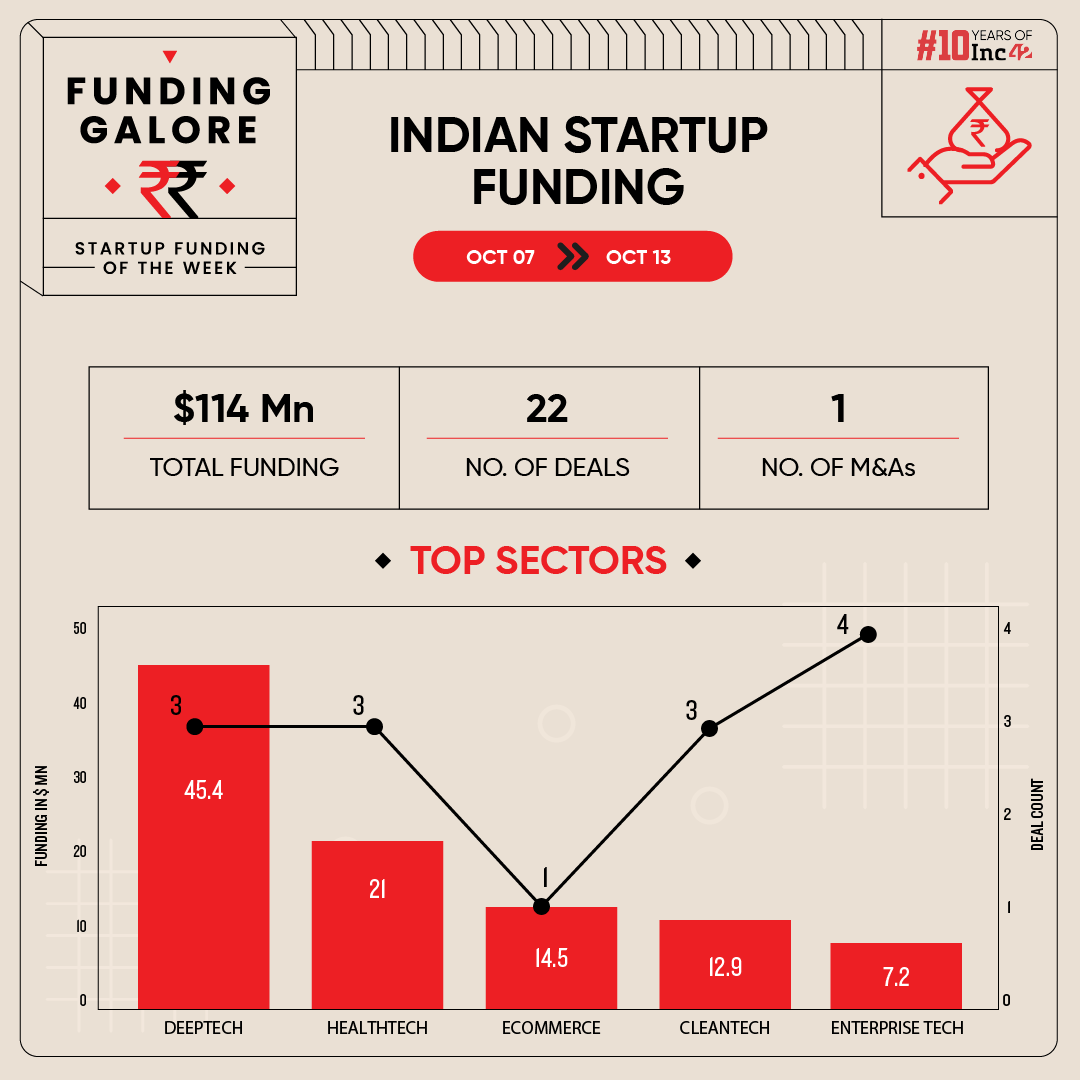

Indian startups cumulatively raised $114 Mn across 22 deals, a 32% increase from $86.4 Mn raised across 16 deals last week

Deeptech emerged as the investor favourite sector this week on the back of Haber’s $38 Mn fundraise

Seed funding picked up this week to $17.8 Mn from $1.9 Mn last week

After a significant drop in funding trends leading into the month of October, investor sentiment picked up slightly in the second week of the month. Indian startups raised $114 Mn via 22 deals during October 7-12, up 32% from $86.4 Mn raised last week across 16 deals.

