Who Is A Limited Partner?

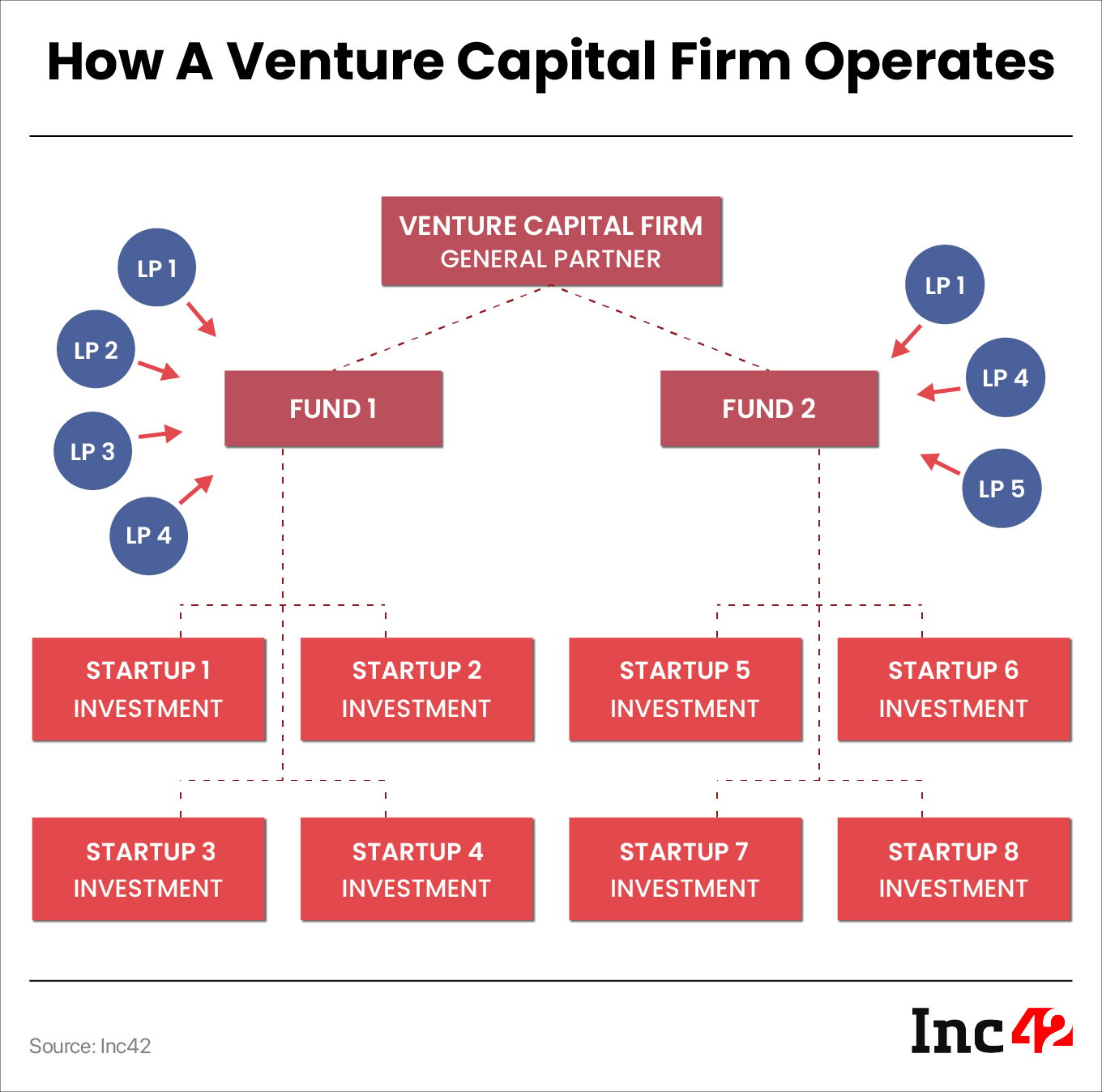

In venture capital, limited partners or LPs are entities or individuals who contribute capital to VC funds. LPs invest in the fund’s corpus with the expectation of generating returns from the fund’s investments in various startups and high-growth companies. LPs are also known as passive investors because they are not involved in the day-to-day operations of a startup and have limited liability for any debts the startup may incur.

