR 8.36 Cr in the year-ago quarter. Revenue from operations rose 16% to INR 181.87 Cr from INR 156.55 Cr in Q1 FY24.

Gross transaction value surged 26.6% to INR 2,988.1 Cr during the quarter as against INR 2,359.1 Cr in Q1 FY24. The startup’s EBITDA soared 62% year-on-year to INR 19.2 Cr in Q1 FY25.

Ad-lite browsing experience

Ad-lite browsing experience