What Is A Rolling Fund?

A rolling fund is an innovative investment vehicle that enables managers to exercise their discretion in investing on behalf of investors or limited partners (LPs). Participating investors make regular contributions to the fund, usually on a quarterly or annual basis.

Any accredited investor or an HNI can commit capital to a rolling fund and begin the investment journey. There is no minimum fund size criterion for a rolling fund. However, considering the price structure for such funds, investors are recommended to have at least $500K in soft-circled capital before they start their own rolling fund.

Rolling funds often prove suitable for HNIs wanting to start their investment journey as well as seasoned investors looking for lucrative funding deals.

How Does A Rolling Fund Work?

A rolling fund allows fund managers to add new capital quarterly or yearly by auto-renewing capital commitments from its members. This enables fund managers to quickly pool capital and invest in large investment opportunities.

It also allows fund managers to continuously raise capital as they build a track record, offering a chance to increase the fund size over time. In case a rolling fund doesn’t deploy all its capital in a given quarter/year, the balance is automatically carried forward to the next quarter/year as an additional amount. LPs receive an equal contribution to the new fund, along with their subscribed-for capital contribution.

What Is The Fee Associated With Investing In A Rolling Fund?

Like any VC fund, there are certain charges associated with a rolling fund. These include:

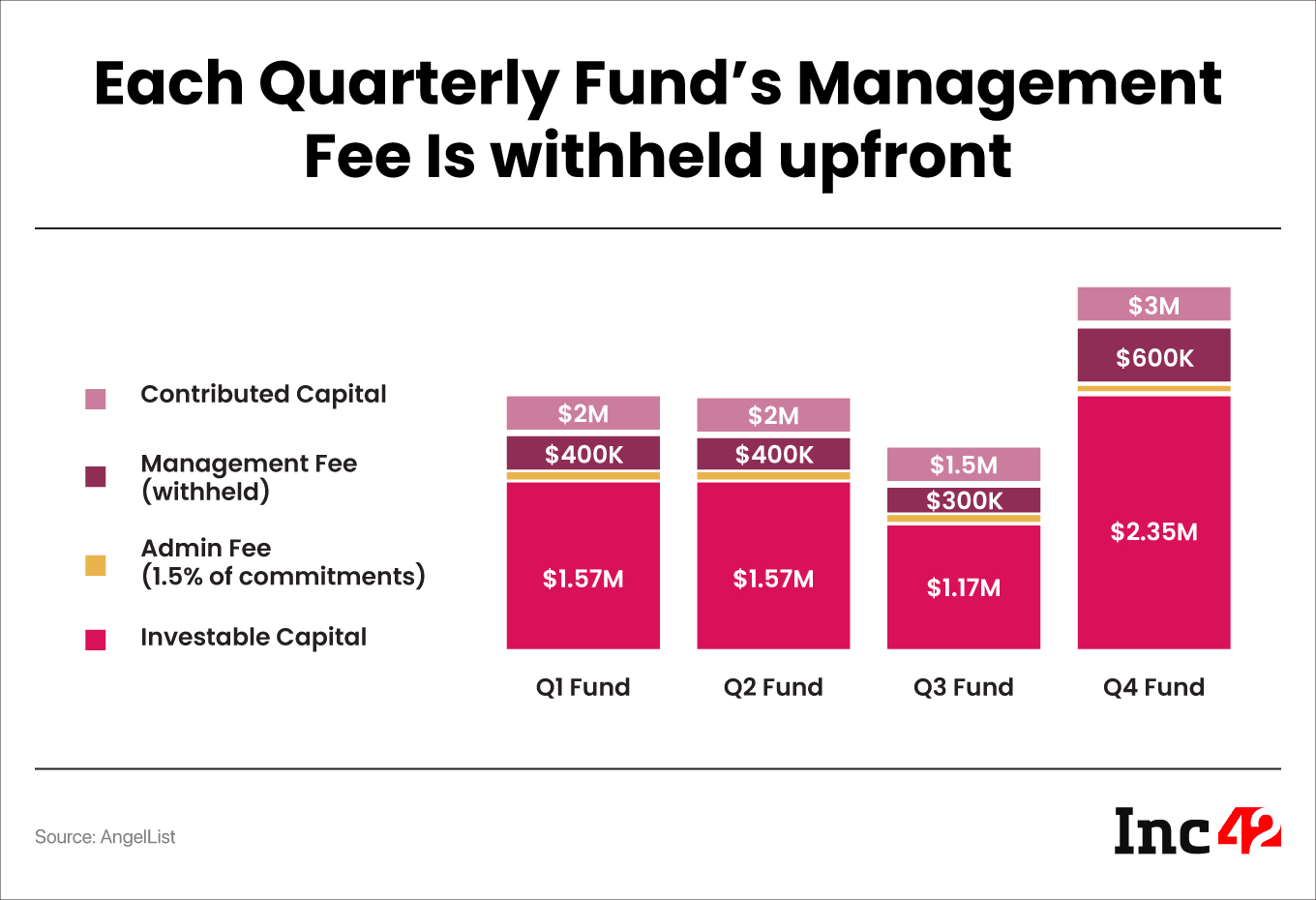