What Are The Types Of LPs?

In Venture Capital, there are three types of LPs:

- Individuals: This consists of high-networth individuals (HNIs) who invest their personal capital into VC funds. They may even choose to become angel investors, directly making investments in startups.

- Institutional LPs: These are organisations with substantial capital with a goal of earning returns over a period of time. This category includes pension funds, endowments, foundations and corporates.

- Family Offices: Similar to individuals, family offices sometimes engage in direct investments in startups, along with their involvement in VC funds.

How Does A Limited Partner Differ From A General Partner?

A VC fund’s partners are called general partners or GPs. They have the authority to manage the fund and choose which investments to include in their portfolios. GPs are also responsible for getting financial commitments from LPs.

On the other hand, LPs don’t have any say in investment decisions. When the fund raises capital, its specific investments are uncertain. However, LPs can choose not to invest more money in the fund if their expectations are not aligned in terms of the fund performance or the person managing the portfolio.

Moreover, unlike LPs, GPs have unlimited liability and are actively involved in managing the partnership. GPs also receive a portion of the profits generated from the combined investments made by LPs. Additionally, they may also receive management fees or other benefits as part of the partnership agreement.

How Do LPs Benefit From VC Funding?

LPs profit from their investment through liquidity events like IPOs or M&A (mergers and acquisitions), which usually occur after a significant time period of seven to 10 years, allowing them enough time to achieve substantial exits.

What Are The Rights And Responsibilities Of A Limited Partner?

Although LPs do not play a hands-on role in day-to-day operations, they do possess certain rights and have responsibilities towards the investment made by a VC firm.

LPs retain the following privileges and responsibilities:

- It is mandatory for LPs to grant their approval for significant alterations to the business plan or company structure, usually through a majority vote.

- LPs have the right to examine financial statements and request updates regarding the business’s progress.

What Is A Limited Partnership Agreement?

A Limited Partnership Agreement (LPA) in a VC fund is a legal contract that defines the terms and conditions between general partners and limited partners, outlining capital contributions, profit distribution, decision-making authority, reporting, and other key aspects of the fund’s operation.

How Are Profits And Losses Distributed Among LPs?

The Limited Partner Agreement (LPA) outlines the distribution of profits and losses among LPs. The specific allocation depends on the terms agreed upon by the LPs and GPs in a fund.

What Are The Benefits Of Becoming An LP?

Some of the benefits of becoming an LP in a VC fund are:

- Portfolio Diversification: Access to a diversified portfolio of startups and investments can help increase returns and spread the risk across multiple ventures.

- Exposure To High Growth Startups: Opportunity to invest in innovative startups with significant growth potential.

- Limited Liability: Limited personal liability for the fund’s debts or obligations.

- Potential for Higher Returns: Possibility of attractive returns from successful portfolio companies.

What Are The Disadvantages Of Becoming An LP?

- Limited control: LPs have little influence over investment decisions. They have to rely on the expertise and judgement of GPs who make decisions on behalf of the fund.

- Returns Take A Long Time: VC investments have long lock-up periods, limiting access to capital.

- High Capital Commitment: VC funds require substantial capital commitments from LPs that can be in the form of a single large investment or spread out over multiple years.

What Are The Tax Implications For LPs?

As LPs are ‘silent investors’, they are not held responsible for compensating any partnership losses through their income tax return.

Additionally, limited partnerships require individual partners to pay income taxes based on their respective shares in the business. This share, also known as distributive share, is passed through the owner’s personal tax return, and income tax is paid as per an individual’s tax bracket.

How Do Limited Partnerships Differ From Limited Liability Partnerships?

A limited partnership is a partnership arrangement consisting of at least one GP and one or more LPs. In contrast, a limited liability partnership (LLP) operates differently as it lacks a general partner, allowing all partners to actively participate in managing the company.

In India, LLPs are governed by the Limited Liability Partnership Act, 2008.