Neobanking startup Jupiter, which counts Tiger Global, Peak XV, QED Investors and Matrix Partners among its backers, is reportedly in discussions to acquire 26% stake in SBM Bank India

The deal, subject to the approval from the Reserve Bank of India (RBI), may materialise in tranches and include an option of raising the stake

This comes days after a report emerged that Jupiter is in early talks to acquire a 5% to 9.9% stake in SBM Bank India

Neobanking startup Jupiter, which counts Tiger Global, Peak XV, QED Investors and Matrix Partners among its backers, is reportedly in discussions for a stake in SBM Bank India.

As per The Arc, the company is looking to acquire a 26% stake in the Mauritius-based SBM Group’s subsidiary. The deal, subject to the approval from the Reserve Bank of India (RBI), may materialise in tranches and include an option of raising the stake.

This comes days after a report emerged that Jupiter

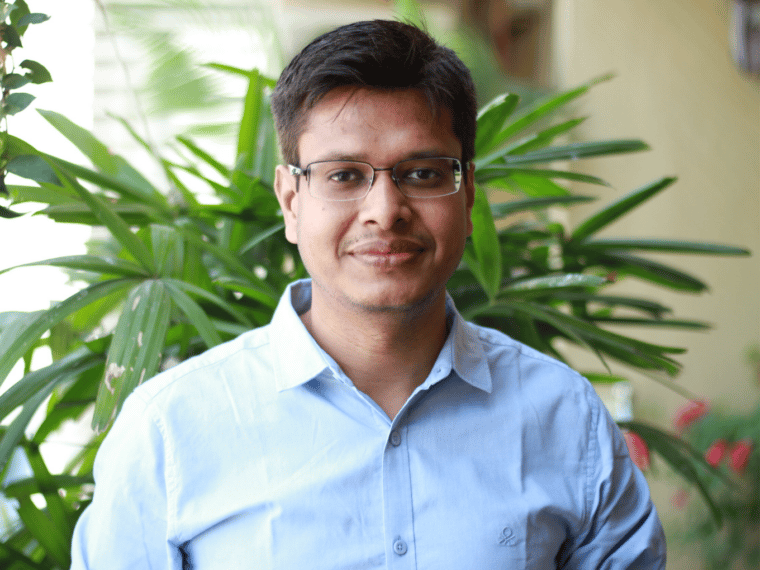

Back then, the startup’s founder and chief executive officer Jitendra Gupta declined to answer Inc42 queries, saying he does not “comment on market rumours”.

“Discussions have been underway for several quarters. A broad agreement has been finalised and will be filed with the RBI in the coming days,” The Arc report quoted a source as saying.

Founded in 2019 by Gupta, Jupiter offers a range of financial services, including debit cards, SIPs, mutual funds, personalised savings options, expense management, and UPI payments.

In June, the neobanking business secured prepaid payments instrument licence from the RBI to provide digital wallets for UPI payments, fund transfers and bill payments, and Jupiter then disclosed its plans to introduce a prepaid account facility in the coming months.

The company has, so far, raised over $171 Mn in about six rounds of funding from various investors, including Tiger Global, Peak XV Partners, QED Investors and Matrix Partners. The company last raised $2.4 Mn in June, as per Inc42 data.

Ad-lite browsing experience

Ad-lite browsing experience