The problem for Ola Electric is deeper than the customer complaints, the company’s sales are also slipping and competition is catching up

We’ve seen founders clash with founders and even their investors, but last week brought a new experience as Bhavish Aggarwal took on a comedian on X (formerly Twitter) over the allegedly poor quality of Ola Electric’s scooters and company’s customer service.

The social media skirmish took place on Sunday and appeared to simmer down by Monday evening. Yet, as the dust settled, the situation for Ola Electric

However, the problem for Ola Electric is deep because the company’s numbers are also slipping. With Q2 results on the horizon, the pressure is real on Bhavish Aggarwal and Ola Electric — as it is for Ola Consumer as it looks to go for an IPO.

Before we see why, here’s a look at the top stories from our newsroom this week:

- Decoding Ather’s Edge: Ather Energy is coming from a vastly different trajectory to join Ola Electric in the public markets. What fate awaits Ather after Ola Electric’s less than pleasant beginning?

- The Deeptech Problem: India’s venture capital firms and fund managers often talk about innovation, but in the age of generative AI and deeptech, such talks seem shallow. So the question is: where are the deeptech investors?

- Swiggy’s Big Ask: The Swiggy IPO raises two major concerns — a high valuation and hefty losses on the books. Besides, the platform is now set to increase its IPO size as well. Will this come back to bite the food delivery giant?

Where Ola Electric Is Slipping

The scrutiny intensified when news broke that the Ministry of Heavy Industries (MHI) has asked the Automotive Research Association of India (ARAI) to verify if Ola Electric is honouring warranties and maintaining the requisite service centres.

This is a critical condition related to the company’s production-linked incentives which not only stipulate production levels but also standards in quality and safety. So there is some element of taxpayer money involved here.

This investigation comes at a time when the company’s sales have been declining. Ola Electric’s market share fell from over 30% in August to 27% in September—a signal that its grasp on the electric two-wheeler market may be weakening.

As Ola Electric grapples with this turmoil, competitors are gaining ground. Bajaj Auto’s sales surged in September, with 166% year-on-year growth, and market share growing from 19% to over 21%,

In contrast, Ola Electric’s registrations slipped 11% month-on-month, its lowest sales figures since October last year.

Legacy automakers, such as Bajaj and TVS Motor, have years of experience and have handled product or part recalls in the past. Ola Electric, being relatively new to the game, is yet to face such an issue, but its current service woes suggest that it could be heading down a spiral if it doesn’t follow the established playbook for product quality and customer service.

Meanwhile, others are also rising quickly. Ather Energy saw a 15% bump in September, and its market share has grown to 14% from 12% in August.

The fluctuations in the electric two-wheeler market this year have been influenced by changes in government subsidies under the FAME scheme. However, the recently approved ‘PM E-DRIVE Scheme,’ with an initial budget of INR 10,900 Cr over two years, aims to provide fresh momentum to EV adoption.

This new initiative targets the production of 24.79 Lakh electric two-wheelers, building on the previous FAME-II scheme, which supported the development of 10 Lakh vehicles.

This dip in sales for Ola Electric is particularly concerning given these widespread concerns about product quality. The Central Consumer Protection Authority (CCPA) issued a show cause notice asking Ola Electric to explain accusations of misleading advertising and unfair trade practices.

This emphasis on service and after-sales support should be the next focus area for electric two-wheeler makers, said Deloitte partner Rajat Mahajan.

Deloitte projects that by 2030, electric two-wheelers could account for as much as 50-55% of the total market, so naturally there’s a lot of room for all kinds of OEMs. Mahajan highlighted the distinct advantage that traditional OEMs have with extensive dealer networks and said they are better equipped to handle service and sales growth in conjunction.

“They don’t sell in districts where their customers cannot get service. Ola Electric and Ather are looking at it like a D2C model, but Ola Electric has taken it to an extreme. You cannot sell in one district and hope that the local mechanic will know how to fix the bike. Ather’s service is said to be much better and more streamlined, but they have their own set of challenges,” a Delhi NCR-based angel investor told Inc42 about why the traditional model is better for OEM services.

As these startups scale up, they may need to adopt hybrid models that combine D2C channels with dealership-based service centres to meet rising customer demands.