- Management Fee: An annual or quarterly fee charged by the fund manager for managing the fund. AngelList charges a 1.5% management fee each quarter.

- Carried Interest: A share of the fund’s profits paid to the fund manager once a certain return threshold is met.

- Admin Fee: Costs associated with operating the fund such as legal fees, administrative expenses, and regulatory compliance. AngelList charges a 1.5% management fee.

Here’s an example from AngelList to give you a better idea:

What Are The Benefits Of Investing In A Rolling Fund?

- Flexible Investing Option: Rolling funds allow LPs to subscribe to quarterly or annual funds, adjust their capital commitments, and continuously support successful fund managers or investment withdrawals as needed.

- Diversity Of Investors: Rolling funds provide an opportunity for investors, whether aspiring or seasoned, to participate with lower upfront capital requirements.

- Shortened Feedback Loops: With rolling investments, LPs make smaller periodic investments, enabling quicker feedback and real-time performance assessment of portfolio companies. This helps venture capitalists make more informed decisions towards their investment allocations.

How Is A Rolling Fund Different From A Traditional Venture Capital Fund?

The rolling fund concept was first introduced by AngelList in the US in 2020 as an alternative to the conventional VC model. It was designed to offer emerging venture capitalists a faster path to initiate and close their first deals.

In a blog post, Naval Ravikant, AngelList’s founder and chairman explains, “The huge benefit for a fund manager is that they can raise money incrementally, one investor at a time, rather than having to do a one-time, big-bang fundraise and then lock the fund for four years.”

