What Does IPO Mean?

An IPO, or initial public offering, is the sale of securities to the public in the stock market, providing a vital source of long-term funds for a company. It is a critical step in business growth, offering access to public capital and increasing credibility. Multiple IPOs indicate a healthy stock market and economy.

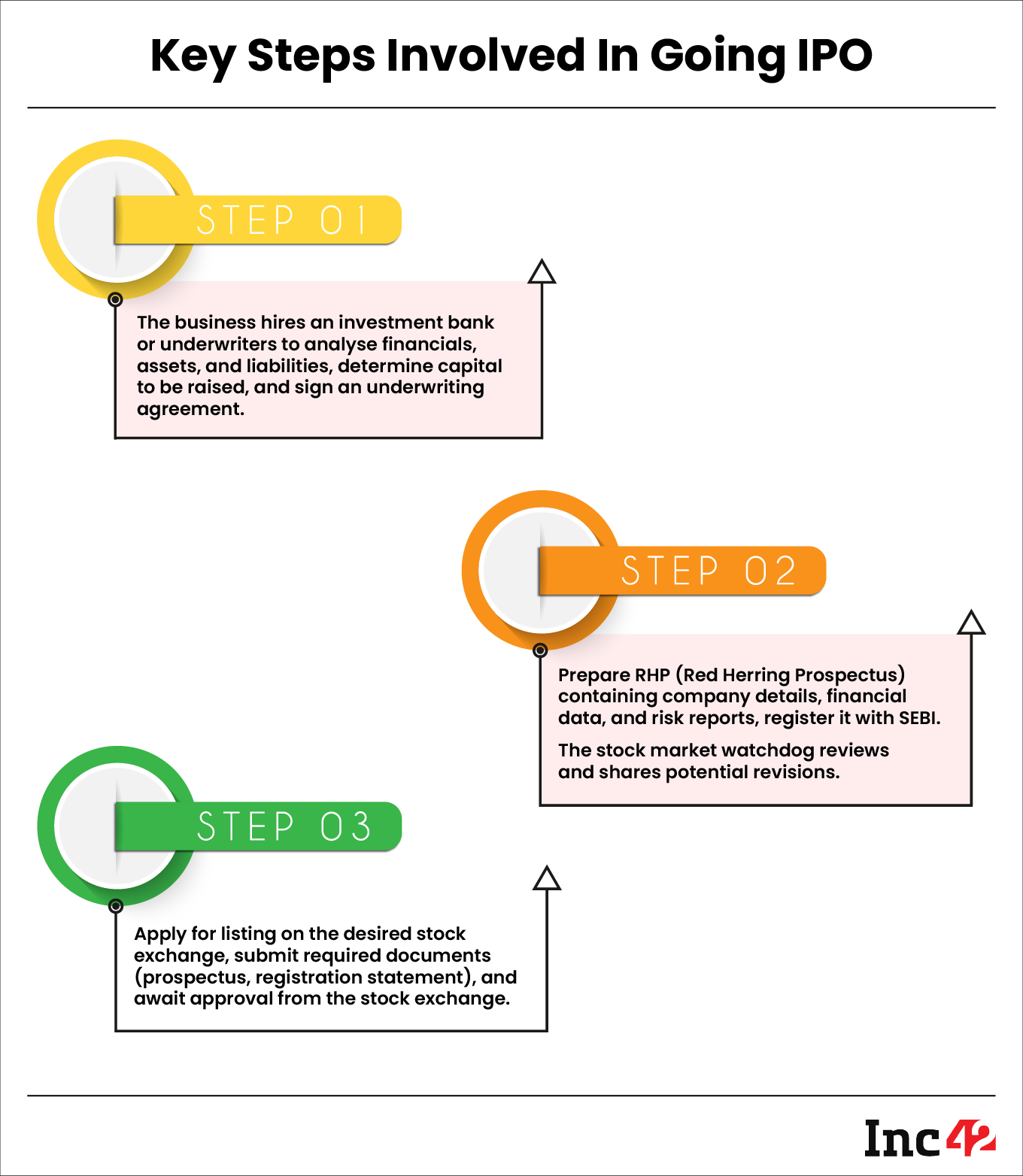

What Is The Process Of Going Public Through An IPO?

Besides this, the company also needs to decide on the offering price for its shares.

How Is The Price Of An IPO Determined?

There are two methods to determine the IPO price:

Fixed Price Method: The company and its underwriter collaborate to set an attractive share price based on liabilities, target capital and demand.