The Stock In Free Fall

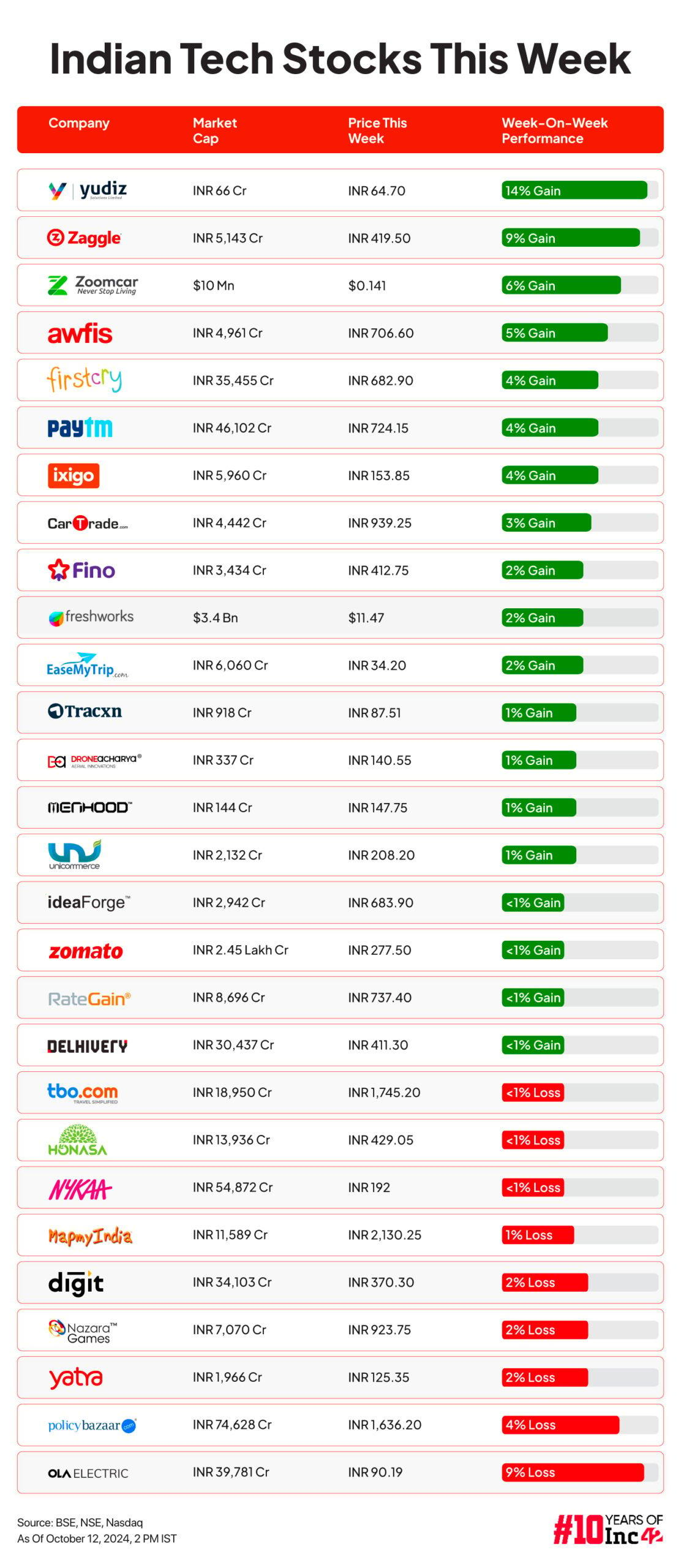

It’s no surprise that Ola Electric’s stock has been on a rollercoaster. On October 10, shares plunged 5.8% during intraday trading on the Bombay Stock Exchange (BSE), before closing down 5.19% at INR 90.81.

Reports around Ola’s poor service standards and the government involvement seems to have rattled investors. Since hitting a post-listing high of INR 157 in August, Ola’s shares have plummeted by 42.1%.

Earlier this week, the company launched its ‘HyperService’ initiative, promising “one-day resolution” for service issues in an attempt to stem the tide of customer complaints that have been widely circulated on social media.

