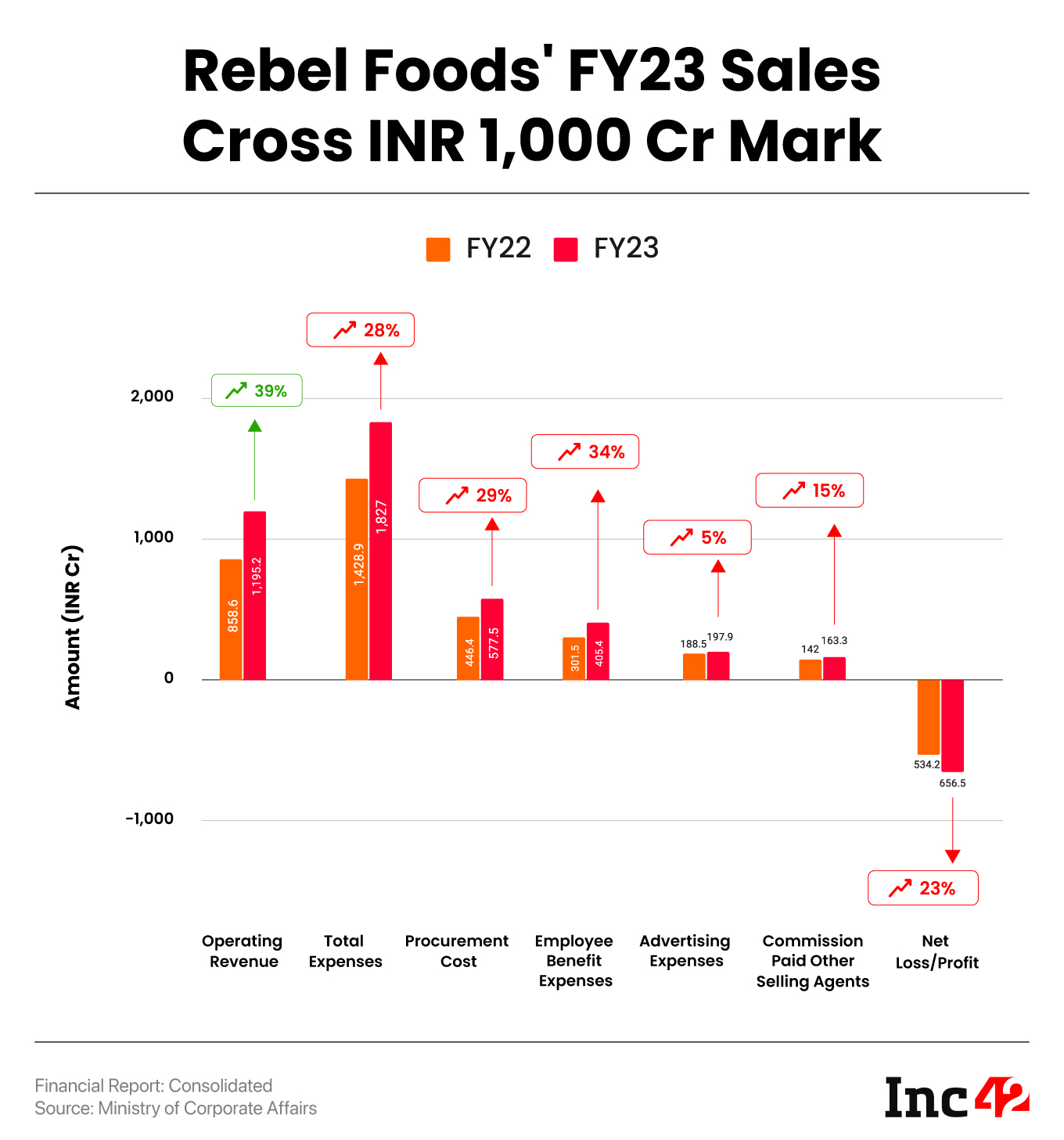

Rebel Foods reported operating revenues of INR 1,195.2 Cr in FY23, a 39% increase from INR 858.6 Cr in FY22

The startup’s loss rose to INR 656.5 Cr during the period under review from INR 534.2 Cr in FY22

Total expenditure rose 28% YoY to INR 1,827 Cr in FY23 on the back of a steep rise in procurement cost

Mumbai-based cloud kitchen giant Rebel Foods’ operating revenue crossed the INR 1,000 Cr mark in the financial year ending on March 31, 2023.

As per the recent financial statements filed with the Registrar of Companies, Rebel Foods, the parent company of both Faasos and Behrouz Biryani, reported an operating revenue of INR 1,195.2 Cr in FY23, up 39% from INR 858.6 Cr a fiscal ago.

Founded in 2011 by Kallol Banerjee and Jaydeep Barman, Rebel Foods

Mandarin Oak, The Good Bowl, SLAY Coffee, and Sweet Truth.

The startup’s primary source of income is through the sale of its food items. Including other income, the startup earned a total revenue of INR 1,258.7 Cr in FY23, a 1.3X markup from INR 907.5 Cr it had generated in FY22. Meanwhile, the startup posted a loss of INR 656.5 Cr in FY23, up 23% year-on-year (YoY).

Expenses That Ate Into Rebel Food’s Revenue In FY23?

During the year under review, the startup’s total expenditure rose to INR 1,827 Cr, up 28% from INR 1,428.9 Cr it had spent a year ago.

Procurement Cost Became The Biggest Contributor: Being a cloud kitchen, Rebel Foods spent most of its money on procuring raw materials. During the period under review, the startup’s procurement cost rose to INR 577.5 Cr from INR 446.4 Cr in FY22.

Employee Expenses: The startup’s employee benefit expenses, which mostly comprised salaries, increased 34% YoY to INR 405.4 Cr in FY23. In June, Rebel Foods granted employee stock ownership plans (ESOPs) to 5,000 employees. The company has 2,743 employees as per its LinkedIn profile.

Advertising Expenses Rise Mildly: Advertising expenses rose a mere 5% rise to INR 197.9 Cr in FY23 from INR 188.5 Cr in FY22.

Besides, the startup spent INR 163.3 Cr on commissions paid to other selling agents, mainly Swiggy and Zomato.

On a unit economics level, Rebel Foods spent INR 1.5 to earn every rupee from operations. The startup’s EBITDA margin improved to -37.8% in FY23 from -46.4% in FY22.

To date, the startup has raised a little over $500 Mn and counts Goldman Sachs, Peak XV Partners, InnoVen Capital, Trifecta Capital, and Qatar Investment Authority (QIA) among its backers. The startup claims that it has over 450 kitchens across 70 cities in the country. The startup primarily competes against the likes of Curefoods, Biriyani By Kilo, Freshmenu, among others.

Ad-lite browsing experience

Ad-lite browsing experience