This was the second week when no mega funding rounds materialised. This came after a quarter filled with heightened funding interest. In the third quarter of calendar year 2024, Indian startup funding doubled year-on-year to $3.4 Bn from $1.7 Bn in the same period last year. Late-stage investments surged 115% to surpass the $2.1 Bn mark in the September quarter this year from $984 Mn in Q3 2023.

Funding Galore: Indian Startup Funding This Week [Oct 7-12]

Date

Name

Sector

Subsector

Business Model

Funding Round Size

Funding Round Type

Investors

Lead Investor

10 Oct 2024

Haber

Deeptech

Robotics Process Automation (RPA)

B2B

$38 Mn

–

Accel India, Beenext Capital, Creaegis

–

9 Oct 2024

Spry Therapeutics

Healthtech

Healthcare SaaS

B2B

$15 Mn

–

Flourish Ventures, Together Fund, Fidelity’s Eight Road Ventures, F Prime Capital

Flourish Ventures

10 Oct 2024

Millenium Babycares

Ecommerce

D2C

B2C

$14.5 Mn

–

Pantamoth Capital

Pantamoth Capital

9 Oct 2024

Urja Mobility

Cleantech

Electric Vehicle

B2B

$12 Mn

pre-Series A

Mufin Green Finance Limited, Hindon Mercantile Limited

Mufin Green Finance Limited, Hindon Mercantile Limited

7 Oct 2024

XDLINK

Deeptech

Spacetech

B2B

$7 Mn

Seed

Ashish Kacholia, E2MC, Mana Ventures

Ashish Kacholia

9 Oct 2024

BioPrime

Agritech

Farm Inputs

B2B

$6 Mn

Series A

Edaphon, Omnivore, Inflexor

Edaphon

8 Oct 2024

Dezy

Healthtech

Telemedicine

B2C

$6 Mn

–

Alpha Wave, Chiratae Ventures, Peak XV

–

9 Oct 2024

Swara Fincare

Fintech

Lendingtech

B2B

$2.3 Mn

Series A

Unitus Capital, Piper Serica, Dev Verma, Mukund Madhav, Sumit Ranjan

Unitus Capital

9 Oct 2024

Figr

Enterprisetech

Horizontal SaaS

B2B

$2.2 Mn

Seed

Kalaari Capital, Antler, Golden Sparrow

Kalaari Capital

9 Oct 2024

LearnTube

Edtech

Skill Development

B2C

$2 Mn

Seed

Blitzscaling Ventures, Goodwater Capital, Bisk Ventures, ACT

–

7 Oct 2024

Framer AI

Enterprisetech

Horizontal SaaS

B2B

$2 Mn

Seed

Lumikai

Lumikai

7 Oct 2024

Nayan Tech

Enterprisetech

Horizontal SaaS

B2B

$2 Mn

pre-Series A

BEENEXT, We Founder Circle, Venture Catalysts, LetsVenture, FAAD Capital

BEENEXT

9 Oct 2024

ZenStatement

Fintech

Fintech SaaS

B2B

$1.6 Mn

Seed

3One4 Capital, Boldcap VC, Dynamis Ventures, Atrium Angels

3One4 Capital, Boldcap VC

10 Oct 2024

Datazip

Enterprisetech

Horizontal SaaS

B2B

$1 Mn

Seed

Equirus InnovateX Fund

Equirus InnovateX Fund

4 Oct 2024

Holiday Tribe

Travel Tech

Travel Planning & Activities

B2C

$642K

Seed

Powerhouse Ventures, GSF, Dinesh Agarwal, Dinesh Gulati, Murugavel Janakiraman, Gaurav Kapur