While the market remains cautious, brokerages like Goldman Sachs and BofA Securities are still bullish, with Goldman Sachs assigning a price target of INR 160 per share.

Brokerage firm Bernstein, for example, maintains that Ola Electric is on track to achieve EBITDA profitability, with the highest gross margins among its competitors.

On the financial front, Ola Electric’s consolidated net loss rose 30% YoY to INR 347 Cr in Q1 FY25, even though it fell on a quarterly basis. The Q2 FY25 numbers expected in early November will make things clear as to how the sales decline impacts Ola Electric.

In the past, Aggarwal had claimed that Ola Electric will rely on the premium category products for profitable growth. “Our premium portfolio is growing, and the launch of the mass segment has resulted in further 77% YoY growth in deliveries,” he said after the Q1 results.

Are EVs Terrible For Customer Service?

So can Ola Electric learn from its competitors or is service an ecosystem-wide problem?

One Ather Energy executive claimed that some companies did not approach after-sales service with a clear strategy like they might have done on the distribution side. According to this senior executive, service is a natural extension of sales in the automobiles space. “When we open a new store, it’s mandatory for the dealer to also open a service centre,” the executive claimed.

Ather ensures that its service capacity matches its sales network, prioritising both technical training and soft skills for its technicians. This past week we examined how Ather’s premium positioning means it has to invest in customer service meaningfully, unlike Ola Electric which has gone for the affordable end of the spectrum. And service is a big part of the premium experience.

After accusations of poor customer service this past week, Ola said that it will look to take feedback and improve its services. Aggarwal said that the company heavily invests in training programmes, and will build a team of skilled EV technicians.

On Ather’s part, our sources said the company conducts skilling and refresher courses every six months, to ensure that its dealers and technicians can meet the high standards customers expect.

The shift to electric vehicles is also changing the dynamics of after-sales services. Traditional two-wheeler dealerships typically generate around 40% of their revenue from after-sales services. But this is not the case with EVs that have fewer mechanical parts. However, the complexity of EV technology and proprietary nature of some scooters means that authorised service centres are critical for scale.

Despite the noise about product quality and service issues, Deloitte’s Mahajan remains confident in his projection that by 2030, electric two-wheelers will dominate the market, provided subsidies and government support remain in place. And this is why the results of the government’s scrutiny into Ola Electric potentially dishonouring warranty claims is important.

Ola Electric, despite its strong product lineup, must address its service issues if it hopes to maintain its leadership position. The company’s current struggles echo those faced by smartphone makers like Xiaomi when they entered the Indian market in the early 2010s. Back then, Xiaomi was criticised for inadequate after-sales support.

This time, people are also more gravely concerned because vehicle safety issues are a lot more dangerous than a dysfunctional smartphone. “Like Xiaomi, Ola Electric will need to build a robust service network if it wants to stay on top. Otherwise, it risks losing customers and market share during this crucial growth period,” the angel investor quoted above added.

The timing of this controversy, coming during the festive season, is particularly concerning for Ola Electric, as poor service or product quality can quickly erode consumer trust. If not addressed, these issues could drive potential buyers toward competitors that have wider service networks and better recent reviews.

For Bhavish Aggarwal and Ola Electric, the road ahead also requires introspection. The company claims to be building an EV for India, but it seems to have forgotten that the quintessentially Indian maxim of ‘sasta aur tikaau’ has two parts that are equally important for the consumer.

