The Swiggy IPO raises two major concerns — a high valuation and hefty losses on the books. Besides, the platform is now set to increase its IPO size as well

Analysts see enough demand in the market for Swiggy’s IPO. However, a valuation discount will only increase the interest for its much-anticipated public offering

Amid debates, discussions, concerns and opportunities, Swiggy’s unlisted shares are trading at INR 485-INR 515 zone in the grey market. Two months ago, its shares were trading at INR 425 apiece

The Indian startup ecosystem and public market are abuzz with anticipation of one of this year’s most awaited IPOs, Swiggy. However, as analysts and investors dive into the company’s prospects in a market otherwise dominated by its rival Zomato, they are seemingly getting cold feet.

The reason? Well, for one, the Swiggy

Besides, as per its DRHP, the IPO also comprises an offer for sale (OFS) component of 18.53 Cr equity shares. Together, this could increase the startup’s total IPO size to more than INR 10,000 Cr, expected to be around $1.5 Bn.

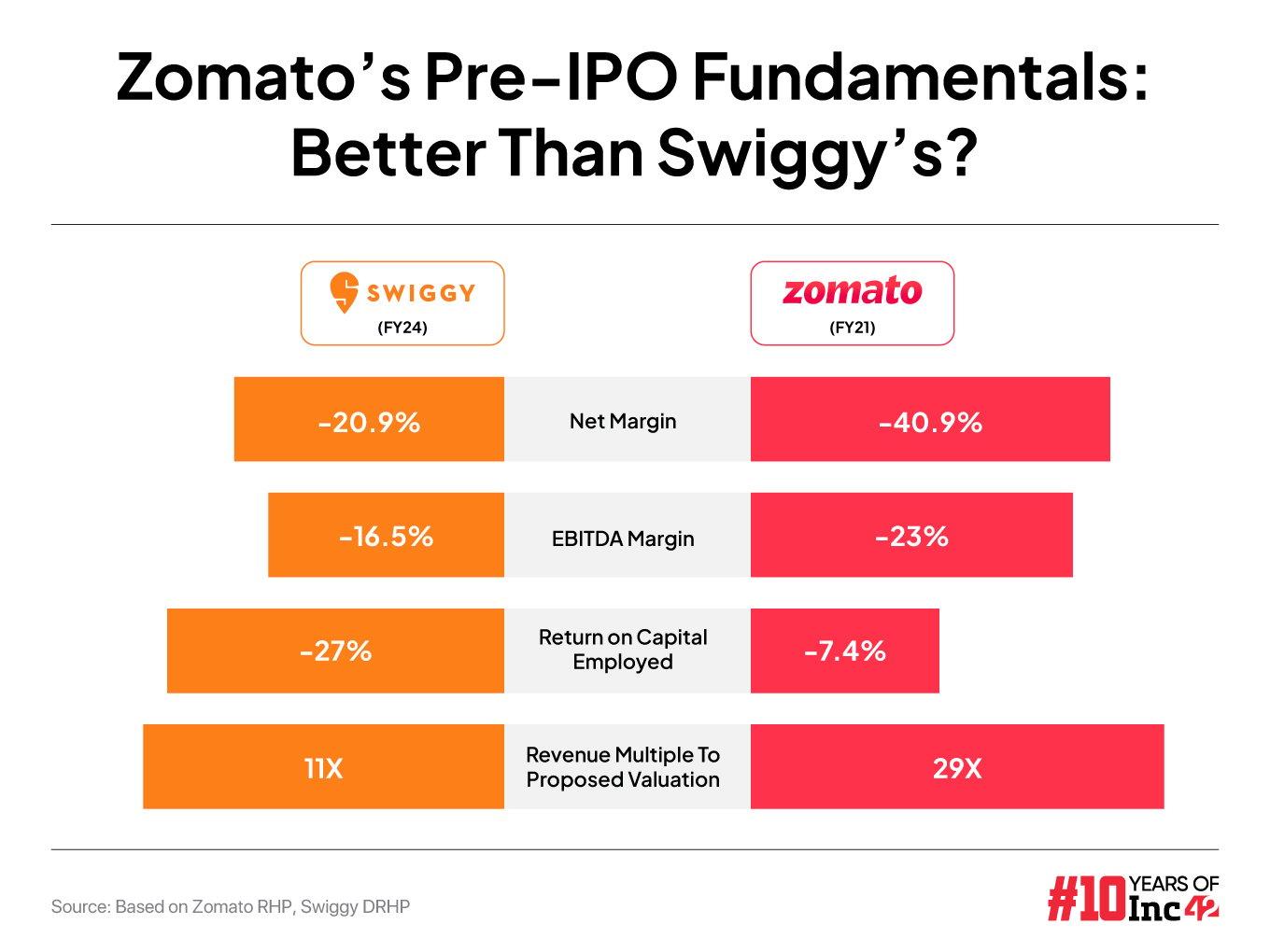

Swiggy is also eyeing a valuation of $15 Bn, which is higher than the $7 Bn valuation at which Zomato went public. Though the initial response to Zomato’s IPO was great, the stock was under significant pressure in the next one year.

