What Is An AIF?

An Alternative Investment Fund (AIF) is a privately pooled investment vehicle that collects funds from investors in accordance with a defined investment policy. The funds are infused as capital for the benefit of its investors.

As of May 2022, the Securities and Exchange Board of India (SEBI) registered more than 900 AIFs, with capital commitments growing at a CAGR of 63% between 2012 and 2022.

How Are AIFs Different From Traditional Investments?

Unlike traditional investments, AIFs do not fall under the purview of SEBI (Mutual Funds) Regulations, 1996; SEBI (Collective Investment Schemes) Regulations, 1999, or any other regulations of the board for regulating fund management activities.

Similarly, unlike traditional investments, AIFs are accredited to those who meet certain net worth criteria and may not be available to a wider range of investors.

What Kind Of Assets Do AIFs Invest In?

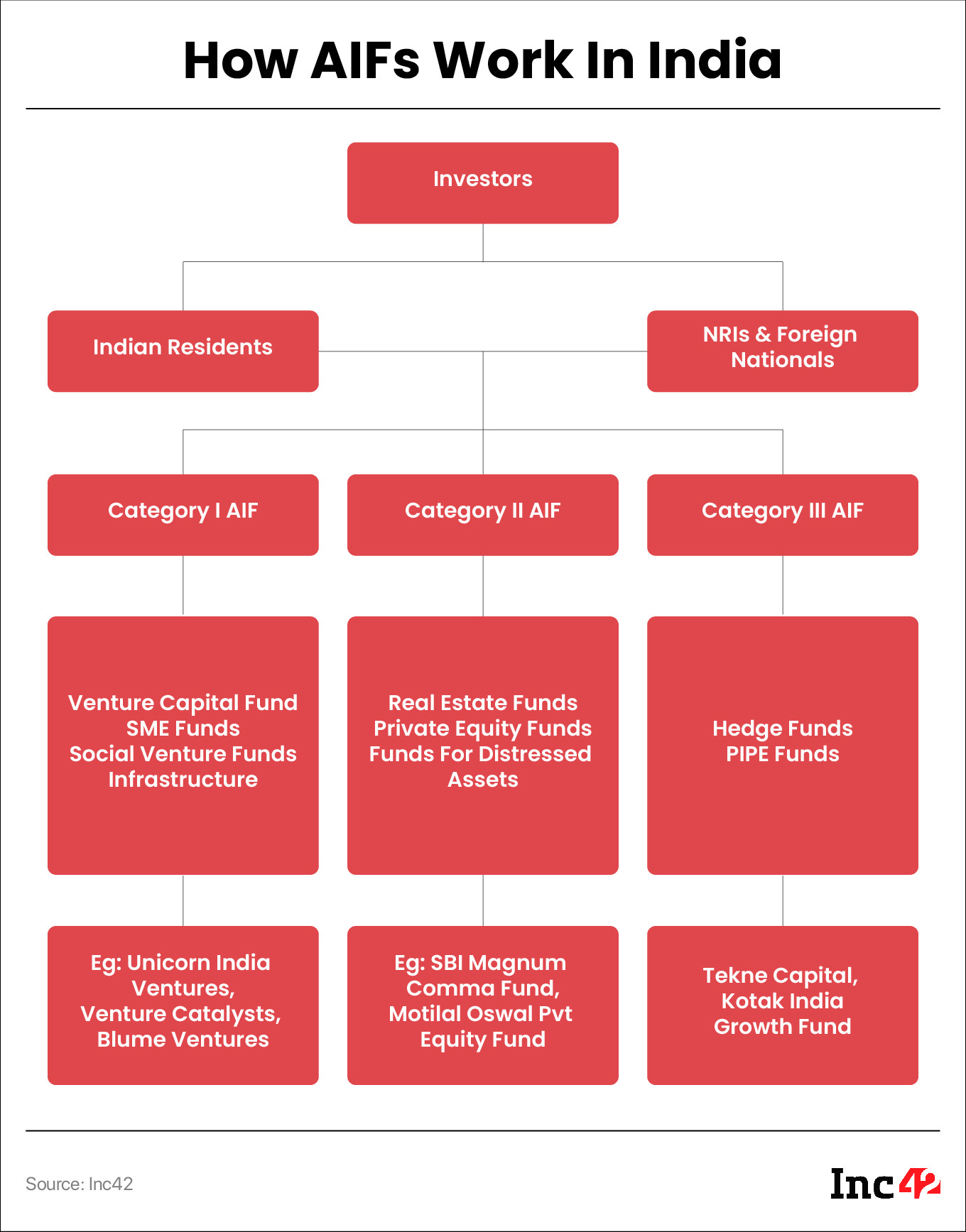

As per the Securities and Exchange Board of India (SEBI), AIFs fall under three major categories:

Category I AIF: This category of AIF includes:

- Venture capital funds (Including angel funds)

- SME funds

- Social venture funds

- Infrastructure funds

Category II AIF: This category of AIF includes:

- Real estate funds

- Private equity funds (PE funds)

- Funds for distressed assets,

Category III AIF: This category includes:

- Funds that engage in many complex trading techniques, for example, investing in listed or unlisted derivatives.