Book Building Method: The underwriter and the company establish a price range for investor bids. The final price is determined based on demand, bidding and target capital. This allows better price discovery, with the final price known as the cut-off price.

Why Do Companies Go For IPOs?

Going public through an IPO offers multiple benefits:

- Loans provided by banks and financial institutions usually have a repayment period, unlike in an IPO.

- There is no obligation to pay interest on the capital raised.

- The funds obtained can be utilised to settle existing debts.

- An IPO can enhance a company’s visibility among the public at large. This leads to successful brand building and increase in market share.

- An IPO offers investors of a company favourable exit opportunities. Many venture capitalists sell their stakes in a company during/following an IPO.

- When a company becomes publicly listed, it becomes subject to a regulatory framework that helps prevent fraudulent activities. This framework, enforced by market regulator SEBI, can benefit the company in the long run as it enhances transparency.

What Are The Disadvantages Of Going For An IPO?

- IPOs incur significant expenses, primarily due to high underwriter fees. Hefty costs may arise if the company engages financial reporting advisors or specialised organisations.

- Founders may see a reduction in their influence over the company’s operations post-IPO, with customer satisfaction and shareholder votes potentially influencing leadership changes.

- Public companies must comply with SEBI’s annual financial reporting and disclosure obligations, which involve significant costs for preparation and auditing.

- The long-term vision of the founders may clash with the short-term, profit-driven approach of the stock market, creating conflicts and challenges for leadership.

What Are The Benefits Of Investing In An IPO?

- Investing in an IPO gives investors an opportunity to gain from a high-growth company, with the potential to make quick profits and long-term wealth accumulation.

- IPO investments offer the chance to achieve significant returns over time.

- IPO offers greater transparency on investments as the pricing information is clearly stated, providing equal access to crucial details for all investors.

- By investing in an IPO, you can secure shares at a discounted price, positioning yourself for substantial gains if the company realises its growth potential.

What Is The State Of IPOs In India’s Startup Ecosystem?

During the bull run of 2021, 11 startups, including Zomato, Paytm, PB Fintech (Policybazaar), EaseMyTrip and Nykaa, went public. However, many of these startups experienced significant dips in their stock prices, ranging from 25% to 75%, since their listing. In 2022, the hesitation among startups to go public became apparent as only three Indian startups proceeded with their IPOs – Delhivery, Tracxn and DroneAcharya.

On the other hand, many startups such as Droom, Snapdeal, PharmEasy, MobiKwi and OYO, either postponed or withdrew their IPO plans or are awaiting approval from SEBI. Industry experts believe that if the startups expected to go public succeed, 2023 may witness increased IPO activity in the Indian startup ecosystem.

According to multiple new reports and Inc42’s sources, OYO may go public at the end of 2023. On the other hand, Aakash is expected to go public in mid 2024, while Mamaearth is also expected to go for an IPO in 2024.

What Is A Lock-In Period In An IPO?

In the context of an IPO, lock-in period refers to the time period during which investors, mostly promoters, employees and other pre-IPO investors, are not allowed to share their shares. Typically, this period ranges from six months to a year.

Can The Share Prices Go Down After IPO?

The share price of a company can fall after it goes public due to various factors such as negative market conditions, changing investor sentiment, expiration of lock-in period and disappointing financial performance. Concerns about the company’s execution & corporate governance, and other controversies can also lead to a decline in the stock price.

How Does An IPO Affect The Company’s Ownership Structure?

An IPO leads to changes in the shareholding structure of a company. While many PE/VC investors exit the company, completely or partly, to make profits by selling shares, new investors like institutions and retail investors come in as the new shareholders. Founders may also decide to sell a part of their stake through the public offering, leading to a decline in their ownership in the company.

What Are The Risks Associated With Investing In IPOs?

Investing in IPOs comes with its own set of risks:

- Market Volatility: Fluctuations in the market can affect the listing of shares.

- Limited Data: Limited historical financial information makes it challenging to evaluate the potential of companies.

- Uncertain Valuation: Determining the appropriate value of companies can be difficult, potentially leading to overvaluation.

- Lock-In Period: Expiry of lock-in period can result in availability of a large number of shares if pre-IPO investors decide to sell their stake, thereby affecting the share price.

- Information Asymmetry: Institutional investors and underwriters often have more information than the general public, creating an imbalance in knowledge.

- Company-Specific Risks: Each IPO carries unique risks based on the industry, competition, business model and more.

- Lack Of Trading History: Newly listed stocks may have low liquidity and wide bid-ask spreads, making it challenging to trade at desired prices.