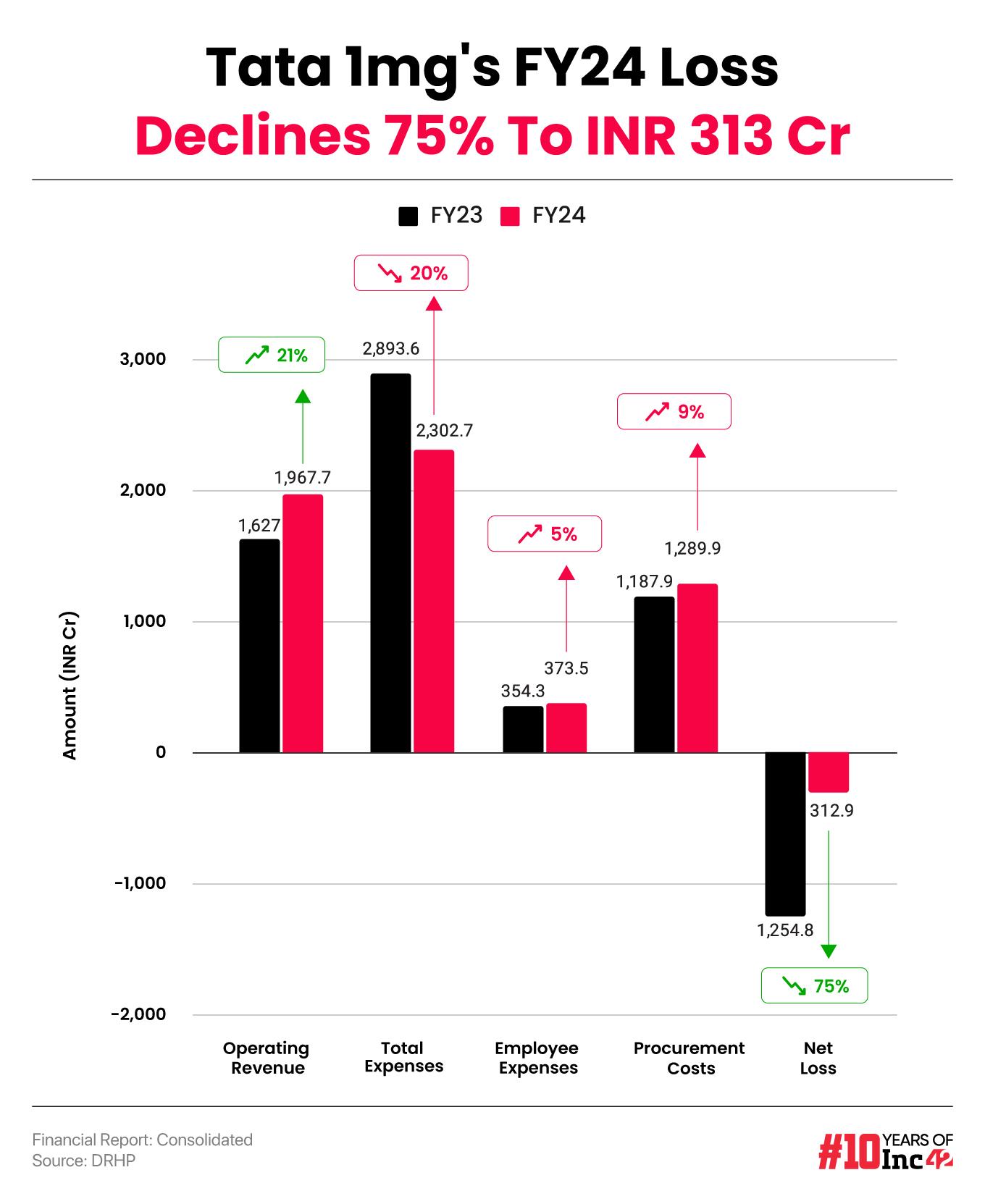

Despite 21% year-on-year increase in operating revenue to INR 1,967.7 Cr in FY24, Tata 1mg managed to cut its total expenses by 20% to INR 2,302.7 Cr

The Tata Digital-owned startup’s revenue from sale of products rose 25% to INR 1,615 Cr in FY24 from INR 1,290 Cr in the previous year

The epharmacy was one of the earliest bets of the Tata Group as part of its efforts to launch the country’s first superapp — Tata Neu

Tata Digital-owned epharmacy Tata 1Mg

Operating revenue rose 21% to INR 1,967.7 Cr during the year under review from INR 1,627 Cr in FY23. The startup’s focus seemed to have been on the bottom line rather than the top line during the year under review. It is pertinent to note that its revenue from operations surged 2.6X year-on-year in FY23.

The startup primarily earns revenue from sales of medicines, and offering lab and diagnostics test services. Besides, it also generates revenue from its loyalty programme.

Tata 1mg’s revenue from sale of products rose 25% to INR 1,615 Cr in FY24 from INR 1,290 Cr in the previous year.

Including other income, total revenue grew 22% to INR 1,991.1 Cr from INR 1,633.9 Cr in FY23.

Founded in 2015 by Prashant Tandon, Gaurav Aggarwal and Vikas Chauhan, Tata 1mg home delivers medicines and health & wellness products. It also provides diagnostics and doctor consultation services.

Where Did Tata 1mg Spend?

Despite the rise in operating revenue, the startup managed to curtail its total expenditure by 20% to INR 2,302.7 Cr in FY24 from INR 2,893.6 Cr in the previous fiscal year.

Procurement Cost: Being a marketplace, the startup’s biggest expense was procurement cost. This number stood at INR 1,290 Cr in FY24, an increase of 9% from INR 1,188 Cr in the previous year.

Employee Benefit Expenses: Employee costs rose 5% to INR 373.5 Cr from INR 544.3 Cr in FY23.

Advertising Expenses: Tata 1mg’s advertising cost declined 37% to INR 84 Cr in FY24 from INR 135.2 Cr in FY23.

The epharmacy was one of the earliest bets of the Tata Group as part of its efforts to launch the country’s first superapp — Tata Neu. Tata Digital acquired a majority stake in Tata 1mg (then 1mg) in June 2021. While the deal amount was not disclosed, it was estimated that Tata Digital infused about $100 Mn to $120 Mn in the startup then.

In late 2022, the startup entered the coveted unicorn club after raising $40 Mn in a funding round led by Tata Digital. The other participants in the round were KWE Beteiligungen AG, HBM Healthcare Investments, among others, according to a regulatory filing.

Tata Digital held over 66% stake in the parent entity of Tata 1mg at the end of FY23.

The epharmacy competes against the likes of PharmEasy, Netmeds, and Practo.

Ad-lite browsing experience

Ad-lite browsing experience