- Various types of funds such as hedge funds and private investment in public equity (PIPE) funds

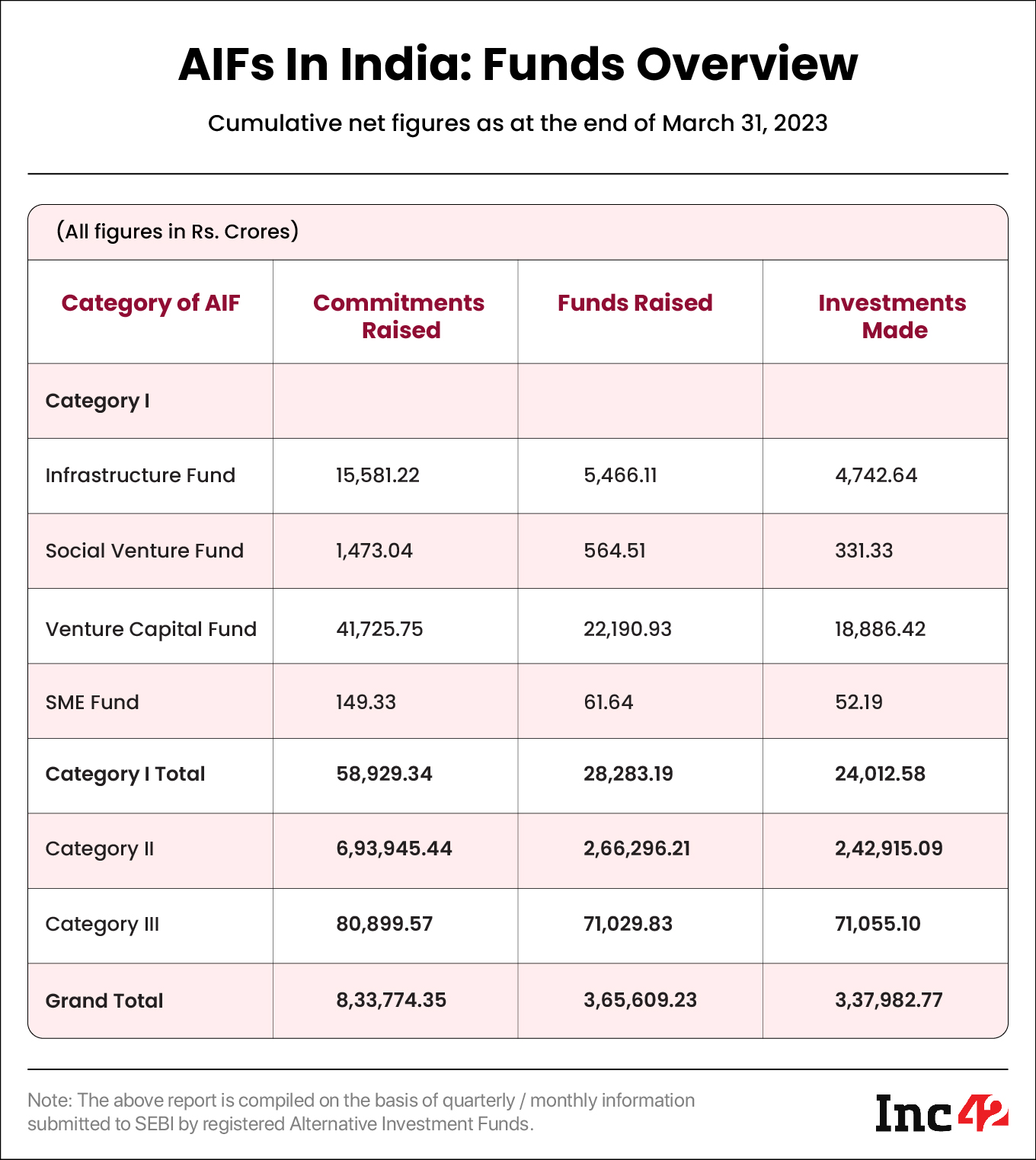

According to SEBI, fund managers for AIFs raised a mammoth INR 6.41 Lakh Cr across categories until the end of June 2022.