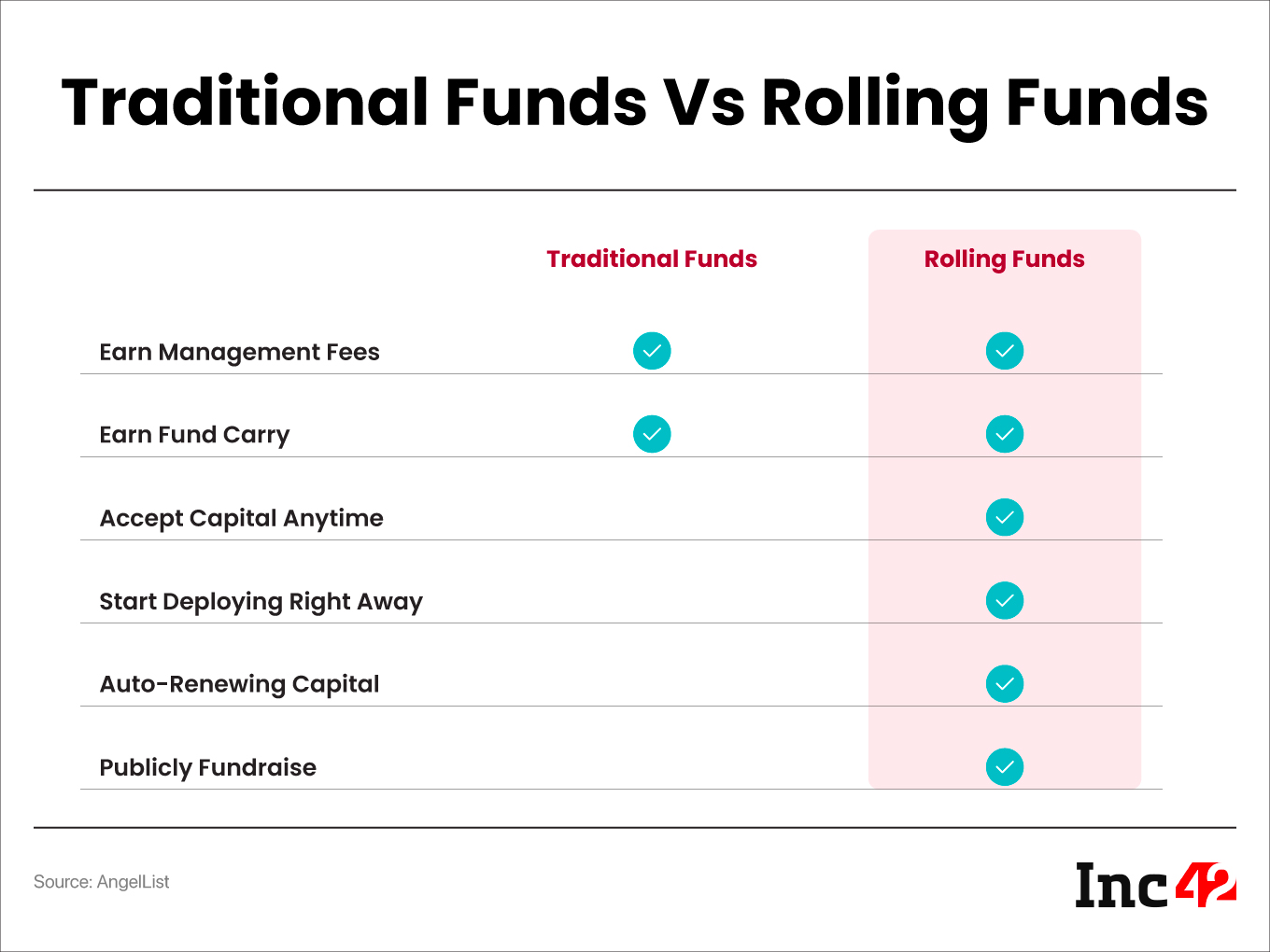

Some differences between rolling funds and traditional VC are:

- In contrast to rolling funds, traditional VCs follow a lengthier process to close. Fund managers approach various LPs such as family offices, high-net-worth individuals (HNIs) and investment firms to secure a minimum capital commitment.

- Rolling funds enable fund managers to publicly raise funds. However, traditional fund deals are typically conducted privately, behind closed doors.

- In rolling investments, fund managers raise fresh capital commitments quarterly and invest as they progress, which is why it is referred to as rolling money.

- On the other hand, traditional funds operate on a 10-year return cycle as per industry standards. LPs and investors are legally obligated for a decade, and the capital commitment remains in effect until it is fully closed.

How Long Does It Typically Last?

The duration of a rolling fund can vary as it operates on a rolling subscription model. However, these funds offer a flexible option to angel investors due to their minimum term commitments, allowing them to commit per quarter for up to four quarters or extend their commitment for up to four to ten years.

How Does The Rolling Fund Select Startups?

Like any other VC fund, a rolling fund selects startups by evaluating various factors such as team expertise, market potential, traction, competitive advantage, and alignment with the fund’s investment thesis.

Can Investors In A Rolling Fund Receive Updates On The Performance Of The Startups In The Portfolio?

Yes, investors in a rolling fund receive regular updates on the performance of the startups in the portfolio, including key metrics, milestones achieved, financial updates and other relevant information. There is more transparency as compared to traditional VCs as these funds invest publicly.