While it is true that business-specific reasons and an overall negative market sentiment adversely impacted Zomato’s market performance, in Swiggy’s case, the concerns cannot be completely brushed off.

However, amid all the buzz and scepticism enveloping the prospect of this IPO, one factor is clear – public market investors would not like to miss the opportunity to ride on the food delivery or quick commerce growth bandwagon.

If we look back to when Zomato was listed in 2021, the Indian investors were new to the concept of food delivery and its overall potential. However, several significant developments have happened since then in the food delivery ecosystem.

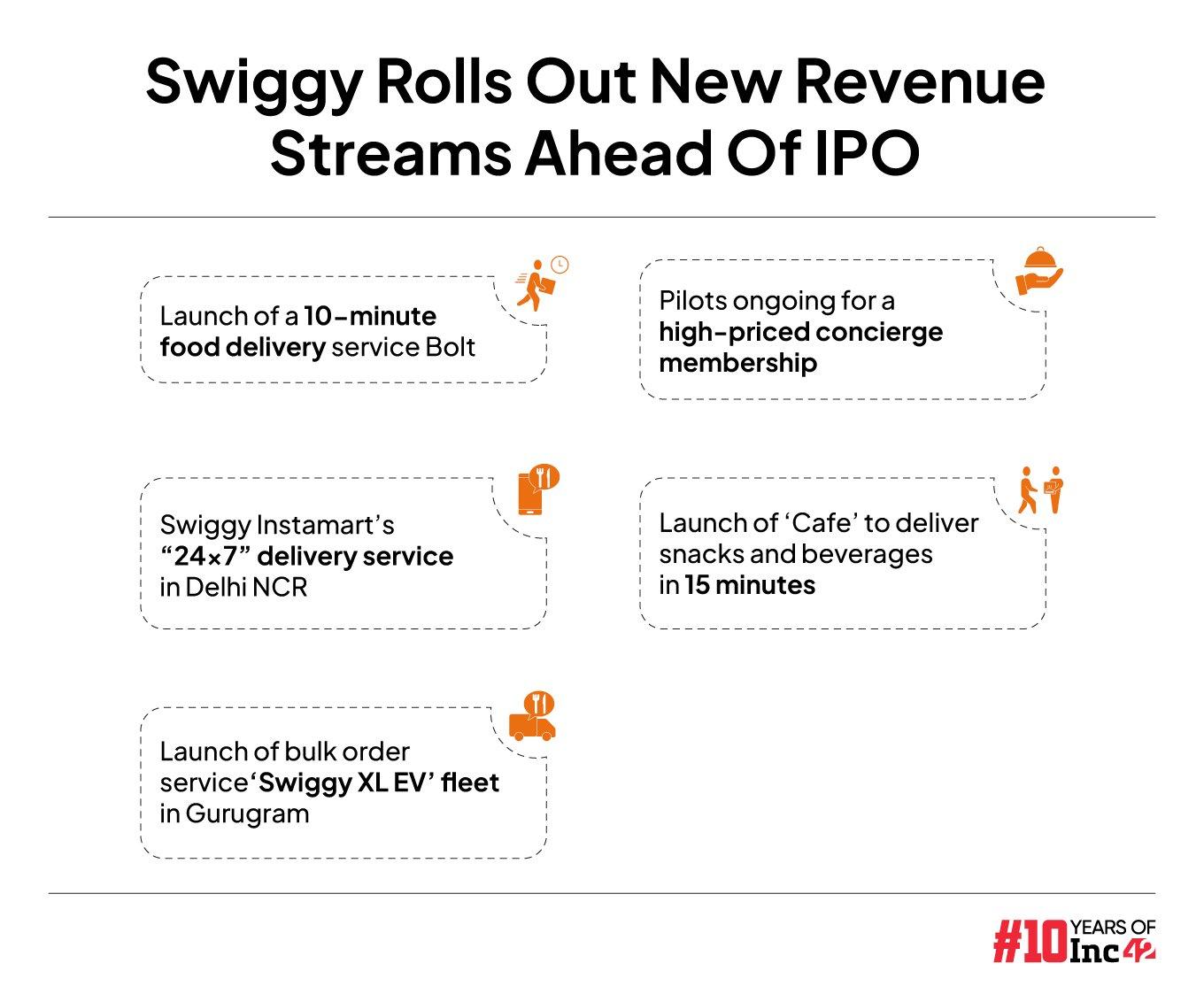

Besides, quick commerce has now entered the delivery realm to change the rules of the ecommerce game, and Swiggy’s Instamart is definitely one of the top industry players.

