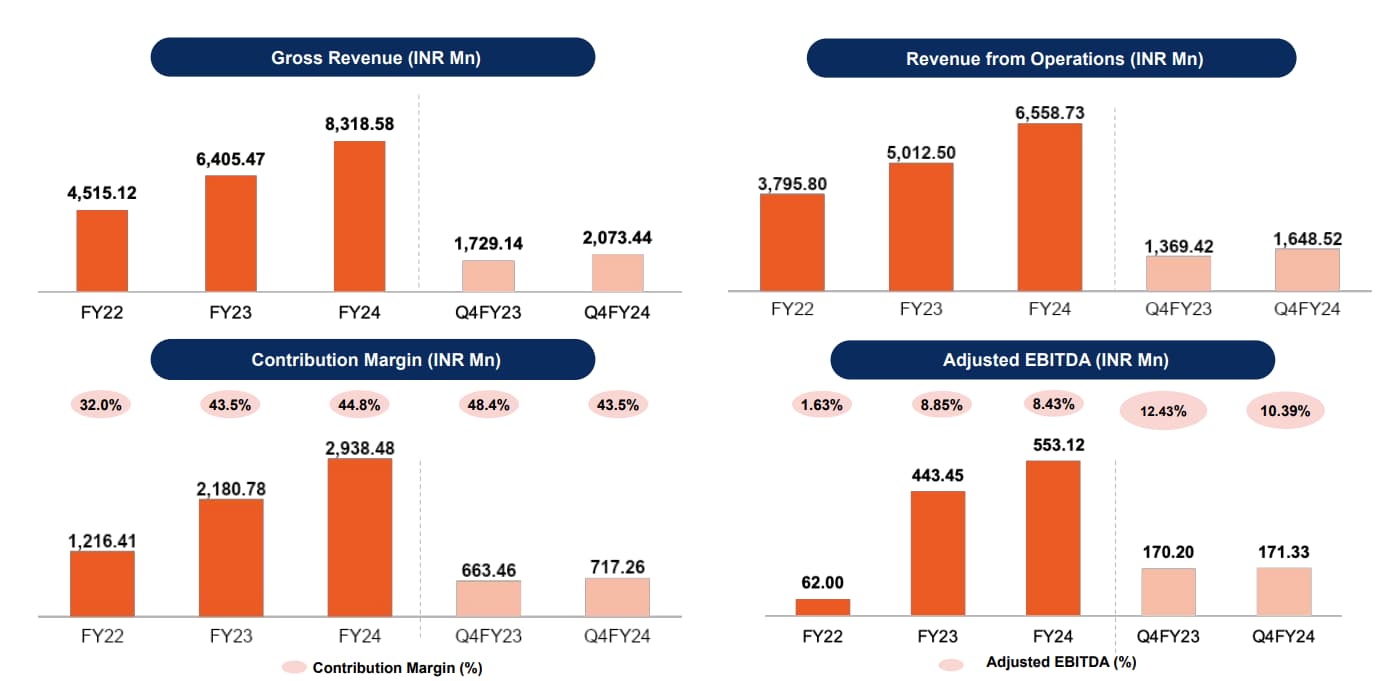

ixigo’s operating revenue increased almost 31% to INR 655.9 Cr in the reported fiscal year from INR 501.2 Cr in FY23

The train ticketing segment continued to be the biggest revenue contributor, with its revenue surging 24% YoY to INR 370.1 Cr in FY24

ixigo’s net profit in Q4 FY24 stood at INR 7.4 Cr on a revenue of INR 164.8 Cr

Recently-listed online travel aggregator Ixigo

ixigo’s operating revenue increased almost 31% to INR 655.9 Cr in the reported fiscal year from INR 501.2 Cr in FY23.

Founded in 2007 by Aloke Bajpai and Rajnish Kumar, ixigo earns revenue from selling various travel services like flights, trains, bus tickets, hotel bookings, and holiday packages. The train ticketing segment continued to be the biggest revenue contributor, with its revenue surging 24% to INR 370.1 Cr in FY24 from INR 297.8 Cr the previous year.