Sunday Roundup: Tech Stocks, Startup Funding & More

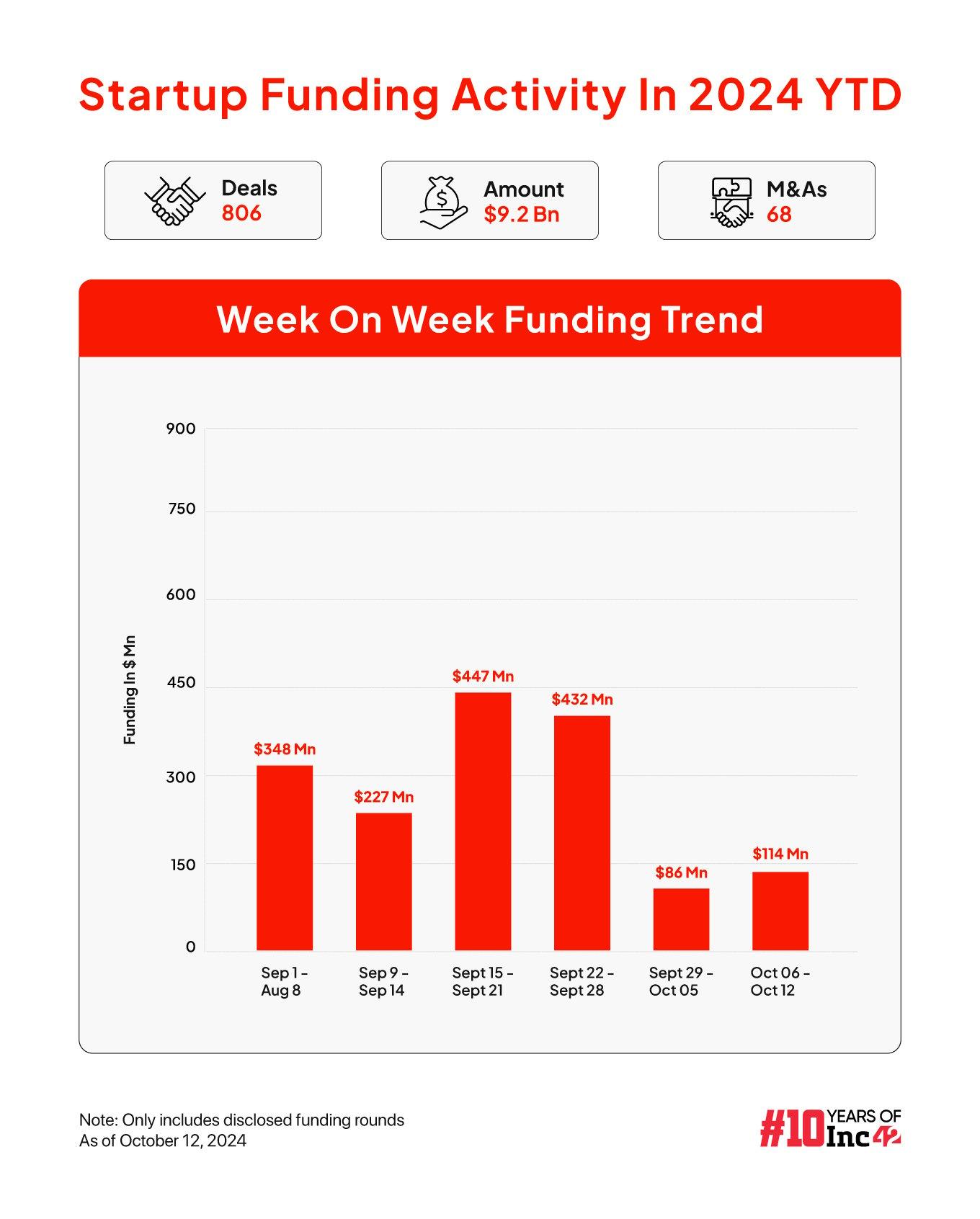

- Indian startups raised $114 Mn via 22 deals during October 7-12, up 32% from $86.4 Mn, but much lower than the past few weeks. Is a cold October on the cards for Indian startups?

- Bengaluru-based B2B marketplace startup Zetwerk has joined the growing list of Indian startups eyeing an initial public offering, and is in talks with investment bank JP Morgan

- In another move to diversify beyond the grocery segment, Zomato-owned Blinkit is now preparing to roll out a cafe feature to deliver snacks and beverages to match Zepto and Swiggy Instamart

- Caratlane founder Mithun Sacheti and brother Siddhartha Sacheti, CEO of Jaipur Gems, have set up an investment firm Finqube Capital looking to institutionalise their angel investments

- Ahead of the IPO, Swiggy founder and CEO Sriharsha Majety and some of the company’s investors sold shares worth INR 670 Cr, with the CEO pocketing INR 23 Cr

Ad-lite browsing experience

Ad-lite browsing experience