Despite tailwinds, Swiggy has some humongous challenges to deal with before it starts marching towards the IPO street where its competitor, Zomato, has already established its dominance with a $28 Bn market cap and much stronger fundamentals.

Swiggy Vs Zomato: An Apple To Apple Comparison

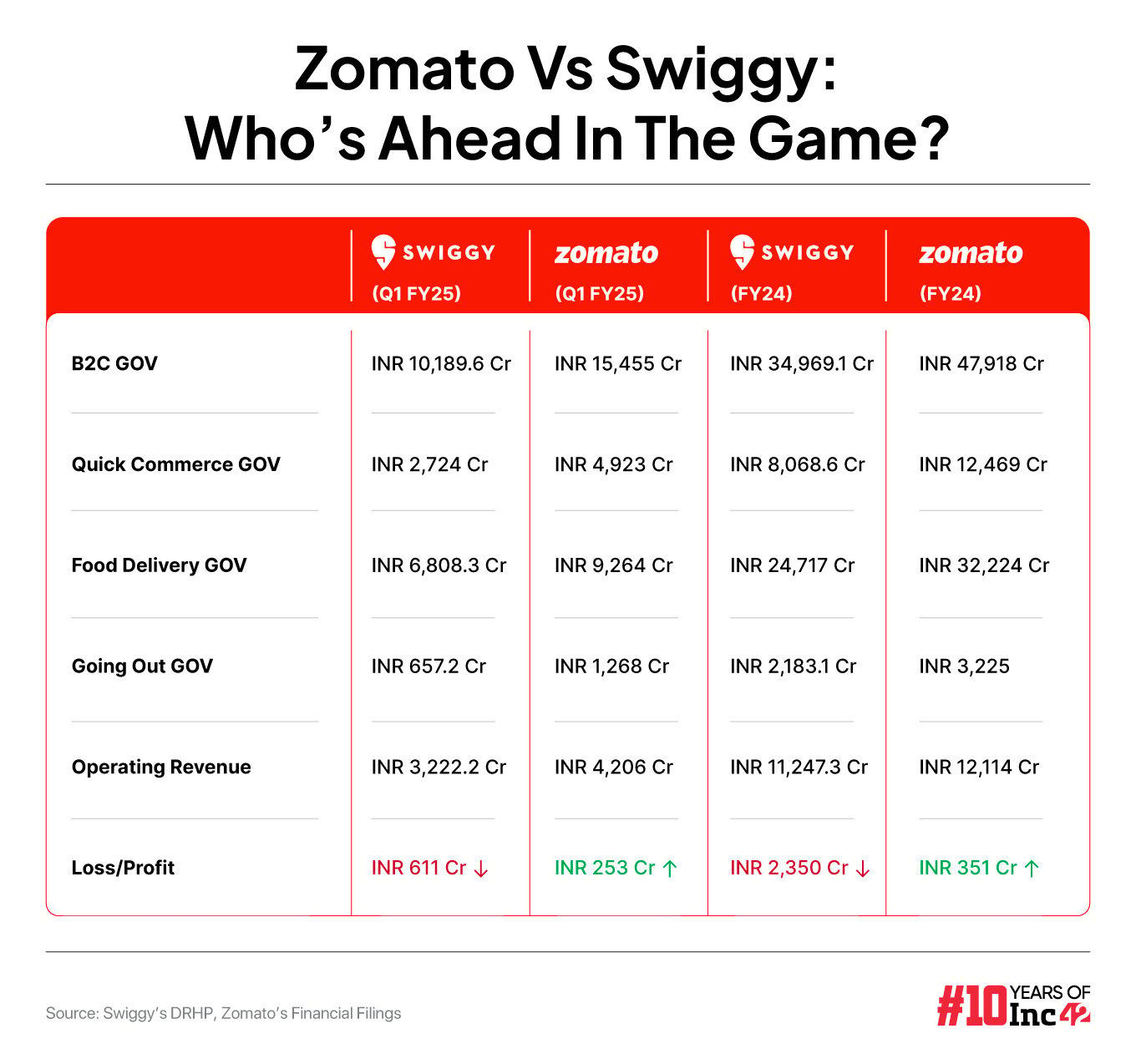

The Indian food delivery space is currently a duopoly with Zomato holding about a 55% market share and the rest being cherished by Swiggy. While quick commerce has become a major driver of their businesses in the recent past, food delivery continues to be the biggest contributor to their top lines.

However, IPO-bound Swiggy is far behind its listed rival. Swiggy’s food delivery gross order value (GOV) stood at INR 24,717 Cr in the financial year 2023-24 (FY24), while Zomato clocked INR 32,224 Cr. Zomato also saw stronger growth in FY24, with its GOV rising by 20% year-on-year (YoY), compared to Swiggy’s 15% YoY increase.