On the other hand, ixigo’s flight ticketing revenue also improved 43% year-on-year (YoY) to INR 146.4 Cr in FY24. The startup’s bus ticketing revenue increased almost 66% YoY to about INR 132 Cr in the year under review.

Commenting on the FY24 earnings, ixigo group CEO Bajpai, said, “FY24 has been a super productive year as we crossed 480 Mn annual active users cumulatively across the group and surpassed INR 10,000 Cr in GTV (+38% YoY). The synergies from our acquisitions have started to play out on our train and bus businesses. We have also improved our ancillary attachment rate rapidly to over 31%.”

“Our playbook of building the best customer experience for travellers has helped us continue our robust growth trajectory of 38% growth in our GTV and 30.8% growth in our revenue from operations. We have also hit double-digit adjusted EBITDA margins in Q4 and gained market share in all three key verticals of flights, buses and trains during the year despite limited capacity growth in the overall market during the quarter,” he said in a statement.

Meanwhile, the startup’s net profit rose 55.2% to INR 7.4 Cr in the March quarter (Q4) of FY24 from INR 4.7 Cr in the year-ago period. Operating revenue increased 20.4% to INR 164.8 Cr from INR 136.9 Cr in Q4 of FY23.

Ixigo’s net profit stood at INR 30.6 Cr in the preceding December quarter of FY24, while revenue was at INR 170.5 Cr.

ixigo said its monthly active users grew to 76.78 Mn in FY24 from 62.83 Mn in FY23.

ixigo’s group co-CEO Kumar said, “The scale of users we now serve is mind-boggling with 95.6 Mn passenger segments booked in FY24. Our flight business has outperformed with 77% YoY growth in passenger segments.”

Kumar also reiterated that ixigo is now leveraging GenAI to expand its AI capabilities and enhance its efficiency and customer experience. With the launch of its hotels segment, now there is further scope to cross-sell and up-sell to its user base.

Ahead of its earnings announcement on Thursday (July 4), shares of ixigo jumped 4.8% to end the session at INR 163.95 on the BSE.

Zooming Into Expenses

As per the company’s P&L report, ixigo’s total expenses jumped almost 30% to INR 627.8 Cr in FY24 from INR 484.3 Cr in the previous year.

In that, the startup spent INR 141 Cr on employee benefit expenses, which increased 11.6% year-on-year (YoY).

Meanwhile, its other expenses increased 36% YoY to INR 471 Cr during the year under review. ixigo did not provide a breakup of the other expenses.

Ixigo, in a separate filing, said that its advertising and branding expenses witnessed a major jump, increasing to INR 55.2 Cr in FY24 from INR 21.4 Cr in the previous year.

Speaking on this jump in ad expenses, Bajpai said it was in line with ixigo’s plans to grow its unaided brand recall and build more trust with the next billion users for all the core categories.

“… in the first 10 years of our existence, we spent very little on brand marketing. We recognise that in the consumer ecommerce space, brand spends should be seen as an investment for the longer-term salience of the brand, and hence we have done three major activities in FY24. We completed a campaign at Asia Cup for the ixigo brand, we signed Rana Dagubatti as the brand ambassador for ConfirmTkt, and we renewed our partnership with Mahesh Babu as the brand ambassador for our Abhibus brand.”

Company Outlook

In its earnings report, ixigo’s Bajpai said that the startup expects the trains segment to grow in mid-teens in terms of volume for the next few years, given the organic acquisition of users and new features and product pipeline.

“As for selling more buses and flights within our ecosystem, there is clearly further scope to do that over time, but this shall be a slow and gradual process of discovering better product marketing hooks and customer retargeting,” said Bajpai.

On the flights side, he said that there has been slow growth in the overall market.

“As our brand gains trust and distribution deals play out, we expect to continue growing faster than the overall market at the flight passenger segment level. However, we may have to spend a little on first-time booker discounts, performance and brand over time to fuel this further, leading to slower growth on the revenue and CM (contribution margin) lines compared to the GTV line,” he said.

“All in all, we foresee growing faster than the overall OTA market for the foreseeable future, though the overall market growth may slow down a bit this year,” Bajpai added.

ixigo made a stellar debut on the Indian bourses last month. Its shares have gained over 21% since listing.

Ad-lite browsing experience

Ad-lite browsing experience