Who Can Invest In An AIF?

Indian residents, non-resident Indians (NRIs) and foreign nationals can invest in AIFs.

According to SEBI, every AIF scheme should have a corpus of at least INR 20 Cr. However for angel funds, the corpus should be at least INR 10 Cr.

Except angel funds, no AIF shall accept an investment of value less than INR 10 Cr. However, for the employees or directors of an AIF or employees or directors of the fund manager, the minimum value of investment stands at INR 25 Lakh.

How Can One Invest In AIFs?

AIFs are designed for HNIs, family offices, institutional investors and other eligible investors who meet specific investment requirements. According to SEBI, an individual investor needs to have a minimum investment corpus of INR 1 Cr to start investing in AIFs.

AIFs are designed for HNIs, family offices, institutional investors and other eligible investors who meet specific investment requirements. According to SEBI, an individual investor needs to have a minimum investment corpus of INR 1 Cr to start investing in AIFs.

What Are The Benefits Of Investing In An AIF?

- Portfolio Diversification: AIFs typically invest in non-traditional assets such as startups, which can offer diversification benefits and reduce overall portfolio risk.

- Higher Returns: Since AIFs invest in non-traditional assets, they have the potential to offer higher returns than traditional investments. According to Inc42’s estimates, VC funds generate an estimated 20% average yearly returns. In comparison, stock markets and mutual funds generate 9.2% and 10% annual returns.

- Limited Investor Liability: Investors often have limited liability, which means they are only responsible for the amount they have invested in the fund and not liable for losses beyond that amount.

What Are The Risks Associated With Investing In An AIF?

Higher returns often accompany greater risks. Some of the risks associated with investing in an AIF include:

Liquidity Risks: Unlike traditional investment that can be bought and sold easily, AIFs offer lesser flexibility and often come with limited liquidity. Further, investors are bound to invest for a minimum lock-in period of three years.

High Fee: The fee associated with AIFs is generally higher than traditional assets. This is because AIFs come with management fees, performance fees and other charges that may even reduce the overall return on investment

Regulatory Concerns: Compared to traditional investment funds, AIFs may have less regulatory oversight, which can heighten the possibility of fraud and mismanagement.

How Are AIFs Regulated?

AIFs are regulated by the SEBI under the SEBI (Alternative Investment Funds) Regulations, 2012. The market watchdog regulates the registration, compliance, and ongoing reporting requirements for AIFs in India.

How Are AIFs Taxed?

The Finance Act, 2015, extends a tax pass to AIFs that are registered with SEBI as Category I and II. Any income earned by such AIFs is exempt from tax. Instead, such income is taxable directly in the hands of the investors of the AIF.

It is important to consult with a tax advisor to understand the specific tax implications of investing in an AIF.

Can An AIF Be Sold Or Traded On A Stock Exchange?

No, AIFs are privately pooled investment vehicles and are not permitted to make an invitation to the public to subscribe to its securities.

AIFs raise funds through the issue of an information memorandum or a placement memorandum.

According to SEBI, the applicants are prohibited by the memorandum and articles of association/trust deed/partnership deed from making any invitation or solicitation to the public.

What Are The Examples Of Prominent AIFs In India?

In September 2022, the Funds of Funds for startups (FFS) committed INR 7,385 Cr to 88 AIFs. For context, FFS was launched in 2016 under the Startup Initiative India to boost the country’s startup ecosystem.

According to the Centre, the prominent AIFs that lead startup investments under FFS include:

- Chiratae Ventures: Its portfolio companies include Axio, Blowhorn, Aura and BeepKart

- India Quotient: Its portfolio companies include WebEngage, Dhiwise, VyaPar and Pagaarbook

- Blume Ventures: Its portfolio companies include Jai Kisan, Stellapps, ApnaKlub and Exotel

- IvyCap: Its portfolio companies include Biryani By Kilo, BlueStone, Miko and Lendbox

- Waterbridge Ventures: Its portfolio companies include Atlan, BigFatPhoenix, BimaKavach and BitClass

- Omnivore: Its portfolio companies include DeHaat, Krishify, Pixxel and AGRIM

- Aavishkaar Capital: Its portfolio companies include GoBolt, Mooofarm, Nepra and Vortex

- Fireside Ventures: Its portfolio companies include Mamaearth, Boat Lifestyle, The Baker’s Dozen and Gynoveda