In the June quarter (Q1) of FY25, Zomato’s food delivery GOV stood at INR 9,264 Cr, while Swiggy’s stood at INR 6,808.3 Cr. In Q1, Zomato also had a higher average monthly transacting customers at 20.3 Mn users compared to Swiggy’s 14.03 Mn.

Despite the wide gap between Swiggy and Zomato, what makes Swiggy a great bet? “Swiggy will do well in the IPO considering investors have high hopes on quick commerce business,” Umesh Chandra Paliwal, cofounder and CEO of UnlistedZone said, adding that Zomato’s success today is also mainly due to the quick commerce business, Blinkit. UnlistedZone is an unlisted share trading platform.

Besides, Brokerage Bernstein also acknowledges that quick commerce has become the dominant force in India’s ecommerce structure.

However, Swiggy is trailing behind Zomato in this area, too.

Notably, in FY24, Swiggy posted a GOV of INR 8,068.6 Cr in quick commerce, up over 57% YoY. Meanwhile, Zomato’s Blinkit clocked INR 12,469 Cr in FY24 GOV, up 93% YoY. This was despite an equal number of dark stores at around 520 at the end of FY24.

It is imperative to mention that the two delivery giants face stiff competition from Zepto in the quick delivery space. Meanwhile, Zomato is way ahead of Swiggy in the going-out segment.

HSBC Global Research recently noted that Swiggy has slightly outperformed Zomato in average order value (AOV) in food delivery over the past year, likely due to its stronger presence in cities like Mumbai and Bengaluru. In FY24, Swiggy’s AOV for food delivery was INR 427.8, and it rose to INR 436 in Q1 FY25, compared to Zomato’s AOV of INR 420.2 and INR 425 during the same periods.

Overall, while an apple-to-apple comparison of the two businesses is necessary, Bernstein notes that “the debate on Zomato vs Swiggy is beyond comparing metrics.”

To understand the two businesses one needs to appreciate the divergent business philosophies – build vs buy, super app vs super brands, innovator vs operator, it said in a report.

The brokerage added that both companies have had different approaches leading to different outcomes in terms of market share, growth and profitability.

“Swiggy has a super app which bundles food delivery and quick commerce. The loyalty program is common – Swiggy One. This allows a stronger frequency (4.5X) at a lower monthly transactional user (MTU) (about 12 Mn). Zomato operates at a lower frequency (3.5X) but a higher base (20 Mn MTU). Both are solving for different outcomes – Swiggy solves for superior LTV/CAC (and higher profitability). Zomato has expanded through aggressive new user acquisition,” as per Bernstein analysts.

Meanwhile, Prashanth Tapse, senior VP (research) at Mehta Equities, believes that Swiggy and Zomato will upscale their business models going ahead.

“Today, they are not just online food delivery companies. Going forward, they will be platforms connecting customers in many other businesses. If we look globally, food delivery companies like DoorDash and Uber Eats have significantly changed their business models to foray into several other segments. So, going forward, a similar thing will happen with Swiggy and Zomato. In the next three 3-5 years, they will have many other business models where the valuation is getting higher,” Tapse said.

So, Who Should Invest In Swiggy?

At a time when Swiggy is faced with a valuation problem, Paliwal sees Zomato, too, sitting on a high valuation — while other experts view it as a new normal.

To draw an analogy, Ola Electric’s IPO had a high valuation that equally made market experts raise eyebrows. Its INR 6,000 Cr public offering at a $4 Bn valuation was well-subscribed but saw a muted listing.

Meanwhile, Swiggy’s current valuation is still lower compared to Zomato, which is also a direct reflection of the latter’s outperformance in all business verticals.

On the other hand, Mehta Equities’ Tapse believes that only long-term investors should invest in the IPO of Swiggy.

“For long-term investors, both Swiggy and Zomato should be in their portfolio. However, investors should invest in these kinds of businesses treating them as startups only and not big tech companies… there can be ups and downs in these businesses in terms of profitability,” Tapse said.

In addition, the analyst anticipates Swiggy to achieve profitability in the coming months on the back of a sustainable platform fee. In all its glory, Swiggy can also emerge as a multi-bagger, despite falling behind its closest competitor Zomato, analysts believe.

“However, short-term trades will burn hands,” Tapse concluded.

Amid debates, discussions, concerns and opportunities, Swiggy’s unlisted shares are trading at INR 485-INR 515 zone in the grey market. Two months ago, its shares were trading at INR 425 apiece.

To sum it all up, analysts see enough demand in the market for Swiggy’s IPO. However, a valuation discount will only increase the interest for its much-anticipated public offering.

[Edited By Shishir Parasher]

Ad-lite browsing experience

Ad-lite browsing experience