Powerhouse Ventures, GSF

10 Oct 2024

Onlygood.ai

Cleantech

Climate Tech

B2B

$475K

Seed

IITMIC, Goel Group, DICV

–

9 Oct 2024

iRasus Technologies

Cleantech

Electric Vehicle

B2B

$475K

Seed

IAN Group, DFAN

IAN Group

10 Oct 2024

flutrr

Media & Entertainment

Social Media & Chat

B2C

$446K

–

Zee Media Corporation

Zee Media Corporation

10 Oct 2024

Social Hardware

Deeptech

Robotics Process Automation (RPA)

B2B

$381K

Seed

Inflection Point Ventures, Ivyleague Ventures, Soonicorn Ventures

Inflection Point Ventures

9 Oct 2024

Deftouch

Media & Entertainment

Gaming

B2C

–

–

KRAFTON, T-accelerate Capital, Lumikai, Visceral Capital, Play Venture

KRAFTON, T-accelerate Capital, Lumikai

8 Oct 2024

Jivi AI

Healthtech

Personal Health Management

B2C

–

–

Andrew Ng

Andrew Ng

Source: Inc42

*Part of a larger round

Note: Only disclosed funding rounds have been included

Key Startup Funding Highlights Of The Week

- Artificial intelligence (AI)-based robotics startup Haber bagged the biggest cheque this week, securing $38 Mn (INR 317 Cr) by issuing Series C CCPS to venture capitalist (VC) firms Accel India, Beenext Capital, and Creaegis.

- On the back of Haber’s funding round, deeptech toppled enterprise tech to emerge as the investor favourite sector this week. Deeptech startups raised $45.4 Mn across three deals this week.

- However, enterprise tech saw the most number of deals materialise this week. Startups in the sector raised $7.2 Mn across four deals this week. Trailing it were deeptech and cleantech, with both the sectors seeing a similar number of three deals.

- Beenext and Lumikai emerged as the most active investors this week, backing two startups apiece. While Beenext invested in Haber and Nayan Tech, Lumikai backed Framer AI and Deftouch.

- Seed funding picked up this week to $17.8 Mn from $1.9 Mn last week.

Fund Launches This Week

- Lighthouse Canton and Nueva Capital’s joint venture LC Nueva Investment Partners announced the launch of a new fund with a target corpus of INR 150 Cr (nearly $18 Mn), with an additional greenshoe option of INR 100 Cr ($12 Mn).

- Recently listed non-banking financial company (NBFC) Northern Arc announced the launch of its category-II alternative investment fund (AIF) Finserv Fund, with a target corpus of INR 1,500 Cr (around $178.5 Mn).

Updates On Indian Startup IPOs

- Over three months after filing its draft red herring prospectus (DRHP), logistics startup BlackBuck received market regulator SEBI’s go ahead for its INR 550 Cr IPO.

- B2B marketplace unicorn Zetwerk has initiated initial discussions with investment banker JP Morgan for its IPO, sources told Inc42 this week. The startup is eyeing a public listing in the next two years.

- Shortly after raising $210 Mn, edtech startup PhysicsWallah has roped in Axis Capital, Kotak Mahindra Capital, Goldman Sachs, and JP Morgan as the bankers for its IPO.

Other Developments Of The Week

- Fresh to the unicorn club, ride hailing major Rapido is eyeing raising $60 Mn from Prosus in a mix of primary and secondary share sales.

- In a bid to capitalise on the fintech investment boom, offline mobile payments startup ToneTag is looking to bag $50 Mn from investor Iron Pillar and others in a mix of primary and secondary share sale.

- VC firm Z47 (erstwhile known as Matrix Partners) is looking to sell shares of unicorns Ola, OfBusiness, Razorpay, and DailyHunt, cumulatively worth between $150 Mn and $180 Mn.

- Hyperlocal services startup Urban Company is likely to see a $30 Mn secondary transaction with its investor Prosus buying shares from Bessemer Venture Partners.

- The Good Glamm Group announced the complete acquisition of D2C feminine hygiene startup Sirona for INR 450 Cr this week.

- Bhavish Aggarwal-led Ola Consumer has sought approval from investors to turn into a public entity.

Ad-lite browsing experience

Ad-lite browsing experience